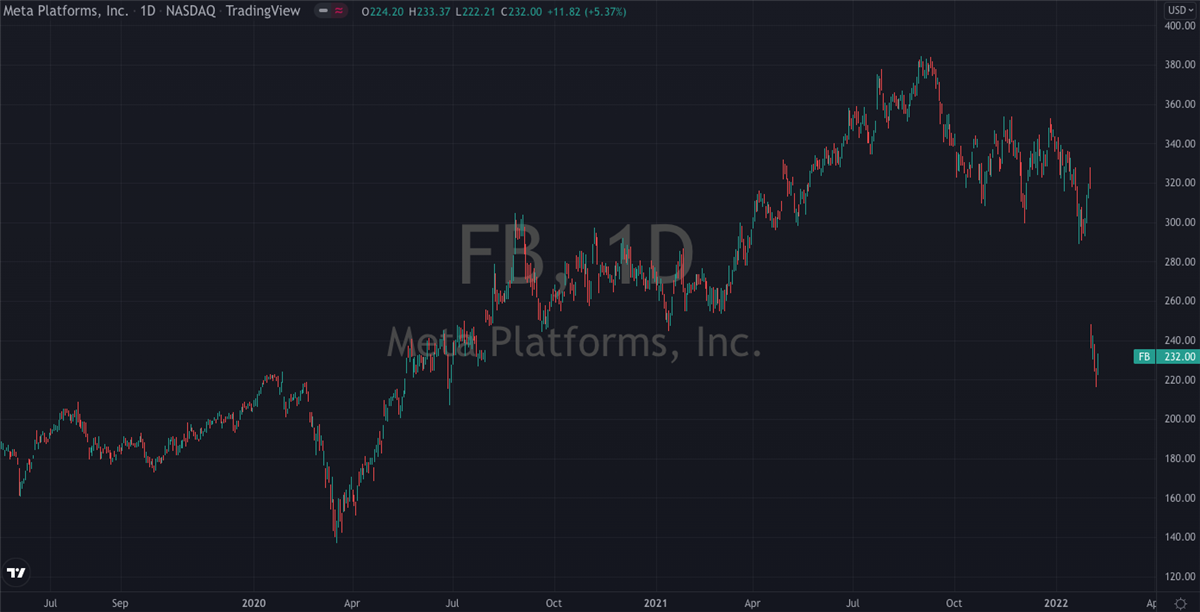

Meta (NASDAQ: FB)

Meta (NASDAQ: FB), previously known as

Facebook, has had a horrible start to February. Since

reporting Q4 earnings on the second day of the month that surprised investors in a bad way, their shares have collapsed as much as 30% in just a few sessions. To be sure, this is a brutal fall from grace for one of the FAANG group of stocks that was trading at all time highs as recently as September. The drop is made all the more painful for investors in light of how some of the other components of that famous acronym have performed in recent weeks.

Shares of

Apple (NASDAQ: AAPL) for example, are up more than 10% since they reported their earnings a few days before Meta, while

Google (NASDAQ: GOOGL) is also trading higher. The last thing Meta needs is to be grouped in with the likes of Netflix (

NASDAQ: NFLX), whose shares have fallen as much as 40% since the start of the year in the face of slowing growth.

Slowing Growth

But for now, at least, that same headwind appears to have made landfall on Meta HQ in Silicon Valley. While revenue for last quarter was up 20% year on year and ahead of what analysts had been expecting, their bottom line EPS was well off the consensus. In the context of the monetary cycle we’re currently in, where the Fed is raising rates which makes tech stocks less attractive, any sign of weakening profitability is going to attract the sharks. To make matters even worse, there were several more dead canaries in the coal mine too.

Daily active users came in short at 1.93 billion, versus the 1.95 Wall Street had been expecting. So did monthly active users. Costs and expenses rose by an eye-watering 38%, which led to a drop in operating profit and a 8% decrease in net income. Looking ahead, management guided first-quarter revenue of between $27 billion to $29 billion, which was, you guessed it, well below the $30 billion that had been expected. In the wake of all this, more than $190 billion was wiped from Meta’s market cap as investors packed their bags and ran.

The likes of UBS were out quickly with a revision to their price target, with analyst Llyod Walmsley slashing his to $280 from $400. To be fair, with shares currently trading around $230, this suggests that the recent wave of selling is well overdone and we could be in for a relief rally pretty soon. Walmsley was mostly concerned with the rising competition from TikTok, as it’s the first time that “Meta has gone up against a more than 1 billion user platform significantly ahead of them in an engaging new format”.

Still A Buy

Interestingly, he left his Buy rating unchanged. So too did Eric Sheridan from Goldman Sachs, who reduced his price target on Meta shares from $445 to $355. In addition to competition from TikTok, he sees Facebook also struggling with Apple’s latest privacy changes, which make it more difficult for companies to track, and therefore utilize users’ data. Sheridan likened the current environment to the volatility seen in what were then Facebook shares during the summer of 2018, but believes that the current price does not reflect a fair valuation of Meta’s longer term potential.

This is an interesting one for those of us on the sidelines. On the one hand, we have a key member of the FAANG group who looks to be trading well below a fair market price, notwithstanding the dodgy earnings report recently released. But there’s a strong argument to be made for considering the long position here, as the recent drop has also pulled down Meta’s price-to-earnings (P/E) ratio. This is now just below 17, a sub 20 print that is more often the characteristic of slow moving industrial and cyclical stocks. Apple for example, has a P/E ratio of 30, while Google’s is at 25.

If you can stomach the massive drop that’s just happened, and maybe pinch your nose for a quarter or two, Meta probably

isn’t a bad buy down here. Sure, shares are back trading at their 2018 and 2020 levels, but ultimately competition is a good thing, and it's hard to see a future where Meta doesn’t fight back hard.

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report