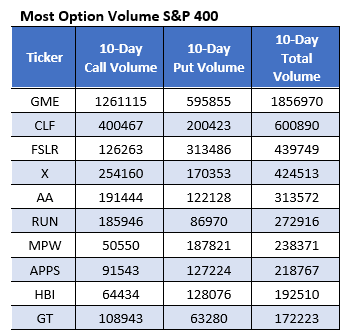

When we last covered Hanesbrands Inc. (NYSE:HBI) exactly two weeks ago, Wells Fargo had double-downgraded the shares to "underweight" and slashed its price target to $5 from $13. In the time since, HBI made its way onto Schaeffer's Senior Quantitative Analyst Rocky White's list of 10 S&P 400 Mid Cap Index (IDX) stocks that saw the heaviest weekly options volume during the past 10 trading days, which can be seen below.

Per White's data, Hanesbrand stock saw 128,076 puts and 64,434 calls exchanged in the last two weeks. This penchant for bearish bets likely picked up after the company reported lower-than-expected third-quarter revenue of $1.67 billion on Nov. 9. The most popular contract by far was the November 7 put, followed by the 7.50 put in the same monthly series.

It shouldn't come as a surprise then that this translates to a high interest in puts for short-term options traders. This is per Hanesbrands stock's Schaeffer's put/call open interest ratio (SOIR) of 1.46, which stands higher than 93% of annual readings.

A barrage of bear notes followed the quarterly results, too. Specifically, at least five analysts slashed their price targets, with Credit Suisse adjusting down to $7 from $10 and downgrading HBI to "neutral" from "outperform." Today, all seven covering brokerages rate the equity a "hold" or worse, and the 12-month consensus target price of $6.80 is a 9.5% discount to the stock's current perch.

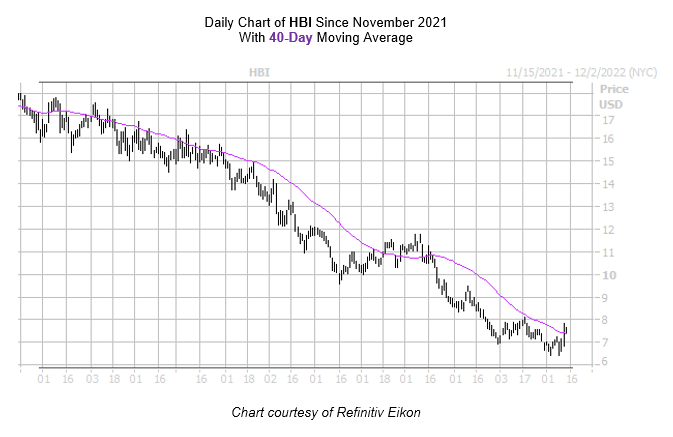

Though Hanesbrands stock was last seen 3.3% lower to trade at $7.52, the shares are looking for their second-straight close above the 40-day moving average, after facing pressure from the trendline since mid-August. Last week, HBI turned in its best weekly performance in more than 12 months, though it remains down 57.4% year-over-year.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report