Flossbach Von Storch AG boosted its position in shares of HDFC Bank Limited (NYSE:HDB - Free Report) by 17.4% during the 4th quarter, according to the company in its most recent disclosure with the SEC. The firm owned 961,915 shares of the bank's stock after buying an additional 142,445 shares during the quarter. Flossbach Von Storch AG owned approximately 0.05% of HDFC Bank worth $64,554,000 at the end of the most recent reporting period.

Flossbach Von Storch AG boosted its position in shares of HDFC Bank Limited (NYSE:HDB - Free Report) by 17.4% during the 4th quarter, according to the company in its most recent disclosure with the SEC. The firm owned 961,915 shares of the bank's stock after buying an additional 142,445 shares during the quarter. Flossbach Von Storch AG owned approximately 0.05% of HDFC Bank worth $64,554,000 at the end of the most recent reporting period.

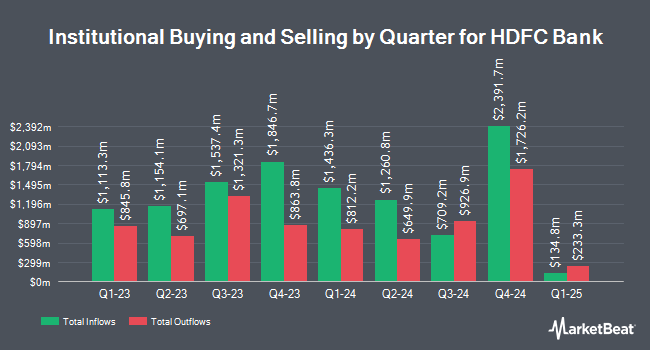

Several other institutional investors also recently bought and sold shares of the business. Skandinaviska Enskilda Banken AB publ acquired a new stake in shares of HDFC Bank in the third quarter worth approximately $27,000. NBC Securities Inc. acquired a new stake in HDFC Bank during the 3rd quarter worth $29,000. Resurgent Financial Advisors LLC purchased a new stake in shares of HDFC Bank during the fourth quarter worth $40,000. FinTrust Capital Advisors LLC raised its position in shares of HDFC Bank by 36.4% in the third quarter. FinTrust Capital Advisors LLC now owns 693 shares of the bank's stock valued at $41,000 after buying an additional 185 shares during the last quarter. Finally, Signaturefd LLC lifted its stake in shares of HDFC Bank by 44.7% in the third quarter. Signaturefd LLC now owns 848 shares of the bank's stock worth $50,000 after buying an additional 262 shares in the last quarter. 17.61% of the stock is owned by institutional investors and hedge funds.

HDFC Bank Price Performance

HDB traded up $0.28 on Wednesday, reaching $56.81. 2,787,880 shares of the company's stock were exchanged, compared to its average volume of 3,632,707. The stock has a market cap of $105.66 billion, a PE ratio of 17.53, a P/E/G ratio of 1.40 and a beta of 0.87. The company has a debt-to-equity ratio of 1.78, a current ratio of 0.52 and a quick ratio of 0.52. HDFC Bank Limited has a twelve month low of $52.16 and a twelve month high of $71.39. The stock's fifty day moving average price is $55.50 and its 200-day moving average price is $58.58.

HDFC Bank (NYSE:HDB - Get Free Report) last posted its quarterly earnings results on Tuesday, January 16th. The bank reported $0.82 EPS for the quarter, beating the consensus estimate of $0.71 by $0.11. The firm had revenue of $8.62 billion during the quarter, compared to analysts' expectations of $5.67 billion. HDFC Bank had a return on equity of 15.98% and a net margin of 17.34%. Sell-side analysts expect that HDFC Bank Limited will post 2.71 EPS for the current year.

About HDFC Bank

(

Free Report)

HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. The company operates in three segments: Wholesale Banking, Retail Banking, and Treasury Services. It accepts savings, salary, current, rural, public provident fund, pension, and demat accounts; fixed and recurring deposits; and safe deposit lockers, as well as offshore accounts and deposits, and overdrafts against fixed deposits.

See Also

Want to see what other hedge funds are holding HDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for HDFC Bank Limited (NYSE:HDB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider HDFC Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HDFC Bank wasn't on the list.

While HDFC Bank currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report