With cybersecurity in the news lately, are stocks like

Fortinet NASDAQ: FTNT well-positioned for gains?

The stock rebounded Thursday, along with the broader market.

In addition to the hacking of the Colonial pipeline, the growing work-from-home movement shed light on cybersecurity risks for enterprise. This week, President Joe Biden signed an executive order designed to strengthen the nation’s cybersecurity.

Fortinet has specialized in core firewall protection, but it’s expanding into a new networking technology called SD-WAN.

Analysts have great expectations for the company for the next two years. Unlike many companies whose revenue and net income hit the skids in 2020, Fortinet saw annual earnings growth of 35% and revenue growth of 20%.

This year, Wall Street expects earnings per share of $3.74, up 12%. Next year, that’s expected to be $4.35, a gain of 16%.

At the company’s virtual investor day in March, Fortinet said it expects revenue to reach $4 billion by 2023.

SD-WAN is short for “software-defined, wide-area network” technology. It serves a need very much in demand these days: Connecting a company’s various offices, as well as at-home workers.

Corporations Change Approach To Security

This business line ramped up fast, with events of 2020 boosting Fortinet’s SD-WAN revenue. Billings in the category nearly doubled, to $355 million.

Enterprise customers are changing their approach to cybersecurity and connectivity. That bodes well for Fortinet, whose firewall products have built-in SD-WAN.

In addition, the SD-WAN rollout is a good move for Fortinet, as firewall business is slowing industrywide, as more and more enterprise users switch to cloud storage.

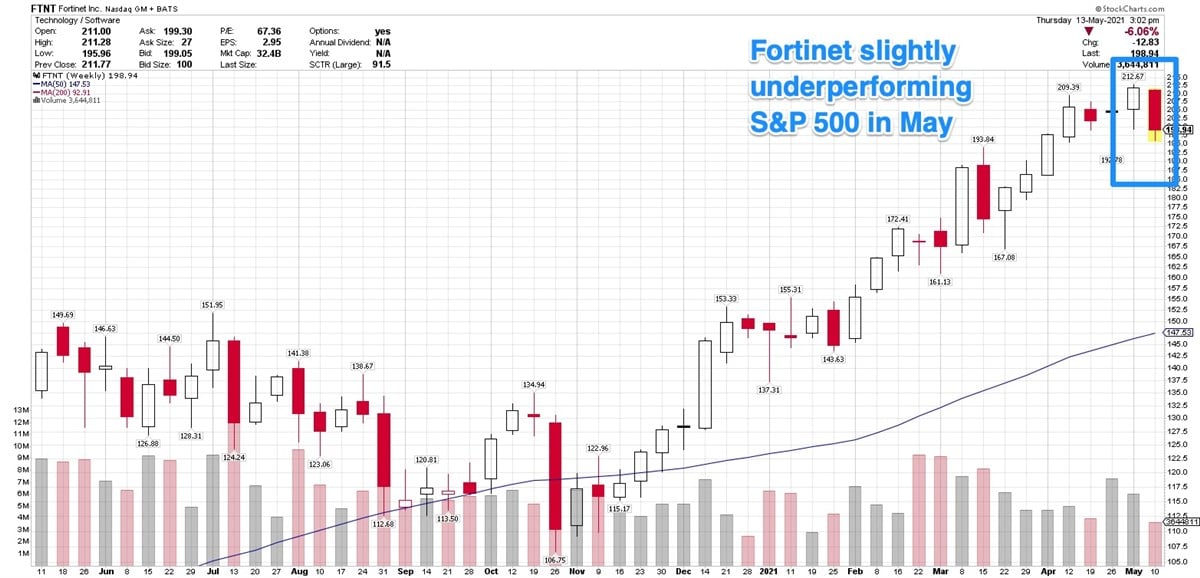

Fortinet's trade has been choppy since its earnings report after the close on April 29. However, much of that chop was due to a decline in the broader market. Fortinet, as a large cap, is part of the S&P 500 index, so it’s appropriate to gauge its performance to the broader index.

Fortinet is down 2.78% in May, trading Thursday at around $198. As a point of comparison, the S&P 500 is down just 1.54% this month.

That’s not a big enough discrepancy to become concerned about, especially with a company that’s situated in a growing industry, and one that’s in the spotlight these days.

What Does Chip Shortage Mean?

One potential headwind is the global semiconductor shortage. In the April earnings call, chief financial officer Keith Jensen addressed that challenge. He discussed the products themselves within Fortinet’s inventory mix.

“One thing about Fortinet, in addition to having different form factors, is the inventory balances that we carry, a two times inventory turns, you're looking at basically six months of inventory that we're carrying on our balance sheet,” he said.

However, he acknowledged that supply chain issues related to chips will be a constant this year and into next year. “But I think in terms of when we sit down and talk about our expectations for the year, I think we have a fairly good understanding of how to work that in,” he added.

Although this stock has a lot going for it, this is not the right time to buy, especially with the broader market in a correction. Downside volume has been lower than upside volume lately, which is a great sign for the stock. However, more selling could be ahead.

There’s a great deal of chatter right now about investors being spooked by inflation, but the reality is: The stock rallied 42.37% over the past year and 32.65% year-to-date. After those rallies, it’s not surprising to see institutional investors take some profits and prepare for the next run-up.

The industry outlook is good, as well. Rivals in the firewall space include Palo Alto Networks NYSE: PANW and Checkpoint Software NASDAQ: CHKP. Smaller cybersecurity stocks include Identiv NASDAQ: INVE and Proofpoint, which is being acquired by private equity firm Thomas Bravo.

Before you consider Fortinet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortinet wasn't on the list.

While Fortinet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report