O'Reilly Automotive (NASDAQ:ORLY - Get Free Report) was upgraded by stock analysts at StockNews.com from a "hold" rating to a "buy" rating in a research report issued on Tuesday.

O'Reilly Automotive (NASDAQ:ORLY - Get Free Report) was upgraded by stock analysts at StockNews.com from a "hold" rating to a "buy" rating in a research report issued on Tuesday.

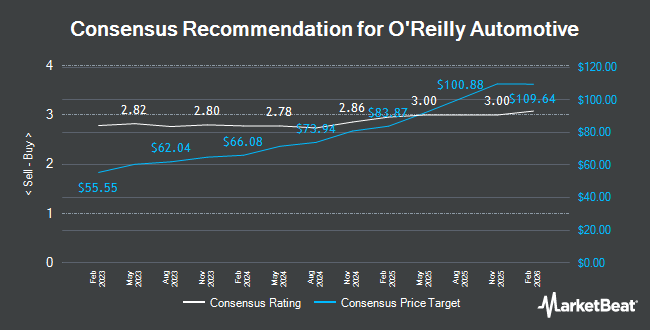

ORLY has been the subject of several other reports. Mizuho assumed coverage on shares of O'Reilly Automotive in a research note on Tuesday, March 19th. They issued a "buy" rating and a $1,225.00 price target for the company. Barclays boosted their price objective on shares of O'Reilly Automotive from $954.00 to $986.00 and gave the company an "equal weight" rating in a research report on Thursday, January 4th. Royal Bank of Canada boosted their price objective on shares of O'Reilly Automotive from $1,003.00 to $1,078.00 and gave the company an "outperform" rating in a research report on Friday, February 9th. The Goldman Sachs Group boosted their price objective on shares of O'Reilly Automotive from $1,022.00 to $1,170.00 and gave the company a "buy" rating in a research report on Friday, February 9th. Finally, Evercore ISI decreased their price objective on shares of O'Reilly Automotive from $1,240.00 to $1,220.00 and set an "outperform" rating on the stock in a research report on Tuesday. Four analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $1,089.59.

Check Out Our Latest Report on ORLY

O'Reilly Automotive Price Performance

O'Reilly Automotive stock traded up $20.24 during mid-day trading on Tuesday, hitting $1,089.51. The company's stock had a trading volume of 535,208 shares, compared to its average volume of 368,148. The stock has a market cap of $64.31 billion, a price-to-earnings ratio of 28.31, a price-to-earnings-growth ratio of 1.95 and a beta of 0.86. The business has a 50 day moving average price of $1,090.52 and a 200-day moving average price of $1,006.87. O'Reilly Automotive has a 12 month low of $860.10 and a 12 month high of $1,169.11.

O'Reilly Automotive (NASDAQ:ORLY - Get Free Report) last posted its quarterly earnings results on Thursday, February 8th. The specialty retailer reported $9.26 earnings per share for the quarter, topping the consensus estimate of $9.07 by $0.19. The business had revenue of $3.83 billion during the quarter, compared to the consensus estimate of $3.86 billion. O'Reilly Automotive had a net margin of 14.84% and a negative return on equity of 139.01%. The firm's revenue for the quarter was up 5.1% on a year-over-year basis. During the same period in the previous year, the firm posted $8.37 earnings per share. On average, equities research analysts expect that O'Reilly Automotive will post 42.09 earnings per share for the current fiscal year.

Insider Buying and Selling at O'Reilly Automotive

In other O'Reilly Automotive news, SVP Christopher Andrew Mancini sold 1,500 shares of the firm's stock in a transaction that occurred on Wednesday, January 17th. The shares were sold at an average price of $1,000.00, for a total transaction of $1,500,000.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. In other O'Reilly Automotive news, SVP Christopher Andrew Mancini sold 1,500 shares of the firm's stock in a transaction that occurred on Wednesday, January 17th. The shares were sold at an average price of $1,000.00, for a total transaction of $1,500,000.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Chairman David E. Oreilly sold 10,000 shares of the firm's stock in a transaction that occurred on Friday, February 16th. The shares were sold at an average price of $1,053.58, for a total transaction of $10,535,800.00. Following the transaction, the chairman now directly owns 216,539 shares of the company's stock, valued at approximately $228,141,159.62. The disclosure for this sale can be found here. Over the last quarter, insiders sold 27,468 shares of company stock valued at $28,769,333. Corporate insiders own 1.18% of the company's stock.

Institutional Investors Weigh In On O'Reilly Automotive

A number of institutional investors have recently made changes to their positions in the company. Geode Capital Management LLC grew its holdings in shares of O'Reilly Automotive by 1.8% during the first quarter. Geode Capital Management LLC now owns 1,489,353 shares of the specialty retailer's stock valued at $1,262,904,000 after buying an additional 26,201 shares during the last quarter. Morgan Stanley grew its holdings in shares of O'Reilly Automotive by 113.8% during the fourth quarter. Morgan Stanley now owns 1,193,792 shares of the specialty retailer's stock valued at $1,007,597,000 after buying an additional 635,416 shares during the last quarter. Jennison Associates LLC grew its holdings in shares of O'Reilly Automotive by 7.6% during the fourth quarter. Jennison Associates LLC now owns 947,484 shares of the specialty retailer's stock valued at $900,186,000 after buying an additional 66,629 shares during the last quarter. Invesco Ltd. grew its holdings in shares of O'Reilly Automotive by 3.7% during the third quarter. Invesco Ltd. now owns 888,110 shares of the specialty retailer's stock valued at $807,168,000 after buying an additional 31,487 shares during the last quarter. Finally, Norges Bank purchased a new stake in shares of O'Reilly Automotive during the fourth quarter valued at approximately $671,384,000. Hedge funds and other institutional investors own 85.00% of the company's stock.

About O'Reilly Automotive

(

Get Free Report)

O'Reilly Automotive, Inc, together with its subsidiaries, operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, and Mexico. The company provides new and remanufactured automotive hard parts and maintenance items, such as alternators, batteries, brake system components, belts, chassis parts, driveline parts, engine parts, fuel pumps, hoses, starters, temperature control, water pumps, antifreeze, appearance products, engine additives, filters, fluids, lighting products, and oil and wiper blades; and accessories, including floor mats, seat covers, and truck accessories.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider O'Reilly Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and O'Reilly Automotive wasn't on the list.

While O'Reilly Automotive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report