Progyny (NASDAQ:PGNY - Get Free Report) updated its second quarter 2024 earnings guidance on Thursday. The company provided earnings per share (EPS) guidance of 0.390-0.410 for the period, compared to the consensus estimate of 0.180. The company issued revenue guidance of $300.0 million-$310.0 million, compared to the consensus revenue estimate of $335.8 million. Progyny also updated its FY 2024 guidance to 1.610-1.680 EPS.

Progyny (NASDAQ:PGNY - Get Free Report) updated its second quarter 2024 earnings guidance on Thursday. The company provided earnings per share (EPS) guidance of 0.390-0.410 for the period, compared to the consensus estimate of 0.180. The company issued revenue guidance of $300.0 million-$310.0 million, compared to the consensus revenue estimate of $335.8 million. Progyny also updated its FY 2024 guidance to 1.610-1.680 EPS.

Progyny Price Performance

PGNY stock traded up $0.34 during mid-day trading on Thursday, reaching $32.50. The company had a trading volume of 1,646,876 shares, compared to its average volume of 800,912. The company has a market capitalization of $3.12 billion, a PE ratio of 52.42, a price-to-earnings-growth ratio of 1.31 and a beta of 1.51. Progyny has a 12 month low of $29.44 and a 12 month high of $44.95. The firm has a 50 day moving average of $34.75 and a 200 day moving average of $35.61.

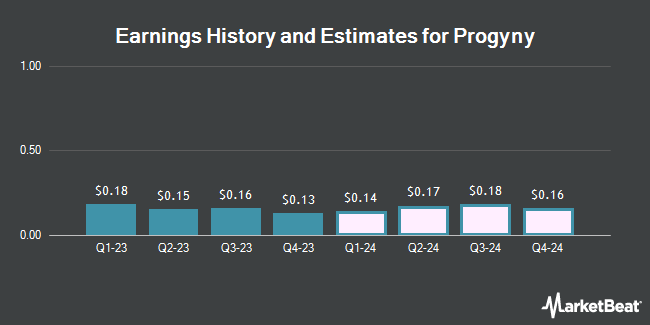

Progyny (NASDAQ:PGNY - Get Free Report) last released its quarterly earnings results on Tuesday, February 27th. The company reported $0.13 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.09 by $0.04. Progyny had a net margin of 5.70% and a return on equity of 12.64%. The business had revenue of $269.94 million for the quarter, compared to analyst estimates of $274.08 million. During the same period in the previous year, the company earned $0.03 earnings per share. The business's revenue for the quarter was up 26.0% on a year-over-year basis. Analysts anticipate that Progyny will post 0.7 EPS for the current year.

Wall Street Analysts Forecast Growth

Several analysts recently commented on PGNY shares. Leerink Partnrs restated an outperform rating on shares of Progyny in a research report on Monday, February 26th. Truist Financial reaffirmed a buy rating and issued a $46.00 target price on shares of Progyny in a research report on Wednesday, April 17th. Cantor Fitzgerald reissued an overweight rating and set a $48.00 price target on shares of Progyny in a research report on Wednesday, February 28th. KeyCorp cut their target price on shares of Progyny from $45.00 to $43.00 and set an overweight rating on the stock in a research note on Wednesday, February 28th. Finally, SVB Leerink assumed coverage on shares of Progyny in a research note on Monday, February 26th. They set an outperform rating and a $49.00 target price on the stock. Ten equities research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company currently has an average rating of Buy and an average target price of $48.30.

Check Out Our Latest Research Report on Progyny

Insider Buying and Selling

In other news, CFO Mark S. Livingston sold 11,165 shares of the firm's stock in a transaction that occurred on Monday, April 1st. The shares were sold at an average price of $37.62, for a total transaction of $420,027.30. Following the completion of the transaction, the chief financial officer now directly owns 50,119 shares of the company's stock, valued at approximately $1,885,476.78. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In related news, Chairman David J. Schlanger sold 5,826 shares of the company's stock in a transaction on Thursday, March 21st. The shares were sold at an average price of $37.74, for a total transaction of $219,873.24. Following the completion of the sale, the chairman now directly owns 86,312 shares of the company's stock, valued at approximately $3,257,414.88. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CFO Mark S. Livingston sold 11,165 shares of the firm's stock in a transaction dated Monday, April 1st. The shares were sold at an average price of $37.62, for a total value of $420,027.30. Following the completion of the transaction, the chief financial officer now directly owns 50,119 shares in the company, valued at $1,885,476.78. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 102,770 shares of company stock valued at $3,853,985. 12.30% of the stock is owned by insiders.

About Progyny

(

Get Free Report)

Progyny, Inc, a benefits management company, specializes in fertility and family building benefits solutions in the United States. Its fertility benefits solution includes differentiated benefits plan design, personalized concierge-style member support services, and selective network of fertility specialists.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Progyny, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progyny wasn't on the list.

While Progyny currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report