Key Points

- Tyson Foods is the nation's largest beef seller and supplies nearly 20% of all the chicken in the United States.

- Tyson repealed its "No Antibiotics Ever" label in July 2023 after bird flu outbreaks; Chick-fil-A modified its "No Antibiotics Ever" policy to "No Antibiotics Important to Human Medicine" on March 24, 2024.

- Tyson Foods continues to recover from its Q4 2023 earnings drop fueled by rising beef prices, possibly driven by high protein, low-carb trends like carnivore and keto diets.

- 5 stocks we like better than Tyson Foods

The avian flu (H5n1) is making headlines again as it spreads through livestock, including cattle and hens -- and even humans are catching the disease. The nation's egg supply is facing tighter supplies as a result of the depopulation (termination) of egg-laying hens that were caught in the outbreak. As a deterrent, the nation's largest poultry and beef producer, Tyson Foods Inc. NYSE: TSN, repealed its no-antibiotics pledge last year to combat the spread of bird flu. Investors have been wondering whether this will be good or bad for the consumer staples sector giant, especially during the carnivore diet trend that's been driving demand for beef and poultry as a side effect of the Ozempic weight-loss trend.

The avian flu (H5n1) is making headlines again as it spreads through livestock, including cattle and hens -- and even humans are catching the disease. The nation's egg supply is facing tighter supplies as a result of the depopulation (termination) of egg-laying hens that were caught in the outbreak. As a deterrent, the nation's largest poultry and beef producer, Tyson Foods Inc. NYSE: TSN, repealed its no-antibiotics pledge last year to combat the spread of bird flu. Investors have been wondering whether this will be good or bad for the consumer staples sector giant, especially during the carnivore diet trend that's been driving demand for beef and poultry as a side effect of the Ozempic weight-loss trend.

CDC Bird Flu Health Alert Issued

On April 5, 2024, the U.S. Centers for Disease Control (CDC) issued a health alert after identifying a second case of a human avian influenza (H5n1) inflection contracted by contact with infected dairy cows. The first human infection was reported in 2022 through dairy cattle as well. The CDC recommends personal protective equipment (PPE) when in contact with persons exposed to sick or dead livestock or wild animals that may be infected with the virus. The CDC still affirms that it hasn't changed its risk assessment that it's a low risk to humans. The infected person's only symptom was eye inflammation.

The Cluck Heard Around the World

Tyson dropped its "no antibiotic ever" label in July 2023. Much of this may have gone unnoticed by the public until popular fast food chain Chick-fil-A announced on Mar. 24, 2024, that it was rephasing its "No Antibiotics Ever (NAE)" policy to "No Antibiotics Important to Human Medicine (NAIHM)" starting in the spring of 2024. This means the company will serve chicken that has been treated with antibiotics for chicken, not humans.

Due to the bird flu outbreaks, Chick-fil-A was apparently having a difficult time procuring antibiotic-free chickens, especially since Tyson walked back their policy and Pilgrim's Pride Co. admitted it also uses "some" antibiotics. Tyson supplies 20% of all the chicken in the United States, so Chick-fil-A was caught between a rock and a hard space. Although Perdue still claims to be antibiotic-free (for now), Panera Bread also reversed its no-antibiotic pledge quietly in 2023.

Why the Concern of Antibiotics in Chicken?

The original concern over antibiotics in chicken stems from the notion that they're going to increase the risk of exposing antibiotic-resistant bacteria to humans, also referred to as superbugs. The World Health Organization (WHO) estimates this could lead to 10 million deaths annually by 2050. Other effects of antibiotics include nephropathy, carcinogenicity and bone marrow toxicity. This is a hotly debated topic, as other experts claim to pose very little risk to humans.

The Incumbent Meat Giant Recovery

Tyson's policy adjustment went into effect in Q2 2024. Its recent earnings show very little negative impact on its top and bottom line as a result. Tyson reported Q1 2024 EPS of 69 cents, crushing 41 cents analyst estimates by 28 cents. Revenues climbed 0.4% YOY to $13.32 billion versus $13.34 billion. Margins slipped by 30bps to 3.1%, which was still an improvement over the prior three quarters.

Tyson also recovered from two prior quarters of negative YOY revenues driven by improvement in average selling prices. The carnivore diet trend may have helped drive beef sales higher by 6.4% YOY to $5.02 billion thanks to a 10.5% increase in average price despite volume dropping 4.1%. Beef is its largest segment. Revenue estimates for the full year 2024 were flat at $52.81 billion versus $53.08 billion consensus estimates.

