Readystate Asset Management LP purchased a new position in Spirit Airlines, Inc. (NYSE:SAVE - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 187,420 shares of the company's stock, valued at approximately $3,072,000. Readystate Asset Management LP owned approximately 0.17% of Spirit Airlines at the end of the most recent quarter.

Readystate Asset Management LP purchased a new position in Spirit Airlines, Inc. (NYSE:SAVE - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 187,420 shares of the company's stock, valued at approximately $3,072,000. Readystate Asset Management LP owned approximately 0.17% of Spirit Airlines at the end of the most recent quarter.

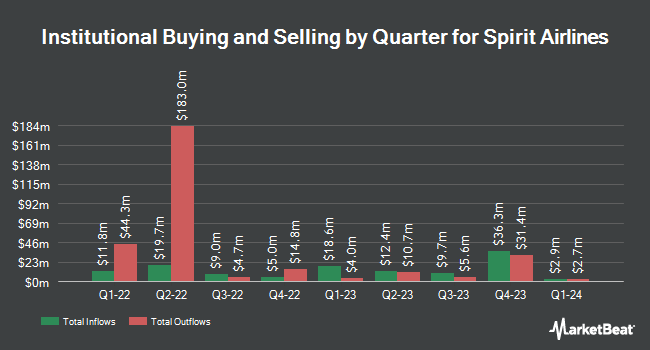

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. Price T Rowe Associates Inc. MD lifted its holdings in shares of Spirit Airlines by 9.1% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 69,667 shares of the company's stock worth $1,142,000 after buying an additional 5,801 shares in the last quarter. Cim Investment Management Inc. increased its position in shares of Spirit Airlines by 121.7% in the fourth quarter. Cim Investment Management Inc. now owns 25,937 shares of the company's stock worth $425,000 after purchasing an additional 14,236 shares during the last quarter. Vanguard Group Inc. increased its position in shares of Spirit Airlines by 0.7% in the fourth quarter. Vanguard Group Inc. now owns 10,418,903 shares of the company's stock worth $170,766,000 after purchasing an additional 68,710 shares during the last quarter. Venator Management LLC bought a new position in shares of Spirit Airlines in the fourth quarter worth approximately $164,000. Finally, Murchinson Ltd. bought a new position in shares of Spirit Airlines in the fourth quarter worth approximately $820,000. 58.73% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on SAVE shares. TD Cowen decreased their price objective on shares of Spirit Airlines from $5.00 to $4.00 and set a "hold" rating on the stock in a research report on Tuesday. Citigroup decreased their price objective on shares of Spirit Airlines from $4.00 to $3.85 and set a "sell" rating on the stock in a research report on Wednesday. Seaport Res Ptn cut shares of Spirit Airlines from a "buy" rating to a "neutral" rating in a research report on Wednesday, January 17th. Susquehanna reduced their price target on shares of Spirit Airlines from $5.00 to $4.00 and set a "negative" rating on the stock in a research report on Tuesday, April 9th. Finally, Bank of America began coverage on shares of Spirit Airlines in a research report on Wednesday, January 17th. They set an "underperform" rating and a $5.00 price target on the stock. Five equities research analysts have rated the stock with a sell rating and three have issued a hold rating to the company. According to MarketBeat.com, Spirit Airlines currently has a consensus rating of "Reduce" and an average price target of $4.91.

Get Our Latest Report on SAVE

Spirit Airlines Price Performance

Shares of Spirit Airlines stock remained flat at $4.12 on Wednesday. 7,080,859 shares of the stock traded hands, compared to its average volume of 15,151,029. The company has a debt-to-equity ratio of 2.69, a quick ratio of 0.90 and a current ratio of 0.90. Spirit Airlines, Inc. has a 1 year low of $3.96 and a 1 year high of $19.69. The firm has a market cap of $450.50 million, a PE ratio of -1.01 and a beta of 1.35. The firm has a 50 day moving average of $5.28 and a 200-day moving average of $10.41.

Spirit Airlines (NYSE:SAVE - Get Free Report) last issued its earnings results on Thursday, February 8th. The company reported ($1.36) earnings per share (EPS) for the quarter, topping the consensus estimate of ($1.42) by $0.06. Spirit Airlines had a negative net margin of 8.34% and a negative return on equity of 26.38%. The firm had revenue of $1.32 billion for the quarter, compared to analysts' expectations of $1.32 billion. During the same quarter last year, the business earned $0.12 earnings per share. The business's revenue was down 5.0% on a year-over-year basis. As a group, equities analysts predict that Spirit Airlines, Inc. will post -2.75 EPS for the current fiscal year.

Spirit Airlines Dividend Announcement

The company also recently announced a dividend, which was paid on Thursday, February 29th. Stockholders of record on Friday, February 23rd were issued a $0.10 dividend. The ex-dividend date was Thursday, February 22nd.

Spirit Airlines Profile

(

Free Report)

Spirit Airlines, Inc provides airline services. The company also offers hotels and rental cars services. It serves 93 destinations in 15 countries in the United States, Latin America, and the Caribbean. As of December 31, 2023, the company operated a fleet of 205 Airbus single-aisle aircraft. The company was formerly known as Clippert Trucking Company and changed its name to Spirit Airlines, Inc in 1992.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Spirit Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spirit Airlines wasn't on the list.

While Spirit Airlines currently has a "Strong Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report