Leeward Investments LLC MA bought a new position in shares of Hologic, Inc. (NASDAQ:HOLX - Free Report) during the 4th quarter, according to its most recent 13F filing with the SEC. The fund bought 78,522 shares of the medical equipment provider's stock, valued at approximately $5,610,000.

Leeward Investments LLC MA bought a new position in shares of Hologic, Inc. (NASDAQ:HOLX - Free Report) during the 4th quarter, according to its most recent 13F filing with the SEC. The fund bought 78,522 shares of the medical equipment provider's stock, valued at approximately $5,610,000.

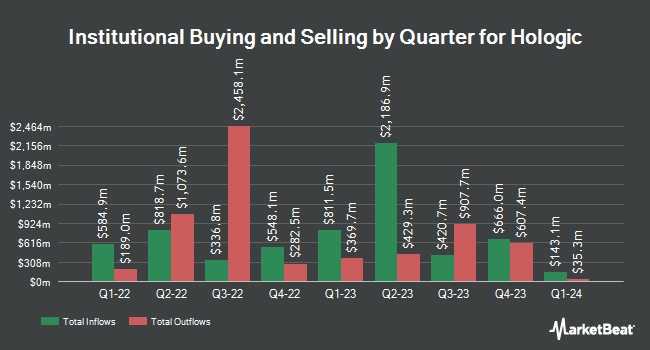

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in HOLX. McGlone Suttner Wealth Management Inc. purchased a new position in Hologic during the 4th quarter worth $27,000. Venturi Wealth Management LLC purchased a new position in Hologic during the 3rd quarter worth $29,000. NBC Securities Inc. purchased a new position in Hologic during the 3rd quarter worth $33,000. Deseret Mutual Benefit Administrators grew its stake in Hologic by 42.2% during the 3rd quarter. Deseret Mutual Benefit Administrators now owns 522 shares of the medical equipment provider's stock worth $36,000 after buying an additional 155 shares during the last quarter. Finally, Massmutual Trust Co. FSB ADV grew its stake in Hologic by 69.4% during the 4th quarter. Massmutual Trust Co. FSB ADV now owns 554 shares of the medical equipment provider's stock worth $40,000 after buying an additional 227 shares during the last quarter. 94.73% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling

In related news, Director Scott T. Garrett sold 16,441 shares of the company's stock in a transaction dated Thursday, March 14th. The stock was sold at an average price of $75.50, for a total value of $1,241,295.50. Following the completion of the transaction, the director now owns 48,611 shares of the company's stock, valued at approximately $3,670,130.50. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other Hologic news, Director Charles J. Dockendorff sold 1,465 shares of the stock in a transaction that occurred on Friday, March 8th. The stock was sold at an average price of $76.21, for a total transaction of $111,647.65. Following the completion of the transaction, the director now owns 1,572 shares of the company's stock, valued at $119,802.12. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Scott T. Garrett sold 16,441 shares of the stock in a transaction that occurred on Thursday, March 14th. The shares were sold at an average price of $75.50, for a total value of $1,241,295.50. Following the transaction, the director now directly owns 48,611 shares of the company's stock, valued at approximately $3,670,130.50. The disclosure for this sale can be found here. In the last 90 days, insiders sold 32,846 shares of company stock valued at $2,473,443. 1.75% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

Several analysts have weighed in on HOLX shares. Evercore ISI boosted their price target on Hologic from $76.00 to $78.00 and gave the company an "in-line" rating in a research note on Thursday, April 4th. Raymond James boosted their price target on Hologic from $85.00 to $88.00 and gave the company an "outperform" rating in a research note on Friday, February 2nd. Citigroup upgraded Hologic from a "neutral" rating to a "buy" rating and boosted their price target for the company from $80.00 to $95.00 in a research note on Wednesday, April 3rd. StockNews.com downgraded Hologic from a "buy" rating to a "hold" rating in a research note on Friday, March 8th. Finally, Needham & Company LLC reiterated a "buy" rating and set a $90.00 price target on shares of Hologic in a research note on Wednesday, April 10th. Six research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $87.00.

Check Out Our Latest Report on HOLX

Hologic Stock Performance

Shares of HOLX stock traded up $0.27 on Friday, hitting $75.98. The company had a trading volume of 919,462 shares, compared to its average volume of 1,769,007. The firm has a market cap of $17.83 billion, a P/E ratio of 36.01, a price-to-earnings-growth ratio of 2.60 and a beta of 1.00. The company has a 50-day moving average price of $76.03 and a 200-day moving average price of $72.78. The company has a quick ratio of 3.18, a current ratio of 3.89 and a debt-to-equity ratio of 0.55. Hologic, Inc. has a twelve month low of $64.02 and a twelve month high of $87.88.

Hologic (NASDAQ:HOLX - Get Free Report) last issued its quarterly earnings data on Thursday, February 1st. The medical equipment provider reported $0.98 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.95 by $0.03. The business had revenue of $1.01 billion during the quarter, compared to analysts' expectations of $989.32 million. Hologic had a return on equity of 18.91% and a net margin of 12.98%. The company's revenue for the quarter was down 5.7% on a year-over-year basis. During the same quarter in the previous year, the firm posted $1.07 EPS. As a group, equities research analysts predict that Hologic, Inc. will post 4.01 earnings per share for the current fiscal year.

About Hologic

(

Free Report)

Hologic, Inc develops, manufactures, and supplies diagnostics products, medical imaging systems, and surgical products for women's health through early detection and treatment. The company operates through four segments: Diagnostics, Breast Health, GYN Surgical, and Skeletal Health. It provides Aptima molecular diagnostic assays to detect the infectious microorganisms; Aptima viral load assays for Hepatitis B virus, Hepatitis C virus, human immunodeficiency virus, and human cytomegalo virus; Aptima bacterial vaginosis and candida vaginitis assays for the diagnosis of vaginitis; Aptima SARS-CoV-2 and Panther Fusion SARS-CoV-2 assays to detect SARS-CoV-2; ThinPrep System for cytology applications; and Rapid Fetal Fibronectin Test that assists physicians in assessing the risk of pre-term birth.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Hologic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hologic wasn't on the list.

While Hologic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report