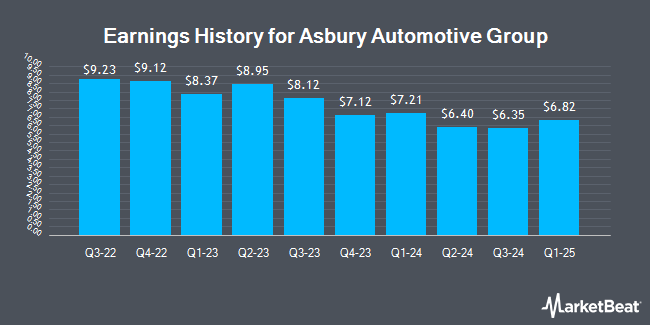

Asbury Automotive Group (NYSE:ABG - Get Free Report) issued its earnings results on Thursday. The company reported $7.21 earnings per share for the quarter, missing analysts' consensus estimates of $7.76 by ($0.55), Yahoo Finance reports. Asbury Automotive Group had a return on equity of 20.37% and a net margin of 3.68%. The company had revenue of $4.20 billion for the quarter, compared to the consensus estimate of $4.26 billion. During the same quarter in the prior year, the company posted $8.37 EPS. Asbury Automotive Group's revenue was up 17.3% compared to the same quarter last year.

Asbury Automotive Group (NYSE:ABG - Get Free Report) issued its earnings results on Thursday. The company reported $7.21 earnings per share for the quarter, missing analysts' consensus estimates of $7.76 by ($0.55), Yahoo Finance reports. Asbury Automotive Group had a return on equity of 20.37% and a net margin of 3.68%. The company had revenue of $4.20 billion for the quarter, compared to the consensus estimate of $4.26 billion. During the same quarter in the prior year, the company posted $8.37 EPS. Asbury Automotive Group's revenue was up 17.3% compared to the same quarter last year.

Asbury Automotive Group Trading Down 1.5 %

Shares of NYSE ABG traded down $3.29 during trading hours on Monday, hitting $218.68. 142,021 shares of the company traded hands, compared to its average volume of 166,650. The stock has a market capitalization of $4.41 billion, a price-to-earnings ratio of 7.96 and a beta of 1.18. The company's 50 day moving average price is $216.97 and its 200 day moving average price is $213.19. Asbury Automotive Group has a 12 month low of $178.40 and a 12 month high of $256.39. The company has a current ratio of 1.06, a quick ratio of 0.45 and a debt-to-equity ratio of 0.96.

Insiders Place Their Bets

In related news, SVP Jed Milstein sold 3,955 shares of Asbury Automotive Group stock in a transaction dated Tuesday, March 12th. The shares were sold at an average price of $209.00, for a total transaction of $826,595.00. Following the completion of the transaction, the senior vice president now directly owns 8,300 shares of the company's stock, valued at approximately $1,734,700. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. 0.53% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Separately, Craig Hallum lowered shares of Asbury Automotive Group from a "buy" rating to a "hold" rating and set a $230.00 target price for the company. in a research report on Thursday, February 8th.

Check Out Our Latest Report on ABG

About Asbury Automotive Group

(

Get Free Report)

Asbury Automotive Group, Inc, together with its subsidiaries, operates as an automotive retailer in the United States. It offers a range of automotive products and services, including new and used vehicles; and vehicle repair and maintenance services, replacement parts, and collision repair services.

Featured Articles

Before you consider Asbury Automotive Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Asbury Automotive Group wasn't on the list.

While Asbury Automotive Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report