Key Points

- PVH reported an earnings blowout for Q4 2022, beating EPS estimates by $0.71 and raising full-year 2023 top and bottom line guidance, surging more than 20% higher shares.

- PVH experienced a (240 bps) drop in YoY gross margins on a 34% rise in inventory levels. Still, the company expects operating margins to grow back to 10% and inventory to normalize, as evidenced by its full-year 2023 EPS raise to $10.00 vs. $8.91 consensus estimates.

- Europe saw 11% YoY growth, offset by an (8%) drop in Asia Pacific sales.

- China’s easing of zero-COVID restrictions started to show sales improvement near the end of the quarter.

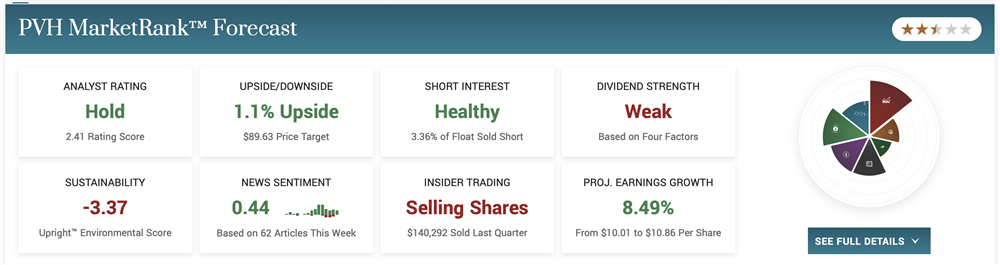

- PVH shares are trading at 8.9X forward earnings with a 0.17% annual dividend yield.

- 5 stocks we like better than PVH

Apparel maker PVH Corp NYSE: PVH stock surged over 20% on its Q4 2022 earnings report. The maker of Calvin Klein and Tommy Hilfiger brand apparel credits its PVH+ strategy plan for the success. It was first unveiled nearly a year ago and now paying big dividends. The plan focuses primarily on bolstering its two key brands, Calvin and Tommy, and expanding its direct-to-consumer (DTC) and digital offerings.

PVH saw strong results in its international business, which grew 11% to surpass pre-pandemic sales levels. Asia Pacific lagged, falling (8%) and taking a (9%) hit on unfavorable FX. While China's easing of zero-COVID restrictions is starting to show improvement, its initial surge of COVID cases hurt sales for the quarter. The company competes with higher-end apparel makers Ralph Lauren Co. NYSE: RL and Capri Holdings Limited NASDAQ: CPRI, maker of Versace, Jimmy Choo, and Michael Kors products.

Earnings Blowout

On March 27, 2023, PVH released its fiscal fourth-quarter 2022 results for the quarter ending January 2023. The company reported earnings-per-share (EPS) of $2.38, excluding non-recurring items beating consensus analyst estimates of $1.67 by $0.71. GAAP earnings were $2.18 versus $5.53 in the prior year. Non-GAAP earnings were $2.84 in the prior year. Revenues grew 2.4% year-over-year (YoY) to $2.49 billion, beating estimates for $2.36 billion. Inventory levels rose 34% YoY due to "abnormally low" inventory levels last year, early receipts of inventory and higher input costs. Gross margins fell (240 bps) to 55.9% versus 58.3% in the year-ago period due to elevated inventory levels and increased promotional activities. PVH bought back 6.2 million shares in 2022 for around $400 million.

PVH CEO Stefan Larsson commented, “We delivered strong fourth quarter performance with stronger than expected high-single digit constant currency revenue growth and earnings above guidance. Our disciplined execution of the PVH+ Plan, our multi-year, brand-focused, direct-to-consumer and digitally-led strategy enabled us to compete to win despite the challenging macro situation.”

Upside Guidance

PVH provided flat guidance for fiscal Q1 2023 EPS of $1.90 versus $1.90 consensus analyst estimates on revenues coming in around $2.12 billion versus $2.09 billion analyst estimates. The company raised its fiscal full-year 2023 EPS to $10.00 versus $8.91 consensus analyst estimates on revenues of $9.30 billion to $9.39 billion compared to $9.15 billion analyst estimates.

