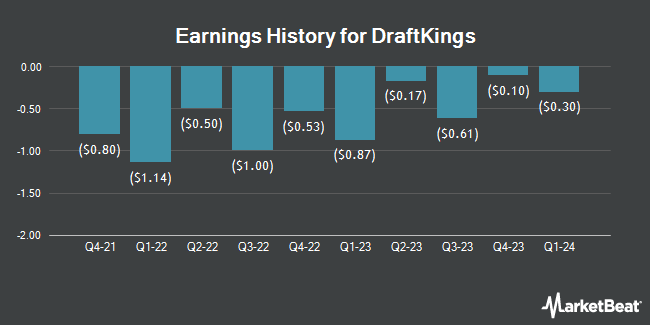

DraftKings (NASDAQ:DKNG - Get Free Report) issued its quarterly earnings results on Thursday. The company reported ($0.30) earnings per share for the quarter, missing analysts' consensus estimates of ($0.28) by ($0.02), Briefing.com reports. DraftKings had a negative net margin of 21.88% and a negative return on equity of 87.24%. The company had revenue of $1.18 billion during the quarter, compared to the consensus estimate of $1.12 billion. During the same period last year, the company earned ($0.87) earnings per share. DraftKings's revenue for the quarter was up 52.7% on a year-over-year basis.

DraftKings (NASDAQ:DKNG - Get Free Report) issued its quarterly earnings results on Thursday. The company reported ($0.30) earnings per share for the quarter, missing analysts' consensus estimates of ($0.28) by ($0.02), Briefing.com reports. DraftKings had a negative net margin of 21.88% and a negative return on equity of 87.24%. The company had revenue of $1.18 billion during the quarter, compared to the consensus estimate of $1.12 billion. During the same period last year, the company earned ($0.87) earnings per share. DraftKings's revenue for the quarter was up 52.7% on a year-over-year basis.

DraftKings Stock Down 2.8 %

Shares of DraftKings stock traded down $1.21 on Friday, reaching $41.82. 27,173,021 shares of the company were exchanged, compared to its average volume of 11,728,833. DraftKings has a one year low of $21.07 and a one year high of $49.57. The company has a market capitalization of $36.24 billion, a price-to-earnings ratio of -23.79 and a beta of 1.87. The company has a current ratio of 1.34, a quick ratio of 1.34 and a debt-to-equity ratio of 1.49. The company has a 50-day moving average of $43.57 and a 200 day moving average of $38.70.

Insider Transactions at DraftKings

In other news, insider Jason Robins sold 200,000 shares of the company's stock in a transaction that occurred on Wednesday, February 21st. The stock was sold at an average price of $40.89, for a total transaction of $8,178,000.00. Following the sale, the insider now owns 3,195,812 shares in the company, valued at approximately $130,676,752.68. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. In related news, insider Jason Robins sold 200,000 shares of the stock in a transaction on Wednesday, February 21st. The stock was sold at an average price of $40.89, for a total value of $8,178,000.00. Following the sale, the insider now owns 3,195,812 shares in the company, valued at approximately $130,676,752.68. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider R Stanton Dodge sold 686,101 shares of the company's stock in a transaction on Thursday, February 8th. The shares were sold at an average price of $43.06, for a total value of $29,543,509.06. Following the completion of the transaction, the insider now directly owns 200,239 shares in the company, valued at $8,622,291.34. The disclosure for this sale can be found here. Insiders have sold a total of 1,086,101 shares of company stock worth $45,903,509 in the last 90 days. Corporate insiders own 51.19% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts recently weighed in on the stock. Mizuho began coverage on shares of DraftKings in a research note on Tuesday, March 26th. They issued a "buy" rating and a $58.00 target price for the company. BNP Paribas lowered DraftKings from a "neutral" rating to an "underperform" rating and set a $28.00 target price for the company. in a research note on Friday, January 19th. Moffett Nathanson lifted their price target on shares of DraftKings from $52.00 to $55.00 and gave the stock a "buy" rating in a research note on Thursday, March 28th. Benchmark upped their target price on shares of DraftKings from $50.00 to $52.00 and gave the company a "buy" rating in a research note on Friday. Finally, Oppenheimer raised their price target on shares of DraftKings from $55.00 to $60.00 and gave the stock an "outperform" rating in a research note on Tuesday, February 20th. Two research analysts have rated the stock with a sell rating, one has assigned a hold rating and twenty-five have issued a buy rating to the stock. According to MarketBeat.com, DraftKings has a consensus rating of "Moderate Buy" and an average target price of $47.45.

View Our Latest Report on DKNG

About DraftKings

(

Get Free Report)

DraftKings Inc operates as a digital sports entertainment and gaming company in the United States and internationally. It provides online sports betting and casino, daily fantasy sports, media, and other consumer products, as well as retails sportsbooks. The company also engages in the design and development of sports betting and casino gaming software for online and retail sportsbooks, and iGaming operators.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider DraftKings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DraftKings wasn't on the list.

While DraftKings currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report