Leeward Investments LLC MA lowered its stake in Pioneer Natural Resources (NYSE:PXD - Free Report) by 22.3% during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 44,531 shares of the oil and gas development company's stock after selling 12,761 shares during the quarter. Leeward Investments LLC MA's holdings in Pioneer Natural Resources were worth $10,014,000 as of its most recent SEC filing.

Leeward Investments LLC MA lowered its stake in Pioneer Natural Resources (NYSE:PXD - Free Report) by 22.3% during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 44,531 shares of the oil and gas development company's stock after selling 12,761 shares during the quarter. Leeward Investments LLC MA's holdings in Pioneer Natural Resources were worth $10,014,000 as of its most recent SEC filing.

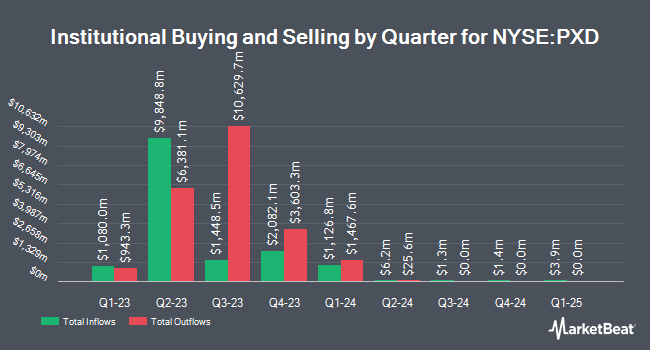

Other hedge funds have also bought and sold shares of the company. Hartford Financial Management Inc. lifted its stake in Pioneer Natural Resources by 61.1% in the 4th quarter. Hartford Financial Management Inc. now owns 116 shares of the oil and gas development company's stock worth $26,000 after purchasing an additional 44 shares in the last quarter. BluePath Capital Management LLC purchased a new stake in shares of Pioneer Natural Resources during the 3rd quarter valued at about $29,000. Carmel Capital Partners LLC purchased a new stake in shares of Pioneer Natural Resources during the 3rd quarter valued at about $34,000. Jones Financial Companies Lllp raised its position in shares of Pioneer Natural Resources by 85.0% during the 3rd quarter. Jones Financial Companies Lllp now owns 148 shares of the oil and gas development company's stock valued at $34,000 after buying an additional 68 shares in the last quarter. Finally, OLD Second National Bank of Aurora purchased a new stake in shares of Pioneer Natural Resources during the 4th quarter valued at about $34,000. Hedge funds and other institutional investors own 80.57% of the company's stock.

Analysts Set New Price Targets

Several analysts have recently issued reports on PXD shares. Susquehanna upped their target price on shares of Pioneer Natural Resources from $246.00 to $278.00 and gave the company a "neutral" rating in a research report on Monday. Stifel Nicolaus upped their target price on shares of Pioneer Natural Resources from $237.00 to $275.00 and gave the company a "hold" rating in a research report on Tuesday. Royal Bank of Canada restated a "sector perform" rating and set a $279.00 target price on shares of Pioneer Natural Resources in a research report on Thursday, April 11th. Mizuho upped their target price on shares of Pioneer Natural Resources from $276.00 to $290.00 and gave the company a "neutral" rating in a research report on Tuesday, March 19th. Finally, StockNews.com assumed coverage on shares of Pioneer Natural Resources in a research report on Sunday, April 21st. They set a "hold" rating on the stock. Two equities research analysts have rated the stock with a sell rating, sixteen have given a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat.com, Pioneer Natural Resources currently has a consensus rating of "Hold" and an average price target of $264.10.

Check Out Our Latest Stock Analysis on Pioneer Natural Resources

Insider Activity

In other news, EVP Mark H. Kleinman sold 3,500 shares of the stock in a transaction that occurred on Monday, March 4th. The shares were sold at an average price of $234.35, for a total transaction of $820,225.00. Following the transaction, the executive vice president now directly owns 49,856 shares in the company, valued at $11,683,753.60. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. In other news, Director Scott D. Sheffield sold 10,000 shares of the stock in a transaction that occurred on Monday, March 4th. The shares were sold at an average price of $235.25, for a total transaction of $2,352,500.00. Following the transaction, the director now directly owns 462,112 shares in the company, valued at $108,711,848. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, EVP Mark H. Kleinman sold 3,500 shares of the stock in a transaction that occurred on Monday, March 4th. The shares were sold at an average price of $234.35, for a total transaction of $820,225.00. Following the transaction, the executive vice president now owns 49,856 shares in the company, valued at $11,683,753.60. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 36,766 shares of company stock worth $9,067,373. Corporate insiders own 0.57% of the company's stock.

Pioneer Natural Resources Trading Down 2.3 %

PXD stock traded down $6.28 during mid-day trading on Friday, reaching $268.87. The company had a trading volume of 2,038,654 shares, compared to its average volume of 1,993,584. The company has a debt-to-equity ratio of 0.21, a current ratio of 0.88 and a quick ratio of 0.72. The company has a market capitalization of $62.81 billion, a PE ratio of 13.28 and a beta of 1.31. The firm has a 50 day moving average of $255.15 and a 200 day moving average of $239.90. Pioneer Natural Resources has a 12 month low of $196.74 and a 12 month high of $278.83.

Pioneer Natural Resources (NYSE:PXD - Get Free Report) last issued its earnings results on Thursday, February 22nd. The oil and gas development company reported $5.28 EPS for the quarter, missing analysts' consensus estimates of $5.41 by ($0.13). The company had revenue of $5.22 billion during the quarter, compared to the consensus estimate of $5.28 billion. Pioneer Natural Resources had a return on equity of 22.42% and a net margin of 25.28%. Pioneer Natural Resources's revenue was up 2.1% on a year-over-year basis. During the same quarter in the prior year, the company earned $5.91 earnings per share. On average, equities analysts predict that Pioneer Natural Resources will post 22.47 earnings per share for the current fiscal year.

Pioneer Natural Resources Cuts Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, March 22nd. Stockholders of record on Monday, March 4th were paid a dividend of $2.56 per share. The ex-dividend date of this dividend was Friday, March 1st. This represents a $10.24 dividend on an annualized basis and a dividend yield of 3.81%. Pioneer Natural Resources's dividend payout ratio is presently 24.70%.

About Pioneer Natural Resources

(

Free Report)

Pioneer Natural Resources Company operates as an independent oil and gas exploration and production company in the United States. The company explores for, develops, and produces oil, natural gas liquids (NGLs), and gas. It has operations in the Midland Basin in West Texas. The company was founded in 1997 and is headquartered in Irving, Texas.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pioneer Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pioneer Natural Resources wasn't on the list.

While Pioneer Natural Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report