Kestra Private Wealth Services LLC boosted its position in shares of Mastercard Incorporated (NYSE:MA - Free Report) by 8.5% during the 4th quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 25,411 shares of the credit services provider's stock after buying an additional 1,980 shares during the quarter. Kestra Private Wealth Services LLC's holdings in Mastercard were worth $10,838,000 as of its most recent SEC filing.

Kestra Private Wealth Services LLC boosted its position in shares of Mastercard Incorporated (NYSE:MA - Free Report) by 8.5% during the 4th quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 25,411 shares of the credit services provider's stock after buying an additional 1,980 shares during the quarter. Kestra Private Wealth Services LLC's holdings in Mastercard were worth $10,838,000 as of its most recent SEC filing.

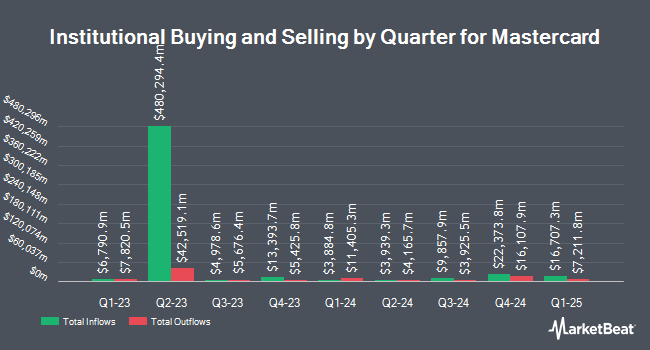

Other hedge funds have also recently bought and sold shares of the company. Atlantic Union Bankshares Corp boosted its stake in shares of Mastercard by 16.7% in the 3rd quarter. Atlantic Union Bankshares Corp now owns 9,787 shares of the credit services provider's stock valued at $3,875,000 after purchasing an additional 1,403 shares during the last quarter. Lodestone Wealth Management LLC boosted its stake in Mastercard by 4.9% in the third quarter. Lodestone Wealth Management LLC now owns 984 shares of the credit services provider's stock valued at $390,000 after acquiring an additional 46 shares during the last quarter. Steward Financial Group LLC grew its holdings in Mastercard by 10.5% during the 3rd quarter. Steward Financial Group LLC now owns 643 shares of the credit services provider's stock worth $254,000 after acquiring an additional 61 shares during the period. Kathleen S. Wright Associates Inc. raised its position in shares of Mastercard by 1,739.1% during the 3rd quarter. Kathleen S. Wright Associates Inc. now owns 846 shares of the credit services provider's stock valued at $331,000 after acquiring an additional 800 shares during the last quarter. Finally, PDS Planning Inc lifted its stake in shares of Mastercard by 2.7% in the 3rd quarter. PDS Planning Inc now owns 3,892 shares of the credit services provider's stock valued at $1,541,000 after purchasing an additional 101 shares during the period. 97.28% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of research firms recently commented on MA. Oppenheimer reiterated an "outperform" rating and issued a $510.00 price objective on shares of Mastercard in a report on Thursday, February 1st. Wells Fargo & Company boosted their price objective on shares of Mastercard from $490.00 to $530.00 and gave the company an "overweight" rating in a report on Wednesday, March 6th. Raymond James increased their target price on shares of Mastercard from $452.00 to $504.00 and gave the stock an "outperform" rating in a report on Thursday, February 1st. The Goldman Sachs Group boosted their target price on Mastercard from $433.00 to $482.00 and gave the company a "buy" rating in a research note on Thursday, January 11th. Finally, Mizuho reaffirmed a "buy" rating and set a $480.00 price target on shares of Mastercard in a research report on Wednesday, March 27th. Two equities research analysts have rated the stock with a hold rating, twenty-two have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, Mastercard currently has an average rating of "Moderate Buy" and a consensus target price of $490.23.

Get Our Latest Stock Report on MA

Insider Buying and Selling

In related news, major shareholder Foundation Mastercard sold 114,000 shares of the stock in a transaction on Friday, April 26th. The stock was sold at an average price of $462.57, for a total value of $52,732,980.00. Following the sale, the insider now owns 96,767,308 shares in the company, valued at approximately $44,761,653,661.56. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In related news, major shareholder Foundation Mastercard sold 114,000 shares of Mastercard stock in a transaction dated Friday, April 26th. The shares were sold at an average price of $462.57, for a total transaction of $52,732,980.00. Following the completion of the sale, the insider now owns 96,767,308 shares of the company's stock, valued at approximately $44,761,653,661.56. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. Also, CMO Venkata R. Madabhushi sold 16,037 shares of the stock in a transaction dated Friday, March 1st. The shares were sold at an average price of $475.94, for a total transaction of $7,632,649.78. Following the completion of the transaction, the chief marketing officer now directly owns 12,255 shares in the company, valued at $5,832,644.70. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 480,630 shares of company stock worth $221,479,470. Company insiders own 0.13% of the company's stock.

Mastercard Stock Down 1.2 %

Shares of NYSE:MA traded down $5.39 during trading on Monday, hitting $457.03. 2,120,953 shares of the company were exchanged, compared to its average volume of 2,406,817. Mastercard Incorporated has a fifty-two week low of $357.85 and a fifty-two week high of $490.00. The stock has a market cap of $426.36 billion, a price-to-earnings ratio of 38.63, a P/E/G ratio of 1.76 and a beta of 1.08. The company has a current ratio of 1.17, a quick ratio of 1.17 and a debt-to-equity ratio of 2.06. The firm has a fifty day moving average price of $471.13 and a two-hundred day moving average price of $437.01.

Mastercard (NYSE:MA - Get Free Report) last issued its earnings results on Wednesday, January 31st. The credit services provider reported $3.18 earnings per share for the quarter, topping analysts' consensus estimates of $3.08 by $0.10. The business had revenue of $6.55 billion for the quarter, compared to the consensus estimate of $6.46 billion. Mastercard had a net margin of 44.60% and a return on equity of 191.22%. During the same period in the previous year, the company earned $2.65 earnings per share. As a group, research analysts anticipate that Mastercard Incorporated will post 14.35 earnings per share for the current fiscal year.

Mastercard Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, May 9th. Investors of record on Tuesday, April 9th will be paid a $0.66 dividend. The ex-dividend date is Monday, April 8th. This represents a $2.64 annualized dividend and a yield of 0.58%. Mastercard's dividend payout ratio (DPR) is currently 22.32%.

Mastercard Profile

(

Free Report)

Mastercard Incorporated, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. The company offers integrated products and value-added services for account holders, merchants, financial institutions, digital partners, businesses, governments, and other organizations, such as programs that enable issuers to provide consumers with credits to defer payments; payment products and solutions that allow its customers to access funds in deposit and other accounts; prepaid programs services; and commercial credit, debit, and prepaid payment products and solutions.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mastercard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mastercard wasn't on the list.

While Mastercard currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report