Merit Financial Group LLC lowered its holdings in McDonald's Co. (NYSE:MCD - Free Report) by 18.8% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 19,402 shares of the fast-food giant's stock after selling 4,487 shares during the quarter. Merit Financial Group LLC's holdings in McDonald's were worth $5,753,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Merit Financial Group LLC lowered its holdings in McDonald's Co. (NYSE:MCD - Free Report) by 18.8% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 19,402 shares of the fast-food giant's stock after selling 4,487 shares during the quarter. Merit Financial Group LLC's holdings in McDonald's were worth $5,753,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

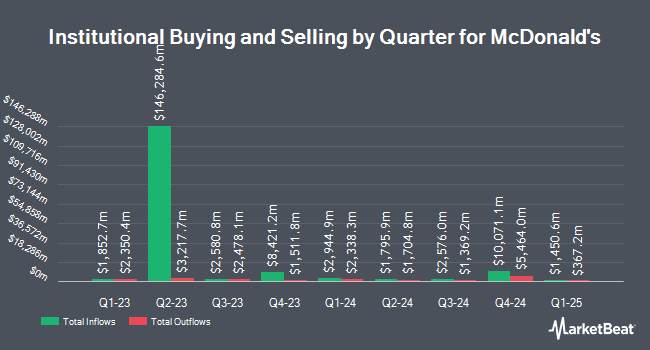

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Independent Wealth Network Inc. increased its position in shares of McDonald's by 4.2% during the 4th quarter. Independent Wealth Network Inc. now owns 863 shares of the fast-food giant's stock valued at $256,000 after purchasing an additional 35 shares during the last quarter. Paragon Capital Management Ltd increased its position in shares of McDonald's by 2.7% during the 4th quarter. Paragon Capital Management Ltd now owns 1,374 shares of the fast-food giant's stock valued at $407,000 after purchasing an additional 36 shares during the last quarter. Mechanics Financial Corp increased its position in shares of McDonald's by 0.7% during the 4th quarter. Mechanics Financial Corp now owns 5,331 shares of the fast-food giant's stock valued at $1,581,000 after purchasing an additional 36 shares during the last quarter. Unique Wealth LLC increased its position in shares of McDonald's by 1.2% during the 4th quarter. Unique Wealth LLC now owns 3,249 shares of the fast-food giant's stock valued at $963,000 after purchasing an additional 38 shares during the last quarter. Finally, Patron Partners LLC increased its position in shares of McDonald's by 0.7% during the 4th quarter. Patron Partners LLC now owns 5,158 shares of the fast-food giant's stock valued at $1,529,000 after purchasing an additional 38 shares during the last quarter. 70.29% of the stock is owned by institutional investors.

Insider Activity

In related news, insider Joseph M. Erlinger sold 1,099 shares of the firm's stock in a transaction on Friday, March 22nd. The shares were sold at an average price of $284.38, for a total transaction of $312,533.62. Following the completion of the transaction, the insider now owns 18,075 shares of the company's stock, valued at $5,140,168.50. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In other McDonald's news, insider Joseph M. Erlinger sold 1,098 shares of the company's stock in a transaction that occurred on Tuesday, April 23rd. The stock was sold at an average price of $276.64, for a total value of $303,750.72. Following the sale, the insider now owns 16,977 shares in the company, valued at approximately $4,696,517.28. The transaction was disclosed in a legal filing with the SEC, which is available at the SEC website. Also, insider Joseph M. Erlinger sold 1,099 shares of McDonald's stock in a transaction that occurred on Friday, March 22nd. The shares were sold at an average price of $284.38, for a total transaction of $312,533.62. Following the transaction, the insider now directly owns 18,075 shares of the company's stock, valued at $5,140,168.50. The disclosure for this sale can be found here. Insiders own 0.23% of the company's stock.

McDonald's Stock Down 1.1 %

Shares of MCD traded down $2.96 during mid-day trading on Friday, hitting $270.32. 2,639,735 shares of the company traded hands, compared to its average volume of 3,321,246. McDonald's Co. has a 1-year low of $245.73 and a 1-year high of $302.39. The company has a market capitalization of $194.90 billion, a PE ratio of 22.95, a price-to-earnings-growth ratio of 3.02 and a beta of 0.71. The business has a 50 day moving average of $280.07 and a 200 day moving average of $282.21.

McDonald's (NYSE:MCD - Get Free Report) last announced its quarterly earnings data on Tuesday, April 30th. The fast-food giant reported $2.70 earnings per share for the quarter, missing analysts' consensus estimates of $2.71 by ($0.01). McDonald's had a net margin of 33.36% and a negative return on equity of 180.54%. The firm had revenue of $6.17 billion during the quarter, compared to analyst estimates of $6.16 billion. During the same period in the prior year, the company posted $2.63 earnings per share. The firm's revenue for the quarter was up 4.6% on a year-over-year basis. As a group, research analysts expect that McDonald's Co. will post 12.25 EPS for the current fiscal year.

McDonald's Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, March 15th. Shareholders of record on Friday, March 1st were paid a dividend of $1.67 per share. This represents a $6.68 annualized dividend and a yield of 2.47%. The ex-dividend date of this dividend was Thursday, February 29th. McDonald's's payout ratio is 56.71%.

Analyst Ratings Changes

Several brokerages have commented on MCD. Argus reaffirmed a "hold" rating on shares of McDonald's in a research report on Monday, March 25th. JPMorgan Chase & Co. cut their price objective on McDonald's from $300.00 to $290.00 and set an "overweight" rating on the stock in a research report on Wednesday. UBS Group cut their price objective on McDonald's from $340.00 to $335.00 and set a "buy" rating on the stock in a research report on Friday, April 5th. Royal Bank of Canada cut their price objective on McDonald's from $340.00 to $335.00 and set an "outperform" rating on the stock in a research report on Tuesday, February 6th. Finally, Citigroup cut their price objective on McDonald's from $312.00 to $297.00 and set a "neutral" rating on the stock in a research report on Tuesday, April 16th. Nine equities research analysts have rated the stock with a hold rating and twenty have given a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $317.74.

Check Out Our Latest Stock Analysis on MCD

McDonald's Profile

(

Free Report)

McDonald's Corporation operates and franchises restaurants under the McDonald's brand in the United States and internationally. It offers food and beverages, including hamburgers and cheeseburgers, various chicken sandwiches, fries, shakes, desserts, sundaes, cookies, pies, soft drinks, coffee, and other beverages; and full or limited breakfast, as well as sells various other products during limited-time promotions.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider McDonald's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McDonald's wasn't on the list.

While McDonald's currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report