Key Points

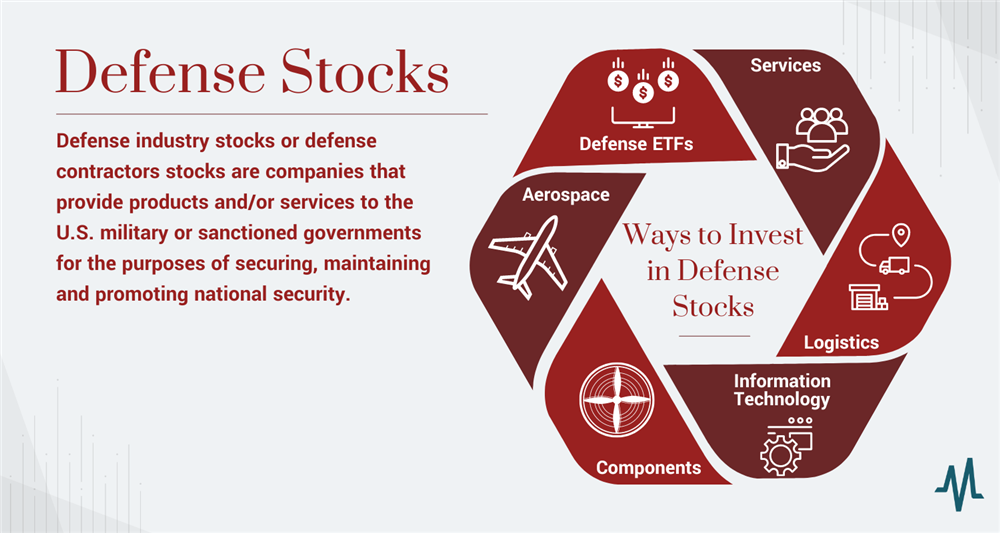

- Defense stocks are companies that provide products and/or services to the U.S. military or sanctioned governments to secure, maintain and promote national security.

- To get broad exposure to the defense sector, a defense-themed ETF can help diversify investment in defense contractors.

- Like healthcare and utility stocks, defense stocks are generally recession-proof, as defense is a national priority.

- 5 stocks we like better than BWX Technologies

When geopolitical tensions rise, defense contractor stocks often surge in response. These stocks are sensitive to international conflicts and national security developments, making them potent investment options. Here’s a deeper dive into what defense stocks are and how you can wisely invest in them.

Don’t confuse defense stocks with defensive stocks, which are typically low-volatility investments with steady dividends. Defense stocks, on the other hand, comprise companies that equip and support military and government security operations with products and services ranging from weaponry to intelligence technology.

What are Defense Contractor Stocks?

Defense contractors play a pivotal role in U.S. and allied military operations, supplying everything from munitions to technological support. These companies are heavily involved in U.S. military engagements and must comply with strict regulations to avoid dealing with adversaries.

Major Players in the Defense Sector

Lockheed Martin Corp.

Lockheed Martin Corp. NYSE: LMT, a major player in the defense sector, derives over 75% of its revenue from defense contracts, illustrating its critical role in U.S. defense spending.

Raytheon Technologies Inc.

Formed from the merger of United Technologies Corp and Raytheon Company, Raytheon Technologies Inc. NYSE: RTX stands out as a top defense company by market cap, known for its advanced defense systems and intelligence services.

General Dynamics Co.

General Dynamics Co. NYSE: GD serves both governmental and private sectors, crafting everything from military vehicles to IT solutions across its diverse divisions.

Northrop Grumman Corp.

Northrop Grumman Corp. NYSE: NOC has a long-standing history of producing high-end military equipment and offers a broad range of services including aerospace, mission systems, and more.

BWX Technologies Inc.

Although smaller in market cap, BWX Technologies Inc. NYSE: BWXT secures significant contracts for its specialized nuclear components, critical to the U.S. Navy’s operations.

Factors Influencing Defense Stocks

Defense stocks are affected by government spending policies and geopolitical events. While the promise of steady government contracts is appealing, the competitive nature of contract awards and political shifts can influence stock performance.

Technological Innovation

Technological advancements play a critical role, as companies that fail to innovate may lose ground to competitors. The future of defense involves more automated and precise technologies.

Investing in Defense Stocks

Investors can choose from defense-specific ETFs for diversified exposure or focus on companies specializing in particular segments such as aerospace or technology services.

Defense ETFs

For those seeking broad market exposure, defense ETFs offer a convenient way to invest in a range of defense contractors without the need for extensive individual stock research.

Specialized Investment Areas

Investors may also consider specialized areas within defense, such as aerospace, components, services, logistics, or IT, depending on their personal investment goals and understanding of the sector. Companies in the aerospace sector include those producing everything from aircraft to advanced electronics.

Strategies for Defense Stock Investment

Investing in defense stocks requires careful analysis of market trends, geopolitical risks, and company fundamentals. Determine your investment approach, whether seeking long-term stability with dividend-paying giants or speculating on shares with higher growth potential.

Market Trends and Outlook

Stay informed on industry trends and technological advancements to identify the defense companies most likely to benefit from current market dynamics and government spending patterns. Consider exploring top-performing defense stocks for potential investment opportunities.

Conclusion

Defense stocks represent a robust investment sector due to their essential role in national security. With careful research and strategic planning, investors can potentially secure lucrative returns from these high-stakes stocks.

FAQs

Are defense stocks reliable investments?

Who leads the market in defense stocks?

While Boeing tops the market in terms of size, defense-focused companies like Raytheon Technologies and Lockheed Martin are significant players in the industry.

Do defense stocks offer dividends?

Yes, major defense companies typically offer dividends, contributing to their appeal as long-term investment options. Notable examples include Huntington Ingalls Industries NYSE: HII known for its strong dividends.

Before you consider BWX Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BWX Technologies wasn't on the list.

While BWX Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report