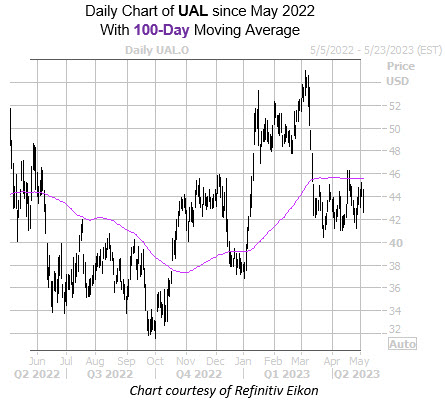

United Airlines Holdings Inc (NASDAQ:UAL) has just come within one standard deviation of its 100-day moving average for the sixth time in the past three years. According to Schaeffer's Senior Quantitative Analyst Rocky White, UAL was lower one month later after every signal, averaging a 12.6% loss.

United Airlines stock is currently down 3% at $43.16, and a similar move would place the equity below the $38 level for the first time since the very start of the year. Peer Delta Air Lines' (DAL) new pilot contract is likely weighing on the equity today, after they offered $7 billion in higher pay and benefits, putting pressure on United and Southwest, who are currently in the middle of contract negotiations with their pilots.

A downgrade or two could push United Airlines stock lower as well, as the majority of analysts are bullish. Of the 16 analysts in coverage, 12 carry a "buy" or better rating.

Now looks like a good time to weigh in with options. The stock is seeing attractively priced premiums at the moment, per UAL's Schaeffer's Volatility Index (SVI) of 40%, which sits in the low 11th percentile of its annual range.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report