Textron (NYSE:TXT - Get Free Report) was downgraded by analysts at StockNews.com from a "strong-buy" rating to a "buy" rating in a report issued on Friday.

Textron (NYSE:TXT - Get Free Report) was downgraded by analysts at StockNews.com from a "strong-buy" rating to a "buy" rating in a report issued on Friday.

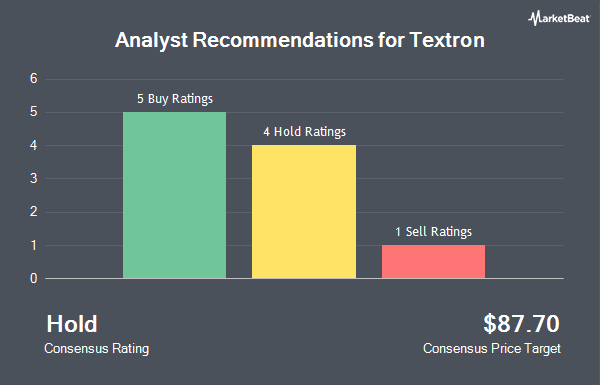

A number of other research analysts also recently weighed in on the company. Bank of America raised Textron from a "neutral" rating to a "buy" rating and upped their price target for the stock from $85.00 to $105.00 in a research note on Friday, March 8th. Susquehanna decreased their price objective on Textron from $110.00 to $105.00 and set a "positive" rating for the company in a report on Friday. Citigroup boosted their price objective on Textron from $104.00 to $111.00 and gave the stock a "buy" rating in a report on Thursday, April 4th. UBS Group boosted their price objective on Textron from $77.00 to $81.00 and gave the stock a "sell" rating in a report on Friday, January 26th. Finally, The Goldman Sachs Group boosted their price objective on Textron from $103.00 to $120.00 and gave the stock a "buy" rating in a report on Tuesday, April 16th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating and six have given a buy rating to the company. According to MarketBeat, Textron has a consensus rating of "Moderate Buy" and an average price target of $95.63.

Check Out Our Latest Stock Report on TXT

Textron Stock Up 1.9 %

TXT stock traded up $1.61 during trading on Friday, reaching $86.51. 2,662,684 shares of the stock were exchanged, compared to its average volume of 1,221,277. The firm's 50 day moving average is $92.10 and its 200 day moving average is $83.86. Textron has a twelve month low of $61.27 and a twelve month high of $97.33. The company has a current ratio of 1.92, a quick ratio of 1.03 and a debt-to-equity ratio of 0.50. The firm has a market cap of $16.64 billion, a P/E ratio of 18.93, a price-to-earnings-growth ratio of 1.48 and a beta of 1.30.

Textron (NYSE:TXT - Get Free Report) last posted its quarterly earnings results on Thursday, April 25th. The aerospace company reported $1.20 earnings per share for the quarter, missing analysts' consensus estimates of $1.28 by ($0.08). Textron had a return on equity of 16.05% and a net margin of 6.73%. The firm had revenue of $3.14 billion for the quarter, compared to analyst estimates of $3.29 billion. During the same period last year, the company posted $1.05 earnings per share. The firm's quarterly revenue was up 3.7% compared to the same quarter last year. As a group, research analysts forecast that Textron will post 6.27 EPS for the current year.

Hedge Funds Weigh In On Textron

Several institutional investors have recently modified their holdings of TXT. Adage Capital Partners GP L.L.C. lifted its stake in Textron by 93.7% in the third quarter. Adage Capital Partners GP L.L.C. now owns 1,474,191 shares of the aerospace company's stock valued at $115,193,000 after purchasing an additional 713,169 shares during the last quarter. Swiss National Bank purchased a new position in Textron in the third quarter valued at approximately $50,696,000. JPMorgan Chase & Co. lifted its stake in Textron by 11.6% in the third quarter. JPMorgan Chase & Co. now owns 5,745,108 shares of the aerospace company's stock valued at $448,923,000 after purchasing an additional 596,214 shares during the last quarter. LSV Asset Management lifted its stake in Textron by 15.9% in the fourth quarter. LSV Asset Management now owns 3,793,047 shares of the aerospace company's stock valued at $305,037,000 after purchasing an additional 521,276 shares during the last quarter. Finally, International Assets Investment Management LLC purchased a new position in Textron in the fourth quarter valued at approximately $394,347,000. 86.03% of the stock is owned by institutional investors.

About Textron

(

Get Free Report)

Textron Inc operates in the aircraft, defense, industrial, and finance businesses worldwide. It operates through six segments: Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance. The Textron Aviation segment manufactures, sells, and services business jets, turboprop and piston engine aircraft, and military trainer and defense aircraft; and offers maintenance, inspection, and repair services, as well as sells commercial parts.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Textron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Textron wasn't on the list.

While Textron currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report