Motley Fool Asset Management LLC grew its holdings in StoneX Group Inc. (NASDAQ:SNEX - Free Report) by 56.4% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 134,181 shares of the company's stock after purchasing an additional 48,385 shares during the period. Motley Fool Asset Management LLC owned about 0.43% of StoneX Group worth $9,907,000 as of its most recent filing with the Securities & Exchange Commission.

Motley Fool Asset Management LLC grew its holdings in StoneX Group Inc. (NASDAQ:SNEX - Free Report) by 56.4% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 134,181 shares of the company's stock after purchasing an additional 48,385 shares during the period. Motley Fool Asset Management LLC owned about 0.43% of StoneX Group worth $9,907,000 as of its most recent filing with the Securities & Exchange Commission.

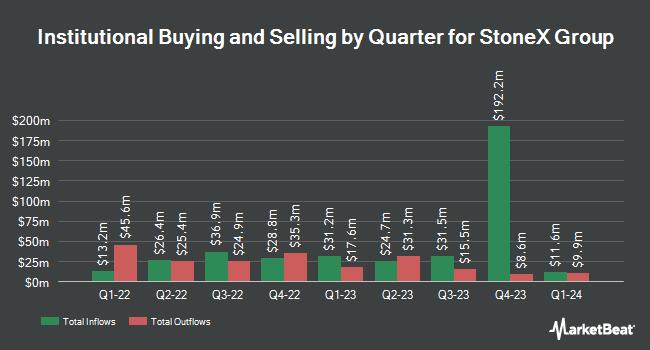

Other hedge funds and other institutional investors have also bought and sold shares of the company. Exchange Traded Concepts LLC purchased a new position in shares of StoneX Group during the third quarter valued at $29,000. Naples Money Management LLC purchased a new position in shares of StoneX Group during the fourth quarter valued at $30,000. Parkside Financial Bank & Trust increased its stake in shares of StoneX Group by 45.2% during the fourth quarter. Parkside Financial Bank & Trust now owns 601 shares of the company's stock valued at $44,000 after buying an additional 187 shares during the period. Allworth Financial LP increased its stake in shares of StoneX Group by 49.5% during the fourth quarter. Allworth Financial LP now owns 815 shares of the company's stock valued at $60,000 after buying an additional 270 shares during the period. Finally, Covestor Ltd increased its stake in shares of StoneX Group by 29.2% during the third quarter. Covestor Ltd now owns 1,975 shares of the company's stock valued at $191,000 after buying an additional 446 shares during the period. Hedge funds and other institutional investors own 75.93% of the company's stock.

StoneX Group Stock Up 1.4 %

SNEX stock traded up $0.99 during trading on Thursday, reaching $70.96. 111,079 shares of the company traded hands, compared to its average volume of 124,350. StoneX Group Inc. has a 12 month low of $49.62 and a 12 month high of $74.01. The business has a 50 day simple moving average of $67.75 and a 200 day simple moving average of $66.40. The company has a market capitalization of $2.24 billion, a price-to-earnings ratio of 9.90 and a beta of 0.87. The company has a debt-to-equity ratio of 0.87, a quick ratio of 1.20 and a current ratio of 1.59.

StoneX Group (NASDAQ:SNEX - Get Free Report) last issued its quarterly earnings data on Tuesday, February 6th. The company reported $2.16 earnings per share for the quarter, beating analysts' consensus estimates of $1.70 by $0.46. StoneX Group had a return on equity of 17.48% and a net margin of 0.34%. The company had revenue of $784.20 million for the quarter, compared to the consensus estimate of $781.80 million. On average, equities research analysts anticipate that StoneX Group Inc. will post 7.64 earnings per share for the current fiscal year.

Insider Activity at StoneX Group

In other StoneX Group news, Director John Moore Fowler sold 600 shares of the firm's stock in a transaction dated Friday, March 1st. The stock was sold at an average price of $68.94, for a total value of $41,364.00. Following the completion of the sale, the director now owns 83,878 shares of the company's stock, valued at $5,782,549.32. The sale was disclosed in a filing with the SEC, which is available through this hyperlink. In other StoneX Group news, Director John Moore Fowler sold 600 shares of the firm's stock in a transaction dated Friday, March 1st. The stock was sold at an average price of $68.94, for a total value of $41,364.00. Following the completion of the sale, the director now owns 83,878 shares of the company's stock, valued at $5,782,549.32. The sale was disclosed in a filing with the SEC, which is available through this hyperlink. Also, Director Scott J. Branch sold 7,500 shares of the firm's stock in a transaction dated Wednesday, February 7th. The stock was sold at an average price of $63.87, for a total value of $479,025.00. Following the completion of the sale, the director now directly owns 519,934 shares of the company's stock, valued at approximately $33,208,184.58. The disclosure for this sale can be found here. Insiders have sold a total of 56,348 shares of company stock valued at $3,769,436 over the last quarter. 16.24% of the stock is owned by corporate insiders.

StoneX Group Company Profile

(

Free Report)

StoneX Group Inc operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem worldwide. The company operates through Commercial, Institutional, Retail, and Global Payments segments. The Commercial segment provides risk management and hedging, exchange-traded and OTC products execution and clearing, voice brokerage, market intelligence, physical trading, and commodity financing and logistics services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider StoneX Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneX Group wasn't on the list.

While StoneX Group currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report