Key Points

- T2 Biosystems has experienced a significant surge in its stock price, with shares rising over 375% in the past month.

- Key catalysts behind the recent movement include an extension from the Nasdaq Hearings Panel to meet compliance requirements.

- The company's Q2 financial results showing reduced revenue but an improved balance sheet, and the rising popularity among retail traders.

- 5 stocks we like better than T2 Biosystems

The small-cap penny stock market has been hot lately, with a surge in volume and activity across several names. The most in-play name, with price and volume soaring remarkably, has been T2 Biosystems NASDAQ: TTOO. Over the past month, shares of this small-cap healthcare stock have soared over 375%. The looming question is whether the surge will continue for TTOO, or should investors be on alert and want to ring the register?

What Is T2 Biosystems?

T2 Biosystems develops diagnostic products to detect pathogens and abnormalities in unpurified patient samples. They offer instruments like T2Dx for running tests and panels such as T2Candida, T2Bacteria, and T2SARS-CoV-2 for identifying infections. They're also working on panels for biothreats, sepsis, Candida auris, and Lyme disease. Founded in 2006, the company is based in Lexington, Massachusetts.

The company has a market capitalization of $195.44 million, a free float of 333 million, an average volume of 40.14 million, and a 52-week range of $0.05 and $7.63.

The Three Catalysts Behind The Move

1) On July 31, TTOO announced that The Nasdaq Hearings Panel had granted an extension to the company until November 20, 2023, to meet Nasdaq's requirements regarding minimum bid price and market value of listed securities.

The company must achieve a closing bid price of at least $1.00 per share and a market value of at least $35 million for ten consecutive business days by that date to comply with the rules. TTOO will actively monitor its stock price and market value during this extension period and consider various options, including a potential reverse stock split, to address the deficiency and maintain its listing. However, timely compliance with the Panel's decision is not guaranteed.

2) On August 7, the company reported financial results for its second quarter. In the second quarter, the company's total revenue was $2 million, down 67% from the previous year, mainly due to a decrease in BARDA research contribution revenues by $3.4 million. Sepsis test panel revenue reached $1.3 million, a 7% increase compared to the previous year, despite a $350 thousand sepsis test backorder at the end of the quarter.

They improved their balance sheet by converting $10 million of term loan debt with CRG Servicing LLC into T2 Biosystems equity. As of June 30, 2023, the company had $16.1 million in cash and cash equivalents and raised $10.9 million in net proceeds through ATM sales in the third quarter.

The company also announced that they received FDA Breakthrough Device designation for Candida auris direct-from-blood molecular diagnostic test.

3) Short Interest and Retail Favorite

The third catalyst, arguably the one which holds the most weight, at least in the short term, has been the stock's popularity amongst retail traders and the rising short interest.

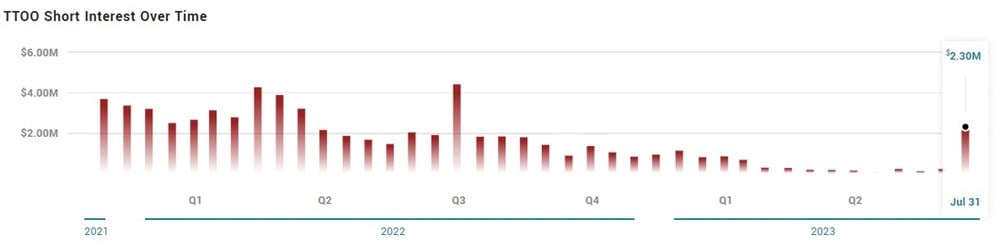

Month over month, as of July 31, the short volume increased by 716.23%, from 1.9m shares to 15.5m shares. As the stock has continued to climb, along with a sustained surge in volume, it's likely so too has the short interest.

The average daily volume of TTOO is 40.62 million shares. However, as the stock has gained popularity and was dubbed a meme stock by many, beginning in late July, the volume has rocketed higher. Since above-average volume first entered the stock in July, it has only traded less than its average daily volume on thirteen out of the last thirty days, with many of those days seeing volume surge over 100 million.

Before you consider T2 Biosystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T2 Biosystems wasn't on the list.

While T2 Biosystems currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to pot stock investing and which pot companies show the most promise.

Get This Free Report