CubeSmart NYSE: CUBE,

CubeSmart NYSE: CUBE, a self-administered and self-managed REIT, provides its customers with storage space. While this is far from the sexiest industry, CUBE shares offer excellent value and yield at current levels.

Like many companies, CubeSmart has been forced to alter its operations to adjust to the “new-normal” environment. But a relatively recession-proof business coupled with a seamless move to contactless operations has allowed CUBE to position itself for continued success.

Relatively Recession-Proof

CubeSmart’s average customer has items stored with the company because they simply don’t have space for them. When people are looking to cut costs, one of the last things they will likely do is throw away these (often cherished) items or take them back and live among clutter.

And even if some people take their items back or new business slows down, the self-storage business has a low break-even occupancy point due to the low overhead and operating expenses. According to The Appraisal’s Journal, break-even points are often as low as 40-45%.

With all that said, CUBE has seen a slight slowdown in its business.

Same-store Rentals

Same-store rental revenue in January and February 2020 tracked above the same period a year ago. Same-store physical occupancy was up 50 basis points yoy and the net effective rate on rentals increased slightly.

But in March, same-store rentals were down 11% yoy and in April, rentals were down 28% yoy.

The good news is that while new rentals were down a lot, vacates were also down; those dipped 26% in April yoy. And in the last seven days leading into the Q1 earnings call, same-store rentals were only down 12% yoy, an improvement on the April numbers.

When all of the effects are tallied, occupancy was 91.8% at the end of Q1, down just half a percentage point yoy. Rent collection has also been solid, as CubeSmart collected 93% of April rent. While that is below the 98% from April 2019, it’s not too shabby considering the economic environment.

Operations in the Face of COVID

Running self-storage facilities doesn’t require a lot of interaction with customers, so CubeSmart has been able to continue operating without major adjustments. On top of that, self-storage was designated an essential business during the lockdowns, something that should comfort investors due to the possibility of additional lockdowns.

Furthermore, CUBE has utilized a contactless rental model since April 2nd. The process, dubbed SmartRental, was possible due to investments made by CubeSmart in its technology and systems over the past few years.

With CUBE looking well-positioned to hold up in the face of COVID, let’s turn our attention to its valuation.

Valuation

REITs are usually valued based on their funds from operations (FFO). CUBE trades at just under 17x projected 2020 FFO, a reasonable number.

The company has had solid top-line and EBITDA growth over the past decade. Over the past ten years, revenue growth has been over 12% annualized and EBITDA growth has come in at over 15% annualized. Those numbers have slowed down a bit over the past three years, but still come in at roughly 9% annualized.

REITs often pay high yields due to the requirement that they pay out 90% of their net earnings to shareholders as dividends. CUBE sports a dividend of almost 5%, a nice yield in the current market.

CubeSmart has a healthy balance sheet. During the Q1 2020 earnings call, CFO Timothy M. Martin said, “At quarter end, our leverage levels remain conservative at 39% debt-to-gross assets, our debt-to-EBITDA was 4.9 times, and our fixed charge coverage ratio was 5.5 times.”

With the fundamentals on CUBE looking good, let’s take a look at the chart.

Technicals

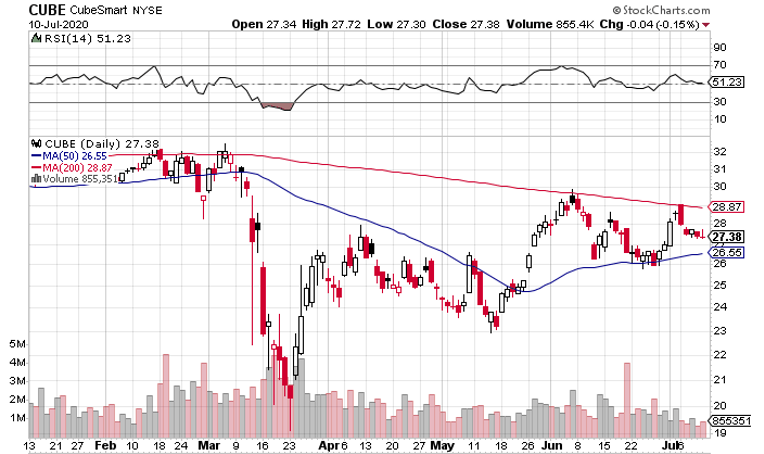

CUBE held up nicely when markets first started to tank in mid-February. But March was a different story as shares lost more than one-third of their value from peak to trough. Since then, the stock has recovered, but still sits a little below its February levels.

Shares have a lot of resistance overhead. They sit just below the 200-day moving average and also trade for less than they did for just about the entire 14-month period leading into COVID.

You have a couple of options:

- Wait for a breakout above the 200-day moving average – shares are currently consolidating just below the 200-day on light volume.

- Get in now and make a long-term value/yield play.

While the first option looks appealing, I would advise going with option #2. CUBE is an excellent value/yield play at current levels and would be a nice buy-and-hold for a few years. Finding a good entry point is always ideal, but the fundamentals are strong enough to carry CUBE on its own.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report