Analyst Actions

Many analysts praised the quarter and adjusted their ratings. UBS upgraded PVH shares to a Buy with a $92 price target. Bank of America also upgraded shares to a Buy. Wedbush maintained its Neutral rating. BMO also maintained its Market Perform rating. BMO analyst Simeon Siegel is still taking a wait-and-see approach.

He indicated that while PVH has done a fantastic job of transforming Calvin Klein and Tommy Hilfiger into two of the world's largest brands in history, CK may have reached it peak. PVH should focus on CK profitability over sales. Margins were the main factor keeping his rating unchanged. He commented, “We rate the shares Market Perform until we see greater evidence of the ability to expand margins.”

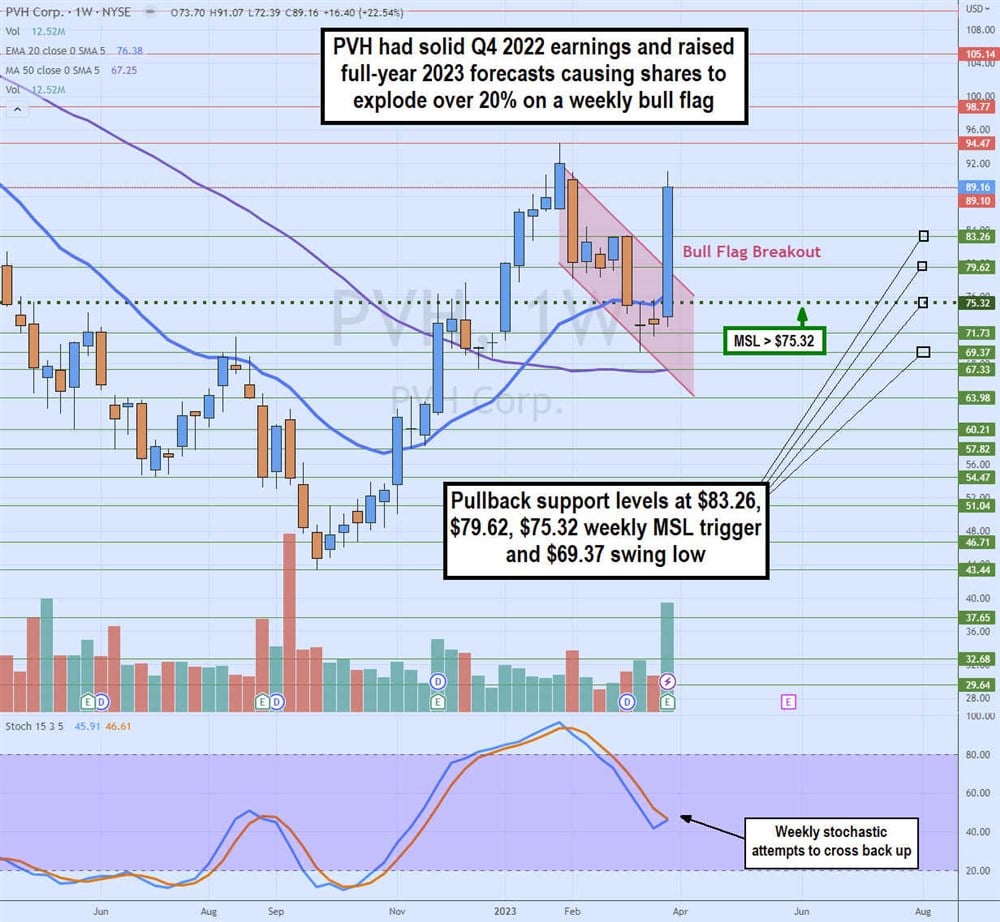

Weekly Bull Flag Breakout

The PVH candlestick chart illustrates the weekly bull flag breakout. PVH shares ran from a low of $43.44 in September 2022 to a high of $94.47 by the end of January 2023. It started its profit taking its descent back down to a low of $69.37 by early March 2023. The sell-off formed a parallel channel with lower highs and higher lows forming the flag.

The weekly market structure low (MSL) trigger breakout through $75.32 occurred in reaction to its blowout Q4 2022 earnings report, which spiked shares up through the $79.62 upper falling trendline of the bull flag. The substantial run-up is causing the weekly stochastic to attempt a crossover backup off the 40-band. Pullback supports are at $83.36, $79.62, $75.32 weekly MSL trigger, and $69.37 swing low.

Before you consider PVH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PVH wasn't on the list.

While PVH currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report