Kovack Advisors Inc. boosted its stake in shares of ADTRAN Holdings, Inc. (NASDAQ:ADTN - Free Report) by 157.9% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 432,750 shares of the communications equipment provider's stock after acquiring an additional 264,950 shares during the quarter. Kovack Advisors Inc. owned 0.55% of ADTRAN worth $3,176,000 at the end of the most recent reporting period.

Kovack Advisors Inc. boosted its stake in shares of ADTRAN Holdings, Inc. (NASDAQ:ADTN - Free Report) by 157.9% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 432,750 shares of the communications equipment provider's stock after acquiring an additional 264,950 shares during the quarter. Kovack Advisors Inc. owned 0.55% of ADTRAN worth $3,176,000 at the end of the most recent reporting period.

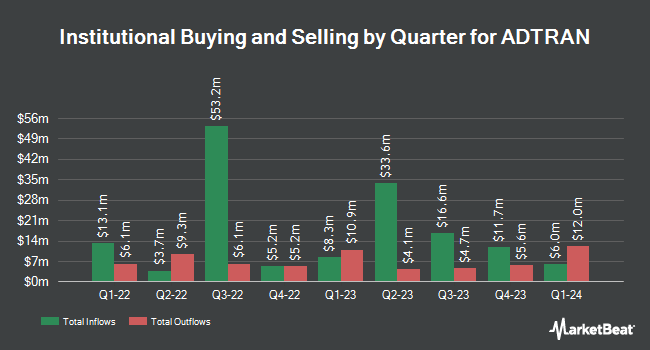

Several other institutional investors also recently bought and sold shares of ADTN. SG Americas Securities LLC purchased a new stake in shares of ADTRAN in the third quarter valued at approximately $387,000. Handelsbanken Fonder AB purchased a new stake in ADTRAN in the third quarter valued at $114,000. Raymond James Financial Services Advisors Inc. purchased a new stake in ADTRAN in the third quarter valued at $119,000. Zurcher Kantonalbank Zurich Cantonalbank raised its position in ADTRAN by 19.7% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 15,185 shares of the communications equipment provider's stock valued at $125,000 after purchasing an additional 2,500 shares during the period. Finally, NewSquare Capital LLC purchased a new stake in shares of ADTRAN in the 3rd quarter valued at $189,000. 80.56% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

ADTN has been the topic of several recent research reports. Needham & Company LLC restated a "buy" rating and set a $8.00 price target on shares of ADTRAN in a report on Wednesday, April 17th. StockNews.com raised ADTRAN to a "sell" rating in a research report on Wednesday, March 6th. Finally, Rosenblatt Securities lowered their price objective on ADTRAN from $8.00 to $7.50 and set a "neutral" rating for the company in a research report on Wednesday, February 28th. One analyst has rated the stock with a sell rating, two have assigned a hold rating and one has assigned a buy rating to the company. According to MarketBeat, ADTRAN presently has a consensus rating of "Hold" and an average target price of $10.50.

Read Our Latest Stock Analysis on ADTRAN

ADTRAN Stock Performance

ADTRAN stock traded down $0.14 during mid-day trading on Friday, reaching $4.43. 532,348 shares of the company were exchanged, compared to its average volume of 732,911. ADTRAN Holdings, Inc. has a twelve month low of $4.43 and a twelve month high of $11.02. The firm's 50-day simple moving average is $5.48 and its two-hundred day simple moving average is $6.22. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.34 and a current ratio of 2.64. The firm has a market cap of $350.50 million, a PE ratio of -1.38 and a beta of 1.13.

ADTRAN (NASDAQ:ADTN - Get Free Report) last posted its quarterly earnings data on Monday, February 26th. The communications equipment provider reported ($1.13) earnings per share for the quarter, missing analysts' consensus estimates of ($0.12) by ($1.01). ADTRAN had a negative return on equity of 15.65% and a negative net margin of 21.80%. The company had revenue of $225.48 million for the quarter, compared to analyst estimates of $232.45 million. Equities analysts predict that ADTRAN Holdings, Inc. will post -0.25 earnings per share for the current fiscal year.

ADTRAN Profile

(

Free Report)

ADTRAN Holdings, Inc, through its subsidiaries, provides networking and communications platforms, software, systems, and services in the United States, Germany, the United Kingdom, and internationally. It operates through two segments, Network Solutions, and Services & Support. It offers residential gateways; ethernet passive optical network ONUs; gigabit passive optical network/XGS-PON ONTs; traditional SSE, routers, and switches; edge cloud; carrier ethernet network interface devices; Optical Line Terminals; Packet Aggregation, Copper Access, and Oscilloquartz; optical transport and engine solutions; infrastructure monitoring solution; and training, professional, software, and managed services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ADTRAN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADTRAN wasn't on the list.

While ADTRAN currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report