Amica Mutual Insurance Co. bought a new position in shares of Summit Materials, Inc. (NYSE:SUM - Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 32,251 shares of the construction company's stock, valued at approximately $1,240,000.

Amica Mutual Insurance Co. bought a new position in shares of Summit Materials, Inc. (NYSE:SUM - Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 32,251 shares of the construction company's stock, valued at approximately $1,240,000.

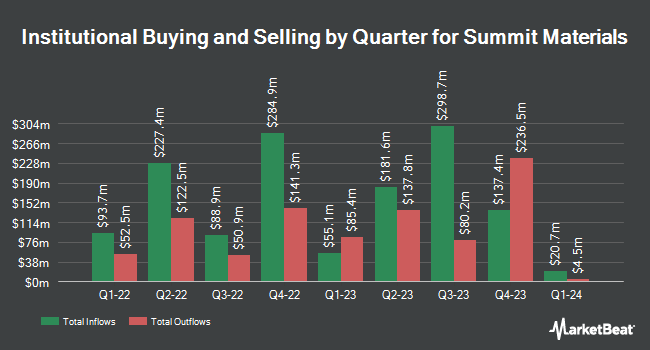

A number of other large investors have also modified their holdings of SUM. Vanguard Group Inc. boosted its position in Summit Materials by 1.2% during the third quarter. Vanguard Group Inc. now owns 11,925,288 shares of the construction company's stock worth $371,353,000 after acquiring an additional 136,921 shares during the last quarter. Massachusetts Financial Services Co. MA grew its position in shares of Summit Materials by 130.6% in the third quarter. Massachusetts Financial Services Co. MA now owns 5,512,959 shares of the construction company's stock valued at $171,674,000 after purchasing an additional 3,122,575 shares in the last quarter. Principal Financial Group Inc. increased its holdings in shares of Summit Materials by 2.1% in the third quarter. Principal Financial Group Inc. now owns 5,251,061 shares of the construction company's stock valued at $163,518,000 after purchasing an additional 105,796 shares during the last quarter. FMR LLC increased its holdings in shares of Summit Materials by 22.6% in the third quarter. FMR LLC now owns 3,880,931 shares of the construction company's stock valued at $120,852,000 after purchasing an additional 714,379 shares during the last quarter. Finally, Clearbridge Investments LLC lifted its position in Summit Materials by 1.1% during the third quarter. Clearbridge Investments LLC now owns 3,061,137 shares of the construction company's stock worth $95,324,000 after buying an additional 34,100 shares in the last quarter.

Summit Materials Trading Up 0.3 %

Shares of NYSE SUM traded up $0.13 during trading on Monday, reaching $40.13. The stock had a trading volume of 884,022 shares, compared to its average volume of 958,936. The business's 50-day moving average price is $41.84 and its 200-day moving average price is $37.98. Summit Materials, Inc. has a fifty-two week low of $27.20 and a fifty-two week high of $44.89. The company has a debt-to-equity ratio of 0.99, a quick ratio of 4.62 and a current ratio of 5.36. The company has a market cap of $6.99 billion, a P/E ratio of 16.86 and a beta of 1.32.

Summit Materials (NYSE:SUM - Get Free Report) last issued its quarterly earnings results on Wednesday, February 14th. The construction company reported $0.31 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.27 by $0.04. Summit Materials had a net margin of 10.91% and a return on equity of 8.73%. The company had revenue of $613.13 million for the quarter, compared to analyst estimates of $560.90 million. During the same period in the prior year, the firm earned $0.32 earnings per share. The business's revenue for the quarter was up 19.8% compared to the same quarter last year. On average, equities research analysts predict that Summit Materials, Inc. will post 2.23 EPS for the current fiscal year.

Analysts Set New Price Targets

Several analysts have issued reports on the company. Citigroup upped their target price on Summit Materials from $46.00 to $51.00 and gave the company a "buy" rating in a report on Friday, April 5th. The Goldman Sachs Group raised their price objective on shares of Summit Materials from $43.00 to $49.00 and gave the stock a "neutral" rating in a research report on Thursday, March 14th. Royal Bank of Canada increased their price target on shares of Summit Materials from $39.00 to $44.00 and gave the company a "sector perform" rating in a research note on Thursday, March 14th. JPMorgan Chase & Co. began coverage on shares of Summit Materials in a research report on Friday, February 23rd. They set an "overweight" rating and a $47.00 price target on the stock. Finally, Barclays increased their price objective on Summit Materials from $40.00 to $45.00 and gave the stock an "equal weight" rating in a research report on Thursday, March 14th. Six analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat.com, Summit Materials has an average rating of "Moderate Buy" and an average target price of $46.09.

View Our Latest Stock Report on SUM

About Summit Materials

(

Free Report)

Summit Materials, Inc operates as a vertically integrated construction materials company in the United States and Canada. It operates in three segments: West, East, and Cement. The company offers aggregates, cement, ready-mix concrete, asphalt paving mixes, and concrete products, as well as plastics components.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Summit Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Materials wasn't on the list.

While Summit Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report