Healthcare improvement company Premiere, Inc. NASDAQ: PINC shares have recovered to the same price range it was trading two years ago after taking a plunge in February 2020 and recovering with the benchmark S&P 500 index NYSEARCA: SPY. The stock is again chopping under a key price level trigger as the surge in COVID-19 spread is pushing various hotspots to slow down restart initiatives and threaten rollbacks. Premiere is perched to benefit from rollbacks as well as the continuation of restart initiatives as it continues to leverage data analytics and supply chain economies of scale to bolster margins and optimize efficiencies. Risk-tolerant investors seeking a healthcare optimization play may want to consider entries on opportunistic pullback levels.

Q3 FY 2020 Earnings Release

On May 5, 2020, Premiere released its third-quarter fiscal 2020 results for the quarter ending March 2020. The Company reported non-GAAP earnings of $0.73-per share beating consensus analyst estimates of $0.71-per share by $0.02-per share. Top line revenues came in at $338.8 million beating the $312.77 million analyst estimates as sales grew 11.2% year-over-year (YoY). Premiere provided mixed guidance for full-year fiscal 2020 forecasting earnings-per-share (EPS) near the lower range of $2.76 to $2.89 versus consensus analyst estimates at $2.85 EPS. The Company raised the upper revenue range guidance to $1.235 billion to $1.284 billion versus $1.26 billion prior analyst estimates. The Products segment saw a 47% YoY top line growth to $61.2 million driven by PremierPro brand commodity products. Premiere ended the quarter with $241.7 million of liquidity consisting of cash and cash equivalents. In late April, the Company repaid $150 million of its $250 million balance on its $1 billion five-year revolver.

Supply Chain Leverage

With a network of over 4,000 hospitals and 175,000 providers totaling nearly $61 billion of purchasing power, Premiere influences tremendous negotiating leverage. The Company is able to use its economies of scale even in COVID-19 pandemic times to gain margin improvements. Its Supply Chain Services division grew Q3 non-GAAP adjusted EBITDA to $149.2 million, up 11% YoY from $134.8 million. Premiere expects the COVID-19-related activity to keep Supply Chain Services revenues to remain at the upper end of estimates in the $895 million to $930 million range. This was expected to offset softness from net administrative fees due to “anticipated softness” from pandemic-induced interruption of elective procedures. elective services. However, this is where the management may be low-balling estimates as the restart initiatives have bolstered the resumption of elective procedures.

Restarting Elective Procedures

With the exception of hotspots, the restart initiatives are still underway. Elective procedures are technical procedures that are “scheduled” and not performed in an emergency. Hospitals make up to 40% of their profits from these treatments. Elective procedures are still critical services including treatments for tumors, cardiovascular procedures, and various outpatient procedures. The alarming spike of non-COVID-19 related deaths has been due to the unavailability of elective procedures during the lockdowns. Even rollbacks would likely leave out the restrictions for elective procedures. Premiere perched at the apex of healthcare trends. COVID-19 has reshaped a new normal for the healthcare industry and Premiere is emerging as a benefactor of it.

