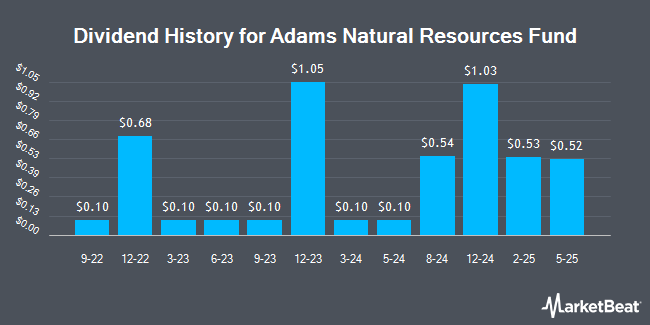

Adams Natural Resources Fund, Inc. (NYSE:PEO - Get Free Report) announced a quarterly dividend on Thursday, April 18th, NASDAQ reports. Shareholders of record on Friday, May 17th will be paid a dividend of 0.10 per share by the financial services provider on Friday, May 31st. This represents a $0.40 annualized dividend and a yield of 1.71%. The ex-dividend date of this dividend is Thursday, May 16th.

Adams Natural Resources Fund, Inc. (NYSE:PEO - Get Free Report) announced a quarterly dividend on Thursday, April 18th, NASDAQ reports. Shareholders of record on Friday, May 17th will be paid a dividend of 0.10 per share by the financial services provider on Friday, May 31st. This represents a $0.40 annualized dividend and a yield of 1.71%. The ex-dividend date of this dividend is Thursday, May 16th.

Adams Natural Resources Fund has increased its dividend payment by an average of 14.2% per year over the last three years.

Adams Natural Resources Fund Stock Up 1.0 %

Shares of NYSE:PEO traded up $0.22 on Friday, hitting $23.37. The stock had a trading volume of 30,221 shares, compared to its average volume of 35,396. Adams Natural Resources Fund has a twelve month low of $19.22 and a twelve month high of $24.25. The firm's 50 day moving average price is $22.30 and its 200-day moving average price is $21.48.

Insider Activity

In related news, VP Gregory W. Buckley purchased 3,350 shares of Adams Natural Resources Fund stock in a transaction that occurred on Monday, January 29th. The shares were acquired at an average price of $20.50 per share, for a total transaction of $68,675.00. Following the transaction, the vice president now directly owns 12,936 shares in the company, valued at $265,188. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 0.06% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Raymond James & Associates lifted its position in Adams Natural Resources Fund by 308.9% during the 1st quarter. Raymond James & Associates now owns 175,456 shares of the financial services provider's stock valued at $3,672,000 after purchasing an additional 132,544 shares during the period. Raymond James Financial Services Advisors Inc. lifted its position in Adams Natural Resources Fund by 5.7% during the 1st quarter. Raymond James Financial Services Advisors Inc. now owns 13,504 shares of the financial services provider's stock valued at $283,000 after purchasing an additional 724 shares during the period. Cambridge Investment Research Advisors Inc. acquired a new position in Adams Natural Resources Fund during the 1st quarter valued at about $422,000. HighTower Advisors LLC lifted its position in Adams Natural Resources Fund by 19.7% during the 1st quarter. HighTower Advisors LLC now owns 80,284 shares of the financial services provider's stock valued at $1,681,000 after purchasing an additional 13,239 shares during the period. Finally, Nations Financial Group Inc. IA ADV acquired a new position in Adams Natural Resources Fund during the 1st quarter valued at about $1,228,000. Institutional investors and hedge funds own 33.54% of the company's stock.

Adams Natural Resources Fund Company Profile

(

Get Free Report)

Adams Natural Resources Fund, Inc is a publicly owned investment manager. The firm invests in the public equity markets across the globe. The firm manages closed-end equity fund focused on the energy and material sectors. It invests in stocks of companies of all market capitalizations operating in the energy and natural resources sector including oil companies, exploration and production, utilities, services, and basic materials sectors.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Adams Natural Resources Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adams Natural Resources Fund wasn't on the list.

While Adams Natural Resources Fund currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report