E Fund Management Co. Ltd. cut its stake in shares of Lufax Holding Ltd (NYSE:LU - Free Report) by 74.6% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,342,661 shares of the company's stock after selling 3,944,307 shares during the quarter. E Fund Management Co. Ltd. owned about 0.23% of Lufax worth $4,122,000 as of its most recent SEC filing.

E Fund Management Co. Ltd. cut its stake in shares of Lufax Holding Ltd (NYSE:LU - Free Report) by 74.6% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,342,661 shares of the company's stock after selling 3,944,307 shares during the quarter. E Fund Management Co. Ltd. owned about 0.23% of Lufax worth $4,122,000 as of its most recent SEC filing.

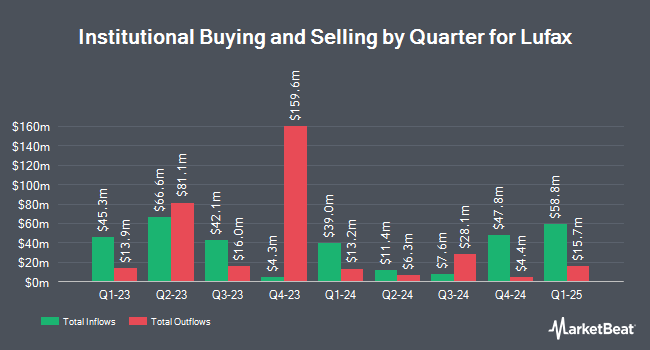

Other hedge funds have also recently made changes to their positions in the company. Asset Management One Co. Ltd. increased its stake in shares of Lufax by 11.1% in the third quarter. Asset Management One Co. Ltd. now owns 163,818 shares of the company's stock worth $174,000 after acquiring an additional 16,354 shares during the period. Bank of New York Mellon Corp raised its stake in shares of Lufax by 5.5% during the 3rd quarter. Bank of New York Mellon Corp now owns 1,808,642 shares of the company's stock valued at $1,917,000 after buying an additional 93,676 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. lifted its holdings in shares of Lufax by 16.6% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,326,193 shares of the company's stock valued at $4,586,000 after buying an additional 615,524 shares during the period. Sumitomo Mitsui Trust Holdings Inc. boosted its position in Lufax by 21.0% during the third quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 1,384,256 shares of the company's stock worth $1,467,000 after acquiring an additional 240,000 shares during the last quarter. Finally, Harvest Fund Management Co. Ltd raised its holdings in Lufax by 44.4% in the 3rd quarter. Harvest Fund Management Co. Ltd now owns 654,287 shares of the company's stock valued at $694,000 after acquiring an additional 201,110 shares during the last quarter. 69.14% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Separately, Bank of America lowered Lufax from a "buy" rating to a "neutral" rating in a research report on Thursday, January 25th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $6.91.

View Our Latest Stock Report on Lufax

Lufax Stock Up 2.4 %

LU stock traded up $0.11 during trading on Thursday, hitting $4.61. 1,570,662 shares of the company's stock were exchanged, compared to its average volume of 4,764,563. The company has a current ratio of 1.70, a quick ratio of 1.70 and a debt-to-equity ratio of 0.07. Lufax Holding Ltd has a 52-week low of $2.11 and a 52-week high of $7.64. The business has a 50-day moving average price of $3.95 and a two-hundred day moving average price of $3.39. The stock has a market capitalization of $2.64 billion, a price-to-earnings ratio of -32.93, a PEG ratio of 0.64 and a beta of 0.82.

Lufax (NYSE:LU - Get Free Report) last posted its quarterly earnings data on Thursday, March 21st. The company reported ($0.21) earnings per share for the quarter, missing the consensus estimate of ($0.03) by ($0.18). The firm had revenue of $965.76 million during the quarter, compared to analyst estimates of $1.06 billion. Lufax had a negative net margin of 2.17% and a negative return on equity of 0.72%. As a group, equities research analysts expect that Lufax Holding Ltd will post 0.21 EPS for the current year.

Lufax Cuts Dividend

The business also recently declared a -- dividend, which will be paid on Tuesday, August 6th. Stockholders of record on Tuesday, June 4th will be paid a dividend of $0.156 per share. This represents a dividend yield of 5.8%. The ex-dividend date of this dividend is Tuesday, June 4th. Lufax's dividend payout ratio (DPR) is presently -178.56%.

About Lufax

(

Free Report)

Lufax Holding Ltd operates a technology-empowered personal financial services platform in China. The company offers loan products, including unsecured loans and secured loans, as well as consumer finance loans. It also provides wealth management platforms, such as Lufax (Lu.com), Lu International (Singapore), and Lu International (Hong Kong) to the middle class and affluent investors to invest in products and portfolios; retail credit facilitation services platform that offers small business owners with lending solutions; and technology empowerment solutions for financial institutions.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lufax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lufax wasn't on the list.

While Lufax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report