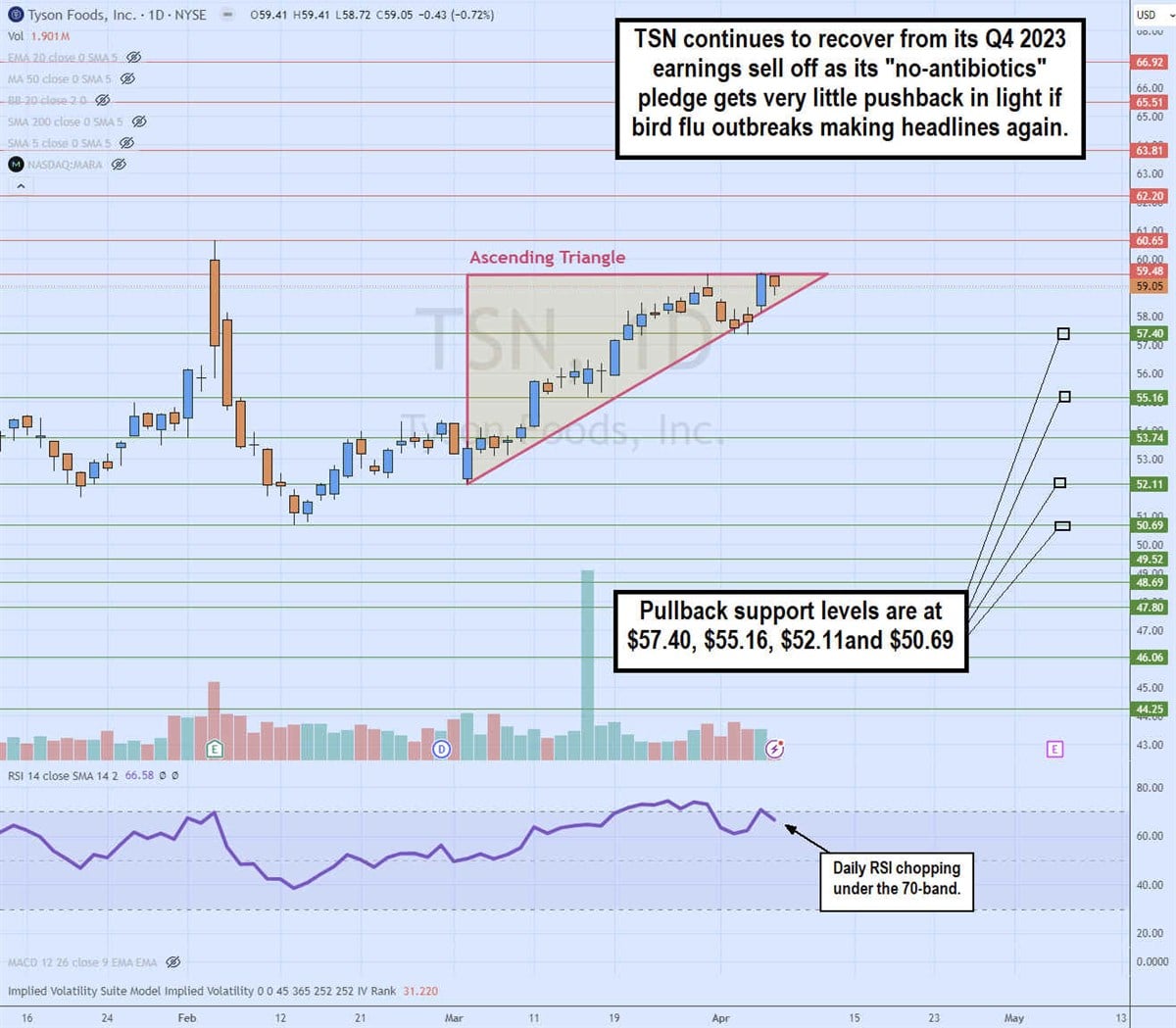

Daily ascending triangle

TSN stock took a tumble on its Q4 2023 earnings report but has been recovering ever since the swing low of $50.69 made on Feb. 13, 2024. This illustrates an ascending triangle pattern. The ascending trendline started at $52.11 on Mar. 4, 2024, as it catches and coils off each higher low against the flat-top upper trendline resistance at $60.65. The daily relative strength index is chopping just under the 70-band.

Before you consider Tyson Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tyson Foods wasn't on the list.

While Tyson Foods currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report