Beck Bode LLC acquired a new stake in Electronic Arts Inc. (NASDAQ:EA - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 15,674 shares of the game software company's stock, valued at approximately $2,144,000.

Beck Bode LLC acquired a new stake in Electronic Arts Inc. (NASDAQ:EA - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 15,674 shares of the game software company's stock, valued at approximately $2,144,000.

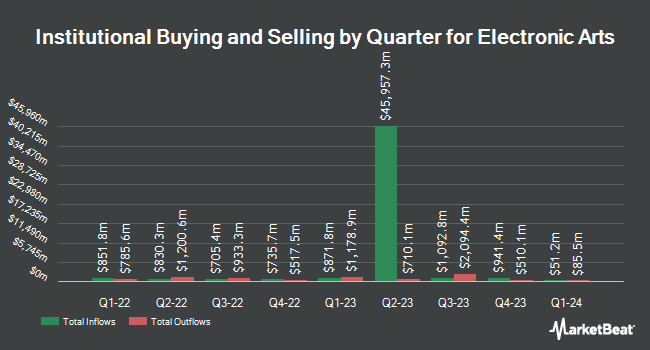

Several other hedge funds also recently bought and sold shares of EA. AE Wealth Management LLC raised its holdings in Electronic Arts by 41.4% in the third quarter. AE Wealth Management LLC now owns 3,441 shares of the game software company's stock worth $414,000 after purchasing an additional 1,007 shares during the period. IFP Advisors Inc raised its holdings in Electronic Arts by 20.6% in the third quarter. IFP Advisors Inc now owns 608 shares of the game software company's stock worth $73,000 after purchasing an additional 104 shares during the period. Commonwealth Equity Services LLC raised its holdings in shares of Electronic Arts by 4.4% during the third quarter. Commonwealth Equity Services LLC now owns 40,542 shares of the game software company's stock worth $4,881,000 after acquiring an additional 1,711 shares during the period. Toews Corp ADV acquired a new stake in shares of Electronic Arts during the third quarter worth $795,000. Finally, Palouse Capital Management Inc. raised its holdings in shares of Electronic Arts by 2.1% during the third quarter. Palouse Capital Management Inc. now owns 8,164 shares of the game software company's stock worth $983,000 after acquiring an additional 170 shares during the period. 90.23% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, insider Vijayanthimala Singh sold 800 shares of Electronic Arts stock in a transaction dated Thursday, February 1st. The shares were sold at an average price of $137.43, for a total transaction of $109,944.00. Following the completion of the sale, the insider now owns 28,683 shares of the company's stock, valued at approximately $3,941,904.69. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. In other Electronic Arts news, insider Vijayanthimala Singh sold 800 shares of Electronic Arts stock in a transaction dated Thursday, February 1st. The shares were sold at an average price of $137.43, for a total value of $109,944.00. Following the completion of the sale, the insider now owns 28,683 shares in the company, valued at approximately $3,941,904.69. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Laura Miele sold 2,000 shares of Electronic Arts stock in a transaction dated Thursday, February 1st. The stock was sold at an average price of $137.43, for a total transaction of $274,860.00. Following the completion of the sale, the chief operating officer now owns 38,548 shares of the company's stock, valued at approximately $5,297,651.64. The disclosure for this sale can be found here. In the last 90 days, insiders sold 37,144 shares of company stock valued at $5,114,335. Company insiders own 0.20% of the company's stock.

Electronic Arts Stock Performance

Shares of EA traded down $1.08 during midday trading on Tuesday, reaching $126.82. The stock had a trading volume of 1,804,927 shares, compared to its average volume of 1,986,541. The firm has a 50 day simple moving average of $133.09 and a 200-day simple moving average of $134.56. Electronic Arts Inc. has a one year low of $117.47 and a one year high of $144.53. The firm has a market cap of $33.91 billion, a PE ratio of 31.94, a P/E/G ratio of 1.77 and a beta of 0.76. The company has a current ratio of 1.33, a quick ratio of 1.33 and a debt-to-equity ratio of 0.25.

Electronic Arts (NASDAQ:EA - Get Free Report) last announced its quarterly earnings data on Tuesday, January 30th. The game software company reported $1.07 EPS for the quarter, missing analysts' consensus estimates of $2.45 by ($1.38). The firm had revenue of $2.37 billion during the quarter, compared to the consensus estimate of $2.40 billion. Electronic Arts had a net margin of 14.09% and a return on equity of 20.58%. The business's revenue was up 1.0% on a year-over-year basis. During the same period last year, the business earned $2.29 EPS. As a group, sell-side analysts anticipate that Electronic Arts Inc. will post 5.35 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on the stock. Wedbush restated an "outperform" rating and set a $162.00 price objective on shares of Electronic Arts in a report on Wednesday, January 31st. UBS Group dropped their price objective on shares of Electronic Arts from $146.00 to $143.00 and set a "neutral" rating on the stock in a report on Wednesday, March 27th. Benchmark restated a "buy" rating and set a $153.00 price objective on shares of Electronic Arts in a report on Thursday, April 18th. Oppenheimer restated an "outperform" rating and set a $150.00 price objective on shares of Electronic Arts in a report on Tuesday, April 23rd. Finally, Stifel Nicolaus lifted their price target on shares of Electronic Arts from $152.00 to $155.00 and gave the company a "buy" rating in a research note on Thursday, January 18th. Eight research analysts have rated the stock with a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $147.00.

Get Our Latest Research Report on EA

About Electronic Arts

(

Free Report)

Electronic Arts Inc develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. It develops and publishes games and services across various genres, such as sports, racing, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Need for Speed, and license games from others, including FIFA, Madden NFL, UFC, and Star Wars brands.

Featured Articles

Want to see what other hedge funds are holding EA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Electronic Arts Inc. (NASDAQ:EA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Electronic Arts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electronic Arts wasn't on the list.

While Electronic Arts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report