Cullen Frost Bankers Inc. trimmed its position in Zoetis Inc. (NYSE:ZTS - Free Report) by 12.7% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 158,104 shares of the company's stock after selling 22,962 shares during the quarter. Cullen Frost Bankers Inc.'s holdings in Zoetis were worth $31,205,000 as of its most recent filing with the Securities and Exchange Commission.

Cullen Frost Bankers Inc. trimmed its position in Zoetis Inc. (NYSE:ZTS - Free Report) by 12.7% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 158,104 shares of the company's stock after selling 22,962 shares during the quarter. Cullen Frost Bankers Inc.'s holdings in Zoetis were worth $31,205,000 as of its most recent filing with the Securities and Exchange Commission.

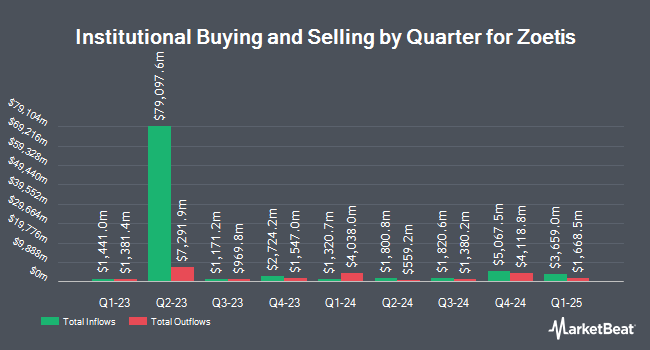

A number of other institutional investors and hedge funds have also modified their holdings of ZTS. Blue Bell Private Wealth Management LLC lifted its stake in shares of Zoetis by 222.5% in the fourth quarter. Blue Bell Private Wealth Management LLC now owns 129 shares of the company's stock worth $25,000 after buying an additional 89 shares during the last quarter. Independence Bank of Kentucky increased its position in Zoetis by 371.4% during the fourth quarter. Independence Bank of Kentucky now owns 165 shares of the company's stock worth $33,000 after acquiring an additional 130 shares during the period. Ramirez Asset Management Inc. bought a new position in Zoetis during the third quarter worth $35,000. First Financial Corp IN increased its position in Zoetis by 57.2% during the fourth quarter. First Financial Corp IN now owns 217 shares of the company's stock worth $43,000 after acquiring an additional 79 shares during the period. Finally, Bogart Wealth LLC increased its position in Zoetis by 188.9% during the third quarter. Bogart Wealth LLC now owns 260 shares of the company's stock worth $45,000 after acquiring an additional 170 shares during the period. 92.80% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of equities analysts recently issued reports on ZTS shares. Barclays dropped their target price on shares of Zoetis from $260.00 to $230.00 and set an "overweight" rating on the stock in a research report on Tuesday, April 23rd. StockNews.com lowered shares of Zoetis from a "strong-buy" rating to a "buy" rating in a research report on Tuesday, February 20th. Stifel Nicolaus lowered their price target on shares of Zoetis from $195.00 to $180.00 and set a "buy" rating on the stock in a report on Tuesday, April 30th. Piper Sandler reissued an "overweight" rating and issued a $195.00 price target (down previously from $220.00) on shares of Zoetis in a report on Tuesday, April 16th. Finally, The Goldman Sachs Group lowered their price target on shares of Zoetis from $223.00 to $196.00 and set a "buy" rating on the stock in a report on Monday. Eight investment analysts have rated the stock with a buy rating, According to data from MarketBeat, the company currently has an average rating of "Buy" and a consensus target price of $212.38.

View Our Latest Analysis on ZTS

Zoetis Price Performance

Shares of ZTS traded up $2.50 during trading hours on Tuesday, hitting $168.45. The stock had a trading volume of 3,318,087 shares, compared to its average volume of 3,179,154. The company's fifty day moving average is $167.64 and its two-hundred day moving average is $178.93. The company has a debt-to-equity ratio of 1.30, a current ratio of 3.33 and a quick ratio of 1.94. Zoetis Inc. has a 52 week low of $144.80 and a 52 week high of $201.92. The stock has a market capitalization of $76.86 billion, a price-to-earnings ratio of 32.46, a P/E/G ratio of 2.62 and a beta of 0.86.

Zoetis (NYSE:ZTS - Get Free Report) last posted its earnings results on Thursday, May 2nd. The company reported $1.38 earnings per share for the quarter, topping the consensus estimate of $1.34 by $0.04. Zoetis had a net margin of 27.38% and a return on equity of 50.34%. The business had revenue of $2.19 billion for the quarter, compared to analyst estimates of $2.14 billion. During the same quarter in the prior year, the firm earned $1.31 EPS. The firm's quarterly revenue was up 9.5% compared to the same quarter last year. On average, analysts anticipate that Zoetis Inc. will post 5.77 EPS for the current year.

Insider Transactions at Zoetis

In related news, EVP Roxanne Lagano sold 923 shares of the company's stock in a transaction dated Thursday, April 18th. The shares were sold at an average price of $151.17, for a total transaction of $139,529.91. Following the transaction, the executive vice president now owns 14,800 shares in the company, valued at approximately $2,237,316. The sale was disclosed in a filing with the SEC, which can be accessed through this link. In the last quarter, insiders have sold 2,209 shares of company stock valued at $371,293. 0.16% of the stock is owned by insiders.

About Zoetis

(

Free Report)

Zoetis Inc engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, and diagnostic products and services in the United States and internationally. The company commercializes products primarily across species, including livestock, such as cattle, swine, poultry, fish, and sheep and others; and companion animals comprising dogs, cats, and horses.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zoetis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoetis wasn't on the list.

While Zoetis currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report