Molina Healthcare (NYSE:MOH - Get Free Report) issued an update on its FY 2024 earnings guidance on Wednesday morning. The company provided earnings per share guidance of 23.500- for the period, compared to the consensus earnings per share estimate of 23.560. The company issued revenue guidance of $39.6 billion-$39.6 billion, compared to the consensus revenue estimate of $39.3 billion. Molina Healthcare also updated its FY24 guidance to at least $23.50 EPS.

Molina Healthcare (NYSE:MOH - Get Free Report) issued an update on its FY 2024 earnings guidance on Wednesday morning. The company provided earnings per share guidance of 23.500- for the period, compared to the consensus earnings per share estimate of 23.560. The company issued revenue guidance of $39.6 billion-$39.6 billion, compared to the consensus revenue estimate of $39.3 billion. Molina Healthcare also updated its FY24 guidance to at least $23.50 EPS.

Molina Healthcare Price Performance

MOH stock traded up $4.40 during trading hours on Wednesday, hitting $367.62. 461,136 shares of the stock traded hands, compared to its average volume of 395,346. The company has a current ratio of 1.54, a quick ratio of 1.54 and a debt-to-equity ratio of 0.57. The stock has a 50-day simple moving average of $393.09 and a 200 day simple moving average of $372.04. Molina Healthcare has a one year low of $266.35 and a one year high of $423.92. The company has a market cap of $21.54 billion, a P/E ratio of 19.50, a P/E/G ratio of 1.01 and a beta of 0.47.

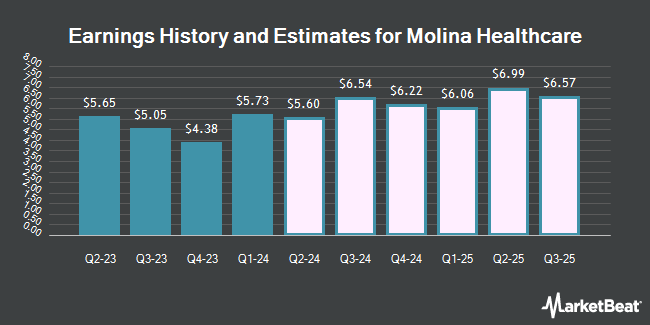

Molina Healthcare (NYSE:MOH - Get Free Report) last announced its quarterly earnings data on Wednesday, February 7th. The company reported $4.38 earnings per share (EPS) for the quarter, topping the consensus estimate of $4.31 by $0.07. The company had revenue of $9.05 billion for the quarter, compared to analysts' expectations of $8.35 billion. Molina Healthcare had a net margin of 3.20% and a return on equity of 32.34%. The business's revenue was up 10.0% compared to the same quarter last year. During the same quarter in the previous year, the company posted $4.10 EPS. Equities analysts forecast that Molina Healthcare will post 23.62 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently issued reports on the stock. Barclays assumed coverage on shares of Molina Healthcare in a report on Wednesday, March 6th. They set an equal weight rating and a $437.00 price target on the stock. Truist Financial lifted their price target on Molina Healthcare from $435.00 to $460.00 and gave the company a buy rating in a report on Tuesday, February 20th. Wells Fargo & Company reduced their price objective on Molina Healthcare from $440.00 to $410.00 and set an equal weight rating for the company in a research note on Monday, April 15th. StockNews.com lowered Molina Healthcare from a strong-buy rating to a buy rating in a research report on Thursday, February 8th. Finally, Cantor Fitzgerald reiterated an overweight rating and issued a $406.00 target price on shares of Molina Healthcare in a report on Thursday, April 4th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and five have issued a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of Hold and an average price target of $393.09.

Check Out Our Latest Stock Analysis on Molina Healthcare

Insider Buying and Selling

In related news, Director Richard M. Schapiro sold 711 shares of Molina Healthcare stock in a transaction on Monday, February 12th. The shares were sold at an average price of $384.06, for a total value of $273,066.66. Following the completion of the sale, the director now owns 12,207 shares of the company's stock, valued at approximately $4,688,220.42. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. In other news, Director Richard M. Schapiro sold 1,000 shares of Molina Healthcare stock in a transaction that occurred on Tuesday, February 20th. The shares were sold at an average price of $401.05, for a total value of $401,050.00. Following the transaction, the director now owns 11,207 shares of the company's stock, valued at $4,494,567.35. The transaction was disclosed in a legal filing with the SEC, which is available at the SEC website. Also, Director Richard M. Schapiro sold 711 shares of the company's stock in a transaction on Monday, February 12th. The stock was sold at an average price of $384.06, for a total transaction of $273,066.66. Following the sale, the director now directly owns 12,207 shares of the company's stock, valued at $4,688,220.42. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 16,711 shares of company stock worth $6,472,517. Insiders own 1.11% of the company's stock.

About Molina Healthcare

(

Get Free Report)

Molina Healthcare, Inc provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces. It operates in four segments: Medicaid, Medicare, Marketplace, and Other. The company served in across 19 states. The company was founded in 1980 and is headquartered in Long Beach, California.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Molina Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molina Healthcare wasn't on the list.

While Molina Healthcare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report