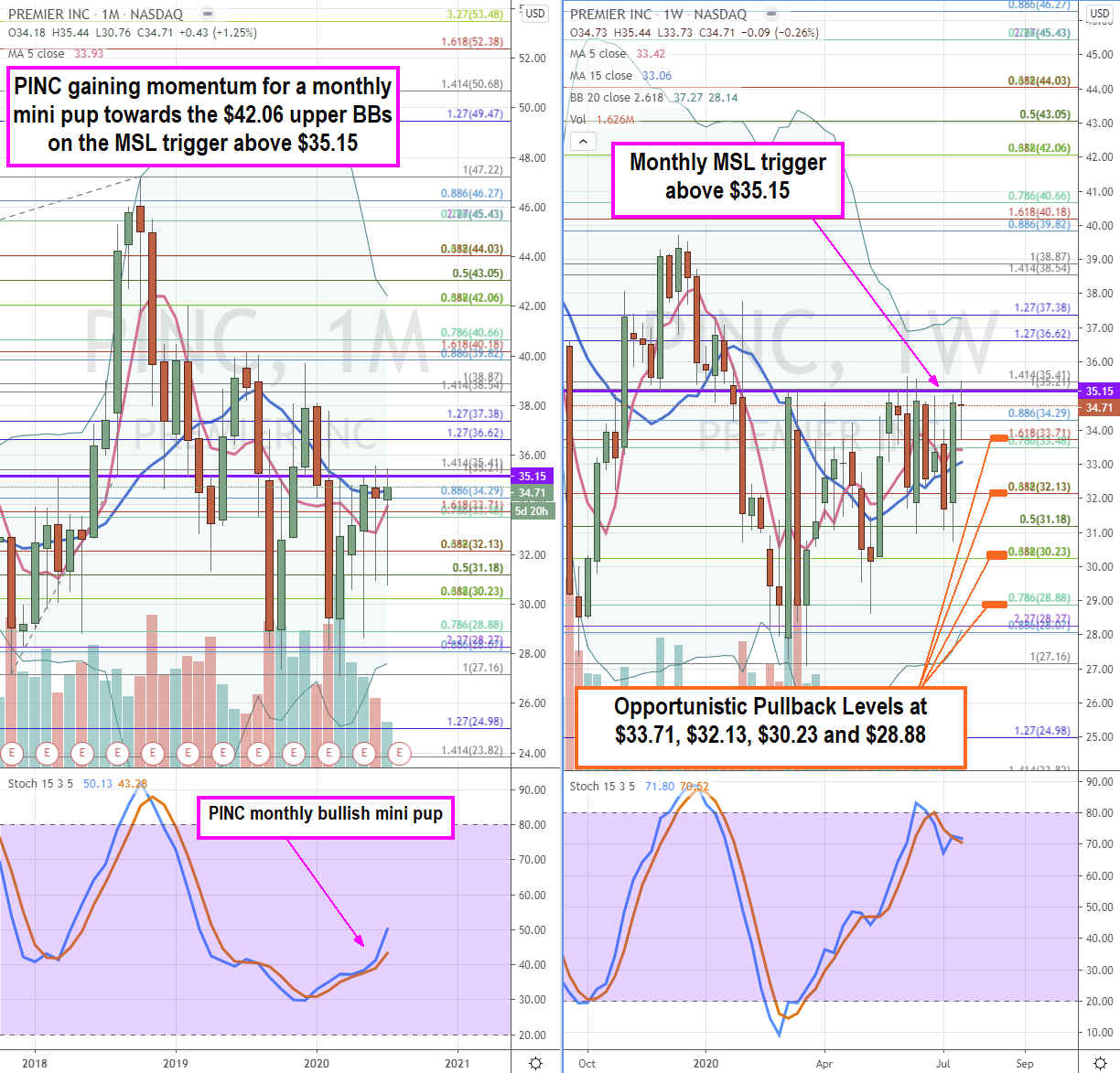

PINC Price Trajectories

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for PINC stock. The monthly rifle chart formed a market structure low (MSL) buy above $35.15 to $35.41 Fibonacci (fib) level. The rare monthly bullish stochastic mini pup is forming as the bulls have been successful deflecting every attempt to close the monthly candle below the 5-period moving average (MA). This has caused the monthly 5-period MA to slope up support to $33.95 as it attempts to crossover the 15-period MA at $34.58. The weekly rifle chart has a pup breakout with the stochastic trying to cross up. This can trigger a surge towards the weekly upper Bollinger Bands (BBs) at the $37.18 fib and ultimately the monthly upper BBs at $42.06. Interested investors should pay attention to pullbacks while the weekly stochastic is stalled out. This can present opportunistic pullback entry levels at the $33.71 fib, $32.13 fib, $30.23 overlapping fib and $28.88 fib. PINC is a benefactor on rollbacks as well as continued restarts. Negative catalysts can arise from supply chain shortages and reinstituting restrictions on elective procedures. PINC is expected to release Q4 FY 2020 results in mid to late August 2020 along with updated FY 2021 guidance.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report