BCK Capital Management LP purchased a new position in shares of National Western Life Group, Inc. (NASDAQ:NWLI - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm purchased 2,850 shares of the financial services provider's stock, valued at approximately $1,377,000. National Western Life Group accounts for about 1.4% of BCK Capital Management LP's investment portfolio, making the stock its 23rd largest holding. BCK Capital Management LP owned approximately 0.08% of National Western Life Group at the end of the most recent quarter.

BCK Capital Management LP purchased a new position in shares of National Western Life Group, Inc. (NASDAQ:NWLI - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm purchased 2,850 shares of the financial services provider's stock, valued at approximately $1,377,000. National Western Life Group accounts for about 1.4% of BCK Capital Management LP's investment portfolio, making the stock its 23rd largest holding. BCK Capital Management LP owned approximately 0.08% of National Western Life Group at the end of the most recent quarter.

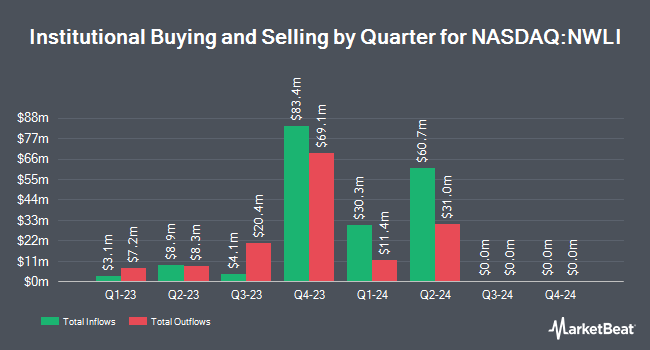

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in NWLI. Allspring Global Investments Holdings LLC grew its position in shares of National Western Life Group by 10.8% during the 4th quarter. Allspring Global Investments Holdings LLC now owns 88,894 shares of the financial services provider's stock valued at $42,938,000 after acquiring an additional 8,681 shares during the period. Bank of New York Mellon Corp grew its position in shares of National Western Life Group by 3.8% during the 3rd quarter. Bank of New York Mellon Corp now owns 16,382 shares of the financial services provider's stock valued at $7,167,000 after acquiring an additional 597 shares during the period. American Century Companies Inc. grew its position in shares of National Western Life Group by 3.1% during the 3rd quarter. American Century Companies Inc. now owns 15,076 shares of the financial services provider's stock valued at $6,596,000 after acquiring an additional 451 shares during the period. FCA Corp TX grew its position in shares of National Western Life Group by 2.1% during the 3rd quarter. FCA Corp TX now owns 10,563 shares of the financial services provider's stock valued at $4,621,000 after acquiring an additional 217 shares during the period. Finally, Tokio Marine Asset Management Co. Ltd. acquired a new stake in shares of National Western Life Group during the 4th quarter valued at about $4,975,000. 81.57% of the stock is owned by institutional investors and hedge funds.

National Western Life Group Price Performance

NWLI stock traded up $1.32 during trading on Monday, hitting $489.80. The stock had a trading volume of 15,757 shares, compared to its average volume of 15,864. National Western Life Group, Inc. has a twelve month low of $258.56 and a twelve month high of $493.00. The stock has a market capitalization of $1.78 billion, a P/E ratio of 18.34 and a beta of 0.71. The company's 50-day moving average price is $488.44 and its two-hundred day moving average price is $484.14.

National Western Life Group (NASDAQ:NWLI - Get Free Report) last posted its quarterly earnings data on Thursday, February 29th. The financial services provider reported ($3.46) earnings per share (EPS) for the quarter. National Western Life Group had a return on equity of 3.96% and a net margin of 13.05%. The firm had revenue of $207.87 million during the quarter.

Analyst Ratings Changes

Separately, StockNews.com began coverage on National Western Life Group in a report on Monday. They issued a "hold" rating on the stock.

View Our Latest Stock Report on National Western Life Group

National Western Life Group Profile

(

Free Report)

National Western Life Group, Inc, through its subsidiary, National Western Life Insurance Company, operates as a stock life insurance company in the United States, Brazil, Taiwan, Peru, Venezuela, Colombia, and internationally. It operates through Domestic Life Insurance, International Life Insurance, Annuities, and ONL and Affiliates segments.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider National Western Life Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Western Life Group wasn't on the list.

While National Western Life Group currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report