With the leaves beginning to fall and the evenings starting to close in, it’s clear that the end of this year’s summer is fast approaching. Leaving aside global events, for equities at least it’s been a good one. The major indices have marched on to fresh highs, Wall Street has shrugged off inflation concerns, and there’s no sign of an impending taper tantrum even as the Fed signals its intention to start winding down its asset purchase program.

There hasn’t been a lot of fresh news recently that would justify a major overhaul of an investor’s portfolio, so let’s take a look at a few tech stocks that could be a

welcome addition to the portfolio for the rest of the year.

Shares of Netflix have spent much of the past twelve months trading sideways in a relatively narrow range. They’ve held onto all of their post COVID gains and are starting to set consistently higher lows as they begin testing the upper band of the range around the $575 level. This is where the bulls have run out of steam on several occasions in the past year, even as the streaming giant’s earnings kept coming in a little soft.

Of their last six reports, taking us back to April of 2020, they’ve beat analyst expectations on only one occasion. This would be more than enough to send most stocks trending downwards, so the fact that Netflix shares remain within a few dollars of their all-time highs speaks volumes. Wall Street and Main Street alike are obviously banking on the long term potential and feel this more than justifies remaining involved even when estimates are missed.

From a technical point of view, the 10% move-up that shares have made in the past fortnight could be the start of a breakout above $575. If this strength continues in the run-up to their next earnings, due sometime in October, we could easily see Netflix trading above $600 before the end of September.

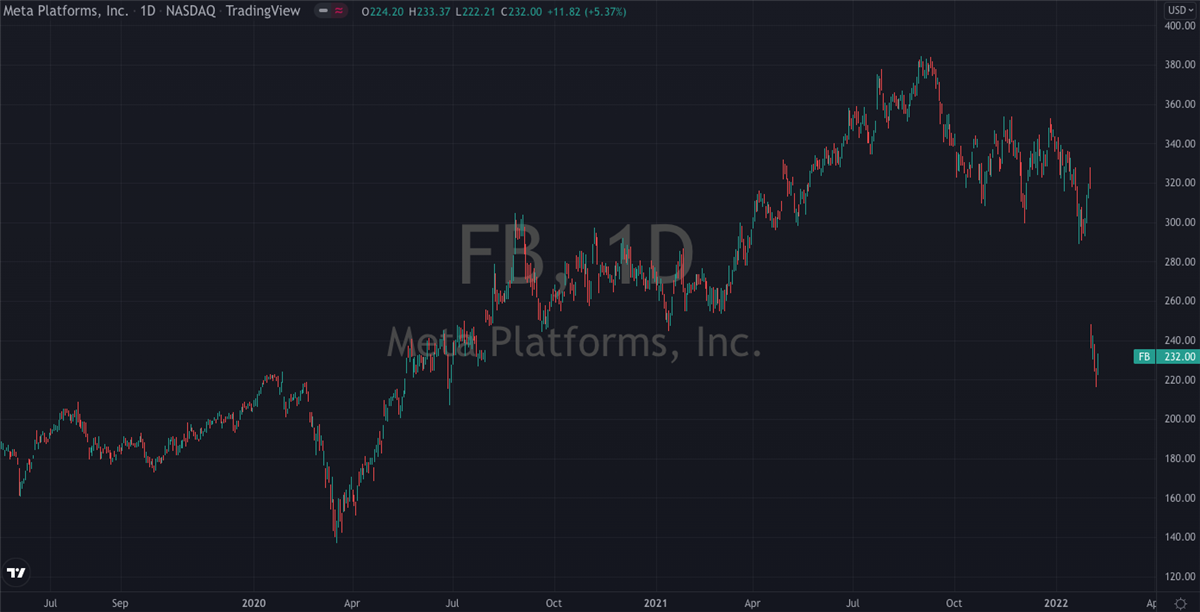

Shares of Facebook traded, like Netflix, in a narrow range for the second half of last year, before kicking off a new rally this past March which is still very much underway. They’ve run up close to 50% in the past six months and closed within $4 of their all time high on Friday.

Unlike Netflix, Facebook has been a joy to hold for investors this year as the company has made a habit of exceeding analyst expectations with their quarterly earnings reports. Case in point, they’ve only missed on one of the past eight. Even with this track record and the current rally that’s underway, there are some voices saying that Facebook has yet to reach its full potential. David Eborall, portfolio manager at SaltLight Capital Management, said in a fund letter from earlier this month that Facebook represents a "durable and indispensable business that is hiding in plain sight."

He sees massive potential for the company to continue finding new ways to monetize its extensive market penetration, for example by expanding its in-app purchase options on apps like Instagram and WhatsApp. “We cannot think of a better company than Facebook” he added in the letter, a sentiment that is no doubt shared by many of Facebook’s investors. All signs point towards their shares continuing to march higher into September and the rest of the year.

Sticking with the social media theme, we have Twitter as the third tech stock worth keeping an eye on over the coming weeks. They’ve been able to give more than a few upside surprises to their investors over the past couple of earnings reports, but despite this their stock has been volatile. It jumped 80% in a month to hit an all time high this past February, then promptly gave back 40% of that into May, before jumping up another 40% through July.

There are clearly plenty of factors at play with this one, with the bulls and the bears unsure of who’s really in control. But for those of us on the sidelines, there’s an attractive technical set up forming that should help make the next move be one to the upside.

We can see on the chart that there’s a rising channel of support, dating back from March of last year, very much still in play, while a downtrend has formed from February’s peak. These two points are fast converging and the scene is set for a likely breakout. With the company’s history of giving investors the right kind of surprises with their earnings, there’s every reason to think a breakout

will be to the north.

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report