Aew Capital Management L P decreased its stake in Digital Realty Trust, Inc. (NYSE:DLR - Free Report) by 1.7% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 979,135 shares of the real estate investment trust's stock after selling 17,400 shares during the quarter. Digital Realty Trust accounts for about 4.8% of Aew Capital Management L P's investment portfolio, making the stock its 5th largest holding. Aew Capital Management L P owned 0.32% of Digital Realty Trust worth $131,772,000 as of its most recent filing with the Securities & Exchange Commission.

Aew Capital Management L P decreased its stake in Digital Realty Trust, Inc. (NYSE:DLR - Free Report) by 1.7% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 979,135 shares of the real estate investment trust's stock after selling 17,400 shares during the quarter. Digital Realty Trust accounts for about 4.8% of Aew Capital Management L P's investment portfolio, making the stock its 5th largest holding. Aew Capital Management L P owned 0.32% of Digital Realty Trust worth $131,772,000 as of its most recent filing with the Securities & Exchange Commission.

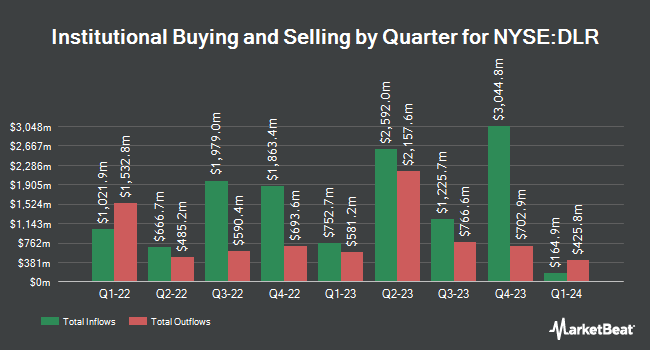

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Schechter Investment Advisors LLC raised its stake in shares of Digital Realty Trust by 2.4% during the 4th quarter. Schechter Investment Advisors LLC now owns 3,347 shares of the real estate investment trust's stock worth $450,000 after purchasing an additional 78 shares in the last quarter. Panagora Asset Management Inc. raised its stake in shares of Digital Realty Trust by 1.1% during the 3rd quarter. Panagora Asset Management Inc. now owns 9,175 shares of the real estate investment trust's stock worth $1,110,000 after purchasing an additional 97 shares in the last quarter. Blair William & Co. IL raised its stake in shares of Digital Realty Trust by 0.6% during the 3rd quarter. Blair William & Co. IL now owns 17,883 shares of the real estate investment trust's stock worth $2,164,000 after purchasing an additional 99 shares in the last quarter. Lmcg Investments LLC raised its stake in shares of Digital Realty Trust by 2.2% during the 3rd quarter. Lmcg Investments LLC now owns 4,620 shares of the real estate investment trust's stock worth $559,000 after purchasing an additional 100 shares in the last quarter. Finally, First Financial Corp IN raised its stake in shares of Digital Realty Trust by 46.6% during the 4th quarter. First Financial Corp IN now owns 324 shares of the real estate investment trust's stock worth $44,000 after purchasing an additional 103 shares in the last quarter. Institutional investors and hedge funds own 99.71% of the company's stock.

Digital Realty Trust Stock Performance

Shares of NYSE:DLR traded up $1.36 during trading on Friday, hitting $142.85. 1,798,142 shares of the stock were exchanged, compared to its average volume of 1,956,292. Digital Realty Trust, Inc. has a 1-year low of $86.33 and a 1-year high of $154.18. The company has a market capitalization of $44.61 billion, a price-to-earnings ratio of 48.10, a price-to-earnings-growth ratio of 3.20 and a beta of 0.54. The company's fifty day simple moving average is $141.81 and its 200-day simple moving average is $136.68. The company has a debt-to-equity ratio of 0.92, a quick ratio of 1.14 and a current ratio of 1.14.

Digital Realty Trust Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, March 28th. Investors of record on Friday, March 15th were paid a $1.22 dividend. This represents a $4.88 annualized dividend and a yield of 3.42%. The ex-dividend date was Thursday, March 14th. Digital Realty Trust's dividend payout ratio is 164.31%.

Wall Street Analyst Weigh In

A number of research analysts recently weighed in on the company. Royal Bank of Canada reissued an "outperform" rating and issued a $144.00 price objective on shares of Digital Realty Trust in a research note on Friday, February 16th. Truist Financial raised their price objective on Digital Realty Trust from $145.00 to $158.00 and gave the company a "buy" rating in a research note on Monday, March 18th. Citigroup lifted their price target on Digital Realty Trust from $154.00 to $160.00 and gave the stock a "buy" rating in a research report on Thursday, February 29th. Barclays lifted their price target on Digital Realty Trust from $110.00 to $119.00 and gave the stock an "underweight" rating in a research report on Tuesday, March 5th. Finally, Raymond James lifted their price target on Digital Realty Trust from $140.00 to $170.00 and gave the stock a "strong-buy" rating in a research report on Friday, February 16th. Three equities research analysts have rated the stock with a sell rating, five have given a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Digital Realty Trust has an average rating of "Hold" and a consensus price target of $143.33.

Read Our Latest Stock Report on DLR

Insider Activity at Digital Realty Trust

In related news, Director Jean F. H. P. Mandeville sold 3,400 shares of the business's stock in a transaction on Tuesday, March 12th. The stock was sold at an average price of $145.50, for a total value of $494,700.00. Following the sale, the director now owns 8,413 shares of the company's stock, valued at approximately $1,224,091.50. The sale was disclosed in a legal filing with the SEC, which is available through this link. 0.39% of the stock is owned by insiders.

Digital Realty Trust Company Profile

(

Free Report)

Digital Realty brings companies and data together by delivering the full spectrum of data center, colocation, and interconnection solutions. PlatformDIGITAL, the company's global data center platform, provides customers with a secure data meeting place and a proven Pervasive Datacenter Architecture (PDx) solution methodology for powering innovation and efficiently managing Data Gravity challenges.

Read More

Want to see what other hedge funds are holding DLR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Digital Realty Trust, Inc. (NYSE:DLR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Digital Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digital Realty Trust wasn't on the list.

While Digital Realty Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report