IFM Investors Pty Ltd bought a new stake in shares of Huntington Ingalls Industries, Inc. (NYSE:HII - Free Report) in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm bought 4,824 shares of the aerospace company's stock, valued at approximately $1,406,000.

IFM Investors Pty Ltd bought a new stake in shares of Huntington Ingalls Industries, Inc. (NYSE:HII - Free Report) in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm bought 4,824 shares of the aerospace company's stock, valued at approximately $1,406,000.

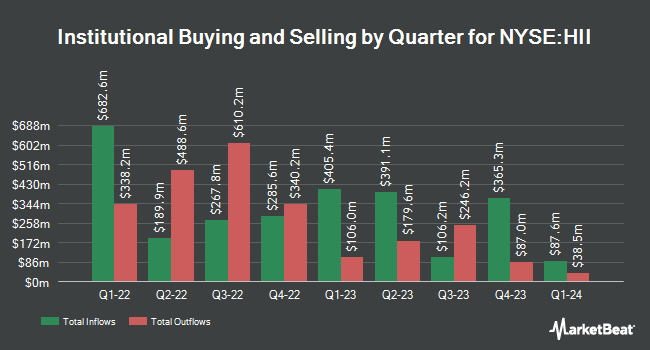

Several other large investors have also recently made changes to their positions in the business. Gulf International Bank UK Ltd grew its holdings in Huntington Ingalls Industries by 1.3% during the first quarter. Gulf International Bank UK Ltd now owns 3,284 shares of the aerospace company's stock valued at $957,000 after purchasing an additional 42 shares during the period. Capital Investment Counsel Inc grew its stake in shares of Huntington Ingalls Industries by 0.5% during the 3rd quarter. Capital Investment Counsel Inc now owns 8,274 shares of the aerospace company's stock worth $1,693,000 after acquiring an additional 44 shares during the period. Steward Partners Investment Advisory LLC increased its holdings in Huntington Ingalls Industries by 5.7% in the 4th quarter. Steward Partners Investment Advisory LLC now owns 871 shares of the aerospace company's stock worth $226,000 after acquiring an additional 47 shares during the last quarter. Kestra Private Wealth Services LLC raised its stake in Huntington Ingalls Industries by 0.5% in the 4th quarter. Kestra Private Wealth Services LLC now owns 10,418 shares of the aerospace company's stock valued at $2,705,000 after acquiring an additional 48 shares during the period. Finally, Wills Financial Group Inc. raised its stake in Huntington Ingalls Industries by 4.6% in the 3rd quarter. Wills Financial Group Inc. now owns 1,135 shares of the aerospace company's stock valued at $232,000 after acquiring an additional 50 shares during the period. 90.46% of the stock is owned by hedge funds and other institutional investors.

Huntington Ingalls Industries Price Performance

NYSE HII traded up $0.99 during trading hours on Friday, hitting $276.97. The company had a trading volume of 259,166 shares, compared to its average volume of 314,788. The firm has a 50 day simple moving average of $285.45 and a 200 day simple moving average of $260.34. Huntington Ingalls Industries, Inc. has a 52 week low of $188.51 and a 52 week high of $299.50. The firm has a market capitalization of $10.97 billion, a price-to-earnings ratio of 16.20, a PEG ratio of 2.61 and a beta of 0.60. The company has a debt-to-equity ratio of 0.54, a quick ratio of 0.89 and a current ratio of 0.95.

Huntington Ingalls Industries (NYSE:HII - Get Free Report) last released its quarterly earnings data on Thursday, February 1st. The aerospace company reported $6.90 EPS for the quarter, beating analysts' consensus estimates of $4.27 by $2.63. Huntington Ingalls Industries had a net margin of 5.95% and a return on equity of 18.12%. The company had revenue of $3.18 billion during the quarter, compared to analyst estimates of $2.78 billion. During the same period last year, the business earned $3.07 earnings per share. Huntington Ingalls Industries's revenue was up 13.0% compared to the same quarter last year. Equities research analysts expect that Huntington Ingalls Industries, Inc. will post 16.34 earnings per share for the current year.

Huntington Ingalls Industries Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, March 8th. Investors of record on Friday, February 23rd were given a $1.30 dividend. This represents a $5.20 annualized dividend and a dividend yield of 1.88%. The ex-dividend date of this dividend was Thursday, February 22nd. Huntington Ingalls Industries's dividend payout ratio (DPR) is 30.41%.

Analysts Set New Price Targets

A number of equities analysts have weighed in on HII shares. JPMorgan Chase & Co. increased their target price on shares of Huntington Ingalls Industries from $288.00 to $295.00 and gave the stock an "overweight" rating in a research report on Thursday, March 21st. Barclays raised their price objective on shares of Huntington Ingalls Industries from $280.00 to $290.00 and gave the stock an "equal weight" rating in a report on Tuesday, February 6th.

Get Our Latest Analysis on Huntington Ingalls Industries

Insider Buying and Selling

In related news, VP Jennifer R. Boykin sold 2,176 shares of the company's stock in a transaction on Friday, February 9th. The shares were sold at an average price of $272.31, for a total value of $592,546.56. Following the completion of the transaction, the vice president now directly owns 6,877 shares in the company, valued at $1,872,675.87. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other news, VP D R. Wyatt sold 500 shares of the business's stock in a transaction that occurred on Wednesday, February 21st. The shares were sold at an average price of $288.56, for a total value of $144,280.00. Following the completion of the sale, the vice president now directly owns 18,600 shares in the company, valued at approximately $5,367,216. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, VP Jennifer R. Boykin sold 2,176 shares of the company's stock in a transaction on Friday, February 9th. The shares were sold at an average price of $272.31, for a total transaction of $592,546.56. Following the completion of the sale, the vice president now directly owns 6,877 shares of the company's stock, valued at approximately $1,872,675.87. The disclosure for this sale can be found here. Over the last three months, insiders have sold 8,472 shares of company stock worth $2,398,345. Insiders own 0.72% of the company's stock.

Huntington Ingalls Industries Profile

(

Free Report)

Huntington Ingalls Industries, Inc designs, builds, overhauls, and repairs military ships in the United States. It operates through three segments: Ingalls, Newport News, and Mission Technologies. The company is involved in the design and construction of non-nuclear ships comprising amphibious assault ships; expeditionary warfare ships; surface combatants; and national security cutters for the U.S.

Further Reading

Want to see what other hedge funds are holding HII? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Huntington Ingalls Industries, Inc. (NYSE:HII - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Huntington Ingalls Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntington Ingalls Industries wasn't on the list.

While Huntington Ingalls Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report