TimesSquare Capital Management LLC lowered its stake in shares of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI - Free Report) by 16.7% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 294,465 shares of the semiconductor company's stock after selling 58,910 shares during the quarter. TimesSquare Capital Management LLC owned about 0.41% of MACOM Technology Solutions worth $27,371,000 at the end of the most recent reporting period.

TimesSquare Capital Management LLC lowered its stake in shares of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI - Free Report) by 16.7% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 294,465 shares of the semiconductor company's stock after selling 58,910 shares during the quarter. TimesSquare Capital Management LLC owned about 0.41% of MACOM Technology Solutions worth $27,371,000 at the end of the most recent reporting period.

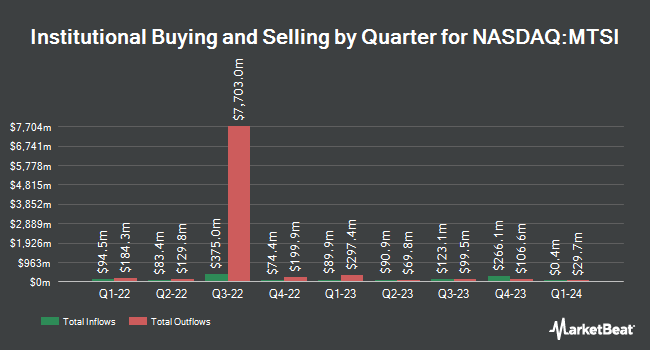

Several other large investors have also recently bought and sold shares of the stock. RiverPark Advisors LLC bought a new position in shares of MACOM Technology Solutions during the 3rd quarter worth about $58,000. Harvest Fund Management Co. Ltd bought a new stake in shares of MACOM Technology Solutions in the 4th quarter worth approximately $69,000. International Assets Investment Management LLC acquired a new stake in shares of MACOM Technology Solutions during the 4th quarter worth approximately $156,000. Headlands Technologies LLC bought a new stake in shares of MACOM Technology Solutions during the third quarter valued at approximately $144,000. Finally, EP Wealth Advisors LLC acquired a new position in shares of MACOM Technology Solutions in the third quarter valued at $208,000. 76.14% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In other news, SVP Robert Dennehy sold 2,370 shares of the firm's stock in a transaction on Friday, March 15th. The stock was sold at an average price of $88.88, for a total value of $210,645.60. Following the transaction, the senior vice president now directly owns 32,827 shares in the company, valued at approximately $2,917,663.76. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In related news, Director Susan Ocampo sold 200,000 shares of MACOM Technology Solutions stock in a transaction that occurred on Monday, February 12th. The shares were sold at an average price of $85.00, for a total transaction of $17,000,000.00. Following the transaction, the director now owns 7,245,668 shares of the company's stock, valued at approximately $615,881,780. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, SVP Robert Dennehy sold 2,370 shares of the company's stock in a transaction that occurred on Friday, March 15th. The shares were sold at an average price of $88.88, for a total transaction of $210,645.60. Following the completion of the sale, the senior vice president now directly owns 32,827 shares of the company's stock, valued at approximately $2,917,663.76. The disclosure for this sale can be found here. Insiders have sold a total of 725,939 shares of company stock valued at $61,816,600 in the last 90 days. 22.75% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

Several equities research analysts have issued reports on MTSI shares. TheStreet lowered shares of MACOM Technology Solutions from a "b" rating to a "c+" rating in a report on Thursday, February 1st. Benchmark increased their price target on shares of MACOM Technology Solutions from $95.00 to $115.00 and gave the stock a "buy" rating in a research report on Monday. Craig Hallum raised their price target on shares of MACOM Technology Solutions from $95.00 to $120.00 and gave the stock a "buy" rating in a research note on Friday, May 3rd. Needham & Company LLC increased their price objective on MACOM Technology Solutions from $100.00 to $110.00 and gave the stock a "buy" rating in a research note on Friday, May 3rd. Finally, Evercore ISI started coverage on shares of MACOM Technology Solutions in a research note on Tuesday, April 16th. They issued an "outperform" rating and a $120.00 target price on the stock. Two equities research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $108.33.

Get Our Latest Analysis on MACOM Technology Solutions

MACOM Technology Solutions Trading Down 1.5 %

NASDAQ:MTSI traded down $1.57 during trading hours on Wednesday, hitting $101.43. 477,834 shares of the stock were exchanged, compared to its average volume of 528,014. The company has a market capitalization of $7.31 billion, a P/E ratio of 115.26, a price-to-earnings-growth ratio of 7.99 and a beta of 1.65. The company has a quick ratio of 5.70, a current ratio of 7.34 and a debt-to-equity ratio of 0.47. The company's 50 day moving average is $97.12 and its two-hundred day moving average is $88.82. MACOM Technology Solutions Holdings, Inc. has a twelve month low of $53.04 and a twelve month high of $107.00.

About MACOM Technology Solutions

(

Free Report)

MACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MACOM Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MACOM Technology Solutions wasn't on the list.

While MACOM Technology Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report