Lisanti Capital Growth LLC cut its holdings in Vertiv Holdings Co (NYSE:VRT - Free Report) by 82.9% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 17,380 shares of the company's stock after selling 84,475 shares during the quarter. Lisanti Capital Growth LLC's holdings in Vertiv were worth $835,000 as of its most recent filing with the SEC.

Lisanti Capital Growth LLC cut its holdings in Vertiv Holdings Co (NYSE:VRT - Free Report) by 82.9% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 17,380 shares of the company's stock after selling 84,475 shares during the quarter. Lisanti Capital Growth LLC's holdings in Vertiv were worth $835,000 as of its most recent filing with the SEC.

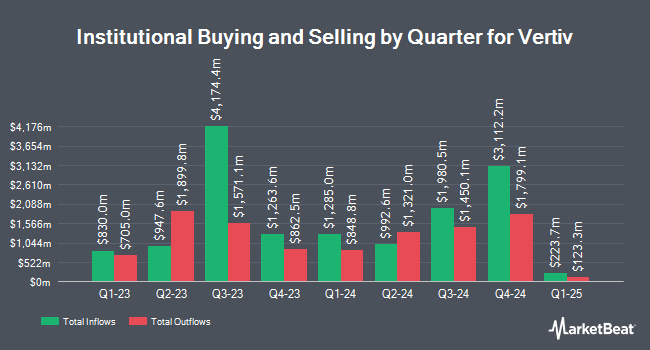

Other institutional investors also recently bought and sold shares of the company. Simon Quick Advisors LLC increased its stake in shares of Vertiv by 1.0% during the fourth quarter. Simon Quick Advisors LLC now owns 20,065 shares of the company's stock worth $964,000 after acquiring an additional 205 shares during the period. Hanseatic Management Services Inc. increased its stake in shares of Vertiv by 0.8% during the third quarter. Hanseatic Management Services Inc. now owns 29,541 shares of the company's stock worth $1,099,000 after acquiring an additional 246 shares during the period. First Horizon Advisors Inc. increased its stake in shares of Vertiv by 161.7% during the third quarter. First Horizon Advisors Inc. now owns 662 shares of the company's stock worth $25,000 after acquiring an additional 409 shares during the period. Xponance Inc. increased its stake in shares of Vertiv by 2.9% during the fourth quarter. Xponance Inc. now owns 14,984 shares of the company's stock worth $720,000 after acquiring an additional 426 shares during the period. Finally, GAMMA Investing LLC purchased a new stake in Vertiv during the fourth quarter worth about $26,000. 89.92% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, EVP Stephen Liang sold 306,196 shares of the company's stock in a transaction that occurred on Friday, March 1st. The shares were sold at an average price of $70.24, for a total transaction of $21,507,207.04. Following the completion of the transaction, the executive vice president now owns 51,841 shares of the company's stock, valued at $3,641,311.84. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. In related news, EVP Stephen Liang sold 306,196 shares of the company's stock in a transaction that occurred on Friday, March 1st. The shares were sold at an average price of $70.24, for a total transaction of $21,507,207.04. Following the completion of the transaction, the executive vice president now owns 51,841 shares of the company's stock, valued at $3,641,311.84. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CAO Scott Cripps sold 56,594 shares of the company's stock in a transaction that occurred on Friday, March 8th. The stock was sold at an average price of $70.76, for a total transaction of $4,004,591.44. The disclosure for this sale can be found here. Over the last quarter, insiders sold 3,362,790 shares of company stock valued at $306,451,347. Insiders own 5.62% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms recently commented on VRT. Citigroup boosted their price objective on shares of Vertiv from $102.00 to $110.00 and gave the stock a "buy" rating in a report on Thursday, April 25th. Evercore ISI boosted their price objective on shares of Vertiv from $90.00 to $95.00 and gave the stock an "outperform" rating in a report on Thursday, April 25th. Mizuho boosted their price objective on shares of Vertiv from $56.00 to $95.00 and gave the stock a "neutral" rating in a report on Friday, April 26th. JPMorgan Chase & Co. boosted their price objective on shares of Vertiv from $95.00 to $100.00 and gave the stock an "overweight" rating in a report on Thursday, April 25th. Finally, Oppenheimer boosted their price objective on shares of Vertiv from $96.00 to $98.00 and gave the stock an "outperform" rating in a report on Thursday, April 25th. One research analyst has rated the stock with a hold rating and nine have given a buy rating to the company's stock. According to MarketBeat.com, Vertiv presently has a consensus rating of "Moderate Buy" and an average price target of $81.11.

Read Our Latest Report on VRT

Vertiv Price Performance

Shares of NYSE VRT traded down $2.35 on Tuesday, hitting $94.91. The company's stock had a trading volume of 5,718,537 shares, compared to its average volume of 8,168,723. The company has a debt-to-equity ratio of 2.09, a current ratio of 1.34 and a quick ratio of 0.98. The company has a market capitalization of $35.53 billion, a price-to-earnings ratio of 91.26, a price-to-earnings-growth ratio of 1.41 and a beta of 1.55. The stock has a 50 day moving average of $80.75 and a 200-day moving average of $60.37. Vertiv Holdings Co has a 12-month low of $14.68 and a 12-month high of $97.49.

Vertiv (NYSE:VRT - Get Free Report) last announced its quarterly earnings data on Wednesday, April 24th. The company reported $0.43 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.37 by $0.06. The business had revenue of $1.64 billion for the quarter, compared to the consensus estimate of $1.62 billion. Vertiv had a net margin of 5.79% and a return on equity of 44.95%. The company's quarterly revenue was up 7.8% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $0.24 earnings per share. As a group, research analysts predict that Vertiv Holdings Co will post 2.42 EPS for the current year.

Vertiv Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, March 28th. Investors of record on Tuesday, March 19th were paid a dividend of $0.025 per share. This represents a $0.10 annualized dividend and a dividend yield of 0.11%. The ex-dividend date was Monday, March 18th. Vertiv's payout ratio is 9.62%.

Vertiv Company Profile

(

Free Report)

Vertiv Holdings Co, together with its subsidiaries, designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vertiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertiv wasn't on the list.

While Vertiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report