Empirical Financial Services LLC d.b.a. Empirical Wealth Management lifted its position in shares of PulteGroup, Inc. (NYSE:PHM - Free Report) by 16.8% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 49,214 shares of the construction company's stock after purchasing an additional 7,073 shares during the period. Empirical Financial Services LLC d.b.a. Empirical Wealth Management's holdings in PulteGroup were worth $5,080,000 at the end of the most recent reporting period.

Empirical Financial Services LLC d.b.a. Empirical Wealth Management lifted its position in shares of PulteGroup, Inc. (NYSE:PHM - Free Report) by 16.8% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 49,214 shares of the construction company's stock after purchasing an additional 7,073 shares during the period. Empirical Financial Services LLC d.b.a. Empirical Wealth Management's holdings in PulteGroup were worth $5,080,000 at the end of the most recent reporting period.

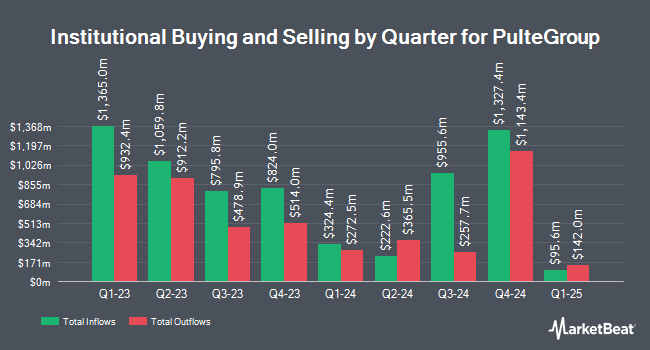

Several other institutional investors also recently added to or reduced their stakes in PHM. Greenhaven Associates Inc. raised its stake in PulteGroup by 0.4% during the 4th quarter. Greenhaven Associates Inc. now owns 5,726,368 shares of the construction company's stock valued at $591,076,000 after acquiring an additional 24,350 shares during the last quarter. FMR LLC raised its stake in shares of PulteGroup by 1.8% during the third quarter. FMR LLC now owns 5,484,469 shares of the construction company's stock worth $406,125,000 after purchasing an additional 95,945 shares during the last quarter. Invesco Ltd. lifted its holdings in shares of PulteGroup by 13.3% during the third quarter. Invesco Ltd. now owns 4,432,965 shares of the construction company's stock worth $328,261,000 after purchasing an additional 522,032 shares during the period. Morgan Stanley grew its position in PulteGroup by 2.0% in the 3rd quarter. Morgan Stanley now owns 3,115,877 shares of the construction company's stock valued at $230,731,000 after buying an additional 61,953 shares during the last quarter. Finally, Pacer Advisors Inc. increased its stake in PulteGroup by 54.6% in the 4th quarter. Pacer Advisors Inc. now owns 3,003,713 shares of the construction company's stock valued at $310,043,000 after buying an additional 1,060,466 shares during the period. Institutional investors and hedge funds own 89.90% of the company's stock.

PulteGroup Price Performance

PHM stock traded down $0.70 during trading on Tuesday, hitting $116.95. The company had a trading volume of 1,881,938 shares, compared to its average volume of 1,810,755. The business has a 50 day moving average of $112.71 and a 200 day moving average of $101.88. The company has a current ratio of 0.85, a quick ratio of 0.85 and a debt-to-equity ratio of 0.18. The firm has a market capitalization of $24.60 billion, a price-to-earnings ratio of 9.36, a P/E/G ratio of 0.52 and a beta of 1.56. PulteGroup, Inc. has a fifty-two week low of $65.16 and a fifty-two week high of $121.07.

PulteGroup Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, July 2nd. Investors of record on Tuesday, June 18th will be issued a dividend of $0.20 per share. This represents a $0.80 dividend on an annualized basis and a yield of 0.68%. The ex-dividend date of this dividend is Tuesday, June 18th. PulteGroup's payout ratio is 6.41%.

PulteGroup declared that its Board of Directors has authorized a share buyback program on Tuesday, January 30th that authorizes the company to repurchase $1.50 billion in outstanding shares. This repurchase authorization authorizes the construction company to buy up to 6.5% of its shares through open market purchases. Shares repurchase programs are generally a sign that the company's management believes its stock is undervalued.

Wall Street Analyst Weigh In

Several research firms have recently commented on PHM. Raymond James reissued an "outperform" rating and issued a $135.00 price target (up from $120.00) on shares of PulteGroup in a report on Thursday, April 25th. Zelman & Associates upgraded shares of PulteGroup from a "neutral" rating to an "outperform" rating in a research report on Wednesday, April 24th. Wedbush reissued a "neutral" rating and set a $85.00 price target on shares of PulteGroup in a research note on Wednesday, January 31st. Jefferies Financial Group upped their target price on PulteGroup from $126.00 to $131.00 and gave the company a "buy" rating in a report on Wednesday, April 24th. Finally, StockNews.com raised shares of PulteGroup from a "hold" rating to a "buy" rating in a research note on Wednesday, April 24th. Five equities research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $111.73.

View Our Latest Stock Report on PulteGroup

PulteGroup Company Profile

(

Free Report)

PulteGroup, Inc, through its subsidiaries, primarily engages in the homebuilding business in the United States. It acquires and develops land primarily for residential purposes; and constructs housing on such land. The company also offers various home designs, including single-family detached, townhomes, condominiums, and duplexes under the Centex, Pulte Homes, Del Webb, DiVosta Homes, John Wieland Homes and Neighborhoods, and American West brand names.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PulteGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PulteGroup wasn't on the list.

While PulteGroup currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report