State of New Jersey Common Pension Fund D cut its position in Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM - Free Report) by 2.2% during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 2,093,539 shares of the semiconductor company's stock after selling 48,085 shares during the quarter. Taiwan Semiconductor Manufacturing comprises 0.7% of State of New Jersey Common Pension Fund D's holdings, making the stock its 18th biggest position. State of New Jersey Common Pension Fund D's holdings in Taiwan Semiconductor Manufacturing were worth $217,728,000 at the end of the most recent quarter.

State of New Jersey Common Pension Fund D cut its position in Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM - Free Report) by 2.2% during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 2,093,539 shares of the semiconductor company's stock after selling 48,085 shares during the quarter. Taiwan Semiconductor Manufacturing comprises 0.7% of State of New Jersey Common Pension Fund D's holdings, making the stock its 18th biggest position. State of New Jersey Common Pension Fund D's holdings in Taiwan Semiconductor Manufacturing were worth $217,728,000 at the end of the most recent quarter.

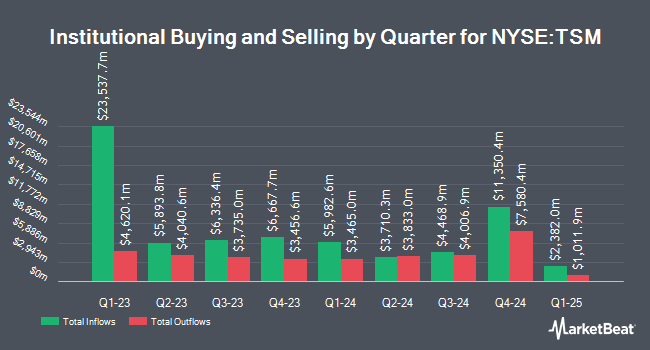

Several other hedge funds have also recently bought and sold shares of TSM. Channing Global Advisors LLC increased its stake in Taiwan Semiconductor Manufacturing by 3.1% during the 4th quarter. Channing Global Advisors LLC now owns 68,440 shares of the semiconductor company's stock valued at $7,118,000 after buying an additional 2,058 shares during the period. Bailard Inc. increased its stake in Taiwan Semiconductor Manufacturing by 135.9% during the 4th quarter. Bailard Inc. now owns 45,573 shares of the semiconductor company's stock valued at $4,740,000 after buying an additional 26,253 shares during the period. Atria Wealth Solutions Inc. increased its stake in Taiwan Semiconductor Manufacturing by 3.3% during the 4th quarter. Atria Wealth Solutions Inc. now owns 39,020 shares of the semiconductor company's stock valued at $4,062,000 after buying an additional 1,242 shares during the period. Wynn Capital LLC acquired a new position in Taiwan Semiconductor Manufacturing during the 4th quarter valued at about $498,000. Finally, Bfsg LLC increased its stake in Taiwan Semiconductor Manufacturing by 37.2% during the 4th quarter. Bfsg LLC now owns 16,793 shares of the semiconductor company's stock valued at $1,746,000 after buying an additional 4,555 shares during the period. 16.51% of the stock is currently owned by institutional investors.

Taiwan Semiconductor Manufacturing Stock Up 1.2 %

Shares of TSM stock traded up $1.68 during trading on Friday, hitting $138.26. 9,444,007 shares of the company were exchanged, compared to its average volume of 15,812,054. The company has a debt-to-equity ratio of 0.27, a quick ratio of 2.06 and a current ratio of 2.33. The firm has a market capitalization of $717.07 billion, a price-to-earnings ratio of 26.31, a P/E/G ratio of 0.95 and a beta of 1.15. The business's 50-day simple moving average is $136.83 and its 200 day simple moving average is $114.30. Taiwan Semiconductor Manufacturing Company Limited has a twelve month low of $82.16 and a twelve month high of $158.40.

Taiwan Semiconductor Manufacturing Cuts Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, July 11th. Investors of record on Thursday, June 13th will be issued a dividend of $0.4408 per share. This represents a $1.76 annualized dividend and a dividend yield of 1.28%. The ex-dividend date is Thursday, June 13th. Taiwan Semiconductor Manufacturing's dividend payout ratio is currently 32.76%.

Wall Street Analysts Forecast Growth

Several equities analysts have commented on TSM shares. Susquehanna raised their target price on shares of Taiwan Semiconductor Manufacturing from $160.00 to $180.00 and gave the company a "positive" rating in a research note on Tuesday, April 2nd. Barclays raised their target price on shares of Taiwan Semiconductor Manufacturing from $145.00 to $150.00 and gave the company an "overweight" rating in a research note on Friday, April 19th. Needham & Company LLC reaffirmed a "buy" rating and issued a $168.00 price objective on shares of Taiwan Semiconductor Manufacturing in a research note on Thursday, April 18th. StockNews.com raised shares of Taiwan Semiconductor Manufacturing from a "hold" rating to a "buy" rating in a research note on Thursday, April 11th. Finally, TD Cowen lifted their price objective on shares of Taiwan Semiconductor Manufacturing from $100.00 to $130.00 and gave the stock a "hold" rating in a research note on Thursday, April 18th. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $157.00.

Read Our Latest Stock Report on TSM

Taiwan Semiconductor Manufacturing Profile

(

Free Report)

Taiwan Semiconductor Manufacturing Company Limited, together with its subsidiaries, manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally. It provides a range of wafer fabrication processes, including processes to manufacture complementary metal- oxide-semiconductor (CMOS) logic, mixed-signal, radio frequency, embedded memory, bipolar CMOS mixed-signal, and others.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Taiwan Semiconductor Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taiwan Semiconductor Manufacturing wasn't on the list.

While Taiwan Semiconductor Manufacturing currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report