Ivanhoe Mines (TSE:IVN - Get Free Report) had its price objective upped by Eight Capital from C$19.00 to C$30.00 in a research note issued to investors on Monday, BayStreet.CA reports. Eight Capital's price target indicates a potential upside of 57.65% from the company's current price.

Ivanhoe Mines (TSE:IVN - Get Free Report) had its price objective upped by Eight Capital from C$19.00 to C$30.00 in a research note issued to investors on Monday, BayStreet.CA reports. Eight Capital's price target indicates a potential upside of 57.65% from the company's current price.

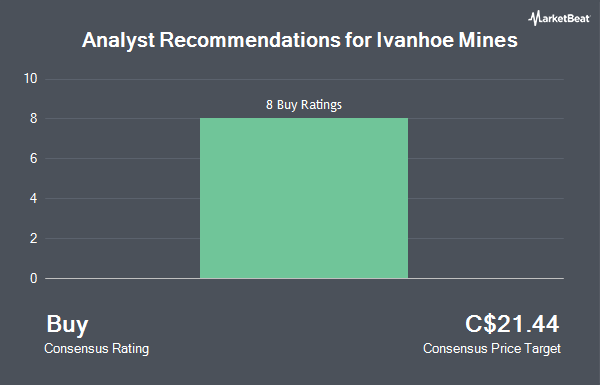

Several other equities analysts have also recently weighed in on the stock. TD Securities raised their price target on shares of Ivanhoe Mines from C$17.00 to C$17.50 and gave the company a "buy" rating in a research report on Wednesday, February 28th. Bank of America increased their price objective on Ivanhoe Mines from C$15.50 to C$21.00 in a report on Tuesday, April 9th. Canaccord Genuity Group boosted their price objective on shares of Ivanhoe Mines from C$16.00 to C$21.00 in a research note on Wednesday, April 17th. Finally, Raymond James lifted their price objective on shares of Ivanhoe Mines from C$18.00 to C$19.00 in a report on Wednesday, March 20th. Five equities research analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average price target of C$19.69.

View Our Latest Stock Report on Ivanhoe Mines

Ivanhoe Mines Trading Down 0.9 %

Ivanhoe Mines stock traded down C$0.18 during mid-day trading on Monday, hitting C$19.03. 5,567,316 shares of the stock were exchanged, compared to its average volume of 2,069,566. Ivanhoe Mines has a 12 month low of C$9.89 and a 12 month high of C$19.99. The company has a quick ratio of 20.86, a current ratio of 3.28 and a debt-to-equity ratio of 18.08. The firm's fifty day simple moving average is C$15.84 and its two-hundred day simple moving average is C$13.47. The stock has a market capitalization of C$24.17 billion, a price-to-earnings ratio of 52.36 and a beta of 2.00.

Ivanhoe Mines (TSE:IVN - Get Free Report) last issued its quarterly earnings results on Monday, February 26th. The company reported C$0.03 EPS for the quarter, missing analysts' consensus estimates of C$0.08 by C($0.05). Analysts forecast that Ivanhoe Mines will post 0.5149972 EPS for the current year.

Insider Buying and Selling at Ivanhoe Mines

In other Ivanhoe Mines news, Senior Officer Mary Vincelli sold 5,000 shares of Ivanhoe Mines stock in a transaction that occurred on Wednesday, March 13th. The shares were sold at an average price of C$15.47, for a total transaction of C$77,350.00. In other Ivanhoe Mines news, Senior Officer Mary Vincelli sold 5,000 shares of Ivanhoe Mines stock in a transaction on Wednesday, March 13th. The shares were sold at an average price of C$15.47, for a total value of C$77,350.00. Also, Director Setha Patricia Makhesha sold 3,295 shares of the stock in a transaction dated Thursday, February 29th. The stock was sold at an average price of C$14.30, for a total transaction of C$47,102.03. Corporate insiders own 50.86% of the company's stock.

About Ivanhoe Mines

(

Get Free Report)

Ivanhoe Mines Ltd. engages in the mining, development, and exploration of minerals and precious metals primarily in Africa. It explores for platinum, palladium, nickel, copper, gold, rhodium, zinc, silver, germanium, and lead deposits. The company's projects include the Platreef project located in the Northern Limb of South Africa's Bushveld Complex; the Kipushi project located in Haut-Katanga Province, Democratic Republic of Congo; and the Kamoa-Kakula project located within the Central African Copperbelt.

See Also

Before you consider Ivanhoe Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ivanhoe Mines wasn't on the list.

While Ivanhoe Mines currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report