Readystate Asset Management LP lowered its position in Alarm.com Holdings, Inc. (NASDAQ:ALRM - Free Report) by 99.9% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 27,846 shares of the software maker's stock after selling 27,828,154 shares during the quarter. Readystate Asset Management LP owned approximately 0.06% of Alarm.com worth $1,799,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Readystate Asset Management LP lowered its position in Alarm.com Holdings, Inc. (NASDAQ:ALRM - Free Report) by 99.9% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 27,846 shares of the software maker's stock after selling 27,828,154 shares during the quarter. Readystate Asset Management LP owned approximately 0.06% of Alarm.com worth $1,799,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

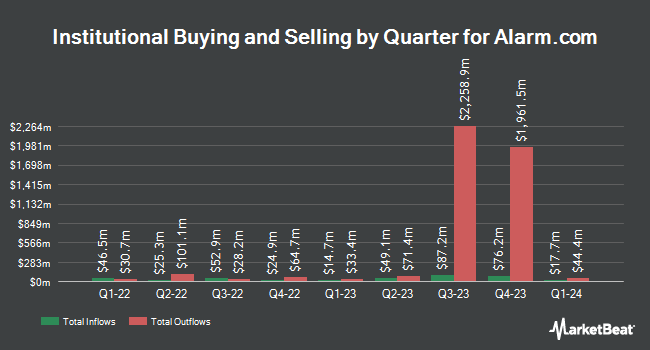

Several other hedge funds and other institutional investors have also bought and sold shares of ALRM. HighTower Advisors LLC boosted its stake in Alarm.com by 5.8% in the first quarter. HighTower Advisors LLC now owns 14,646 shares of the software maker's stock worth $975,000 after buying an additional 800 shares in the last quarter. MetLife Investment Management LLC boosted its stake in Alarm.com by 53.5% in the first quarter. MetLife Investment Management LLC now owns 25,138 shares of the software maker's stock worth $1,671,000 after buying an additional 8,765 shares in the last quarter. Rhumbline Advisers boosted its stake in Alarm.com by 5.8% in the first quarter. Rhumbline Advisers now owns 114,173 shares of the software maker's stock worth $7,588,000 after buying an additional 6,295 shares in the last quarter. Yousif Capital Management LLC boosted its stake in Alarm.com by 1.3% in the first quarter. Yousif Capital Management LLC now owns 41,740 shares of the software maker's stock worth $2,774,000 after buying an additional 540 shares in the last quarter. Finally, Mackenzie Financial Corp boosted its stake in Alarm.com by 44.0% in the first quarter. Mackenzie Financial Corp now owns 3,738 shares of the software maker's stock worth $248,000 after buying an additional 1,143 shares in the last quarter. Hedge funds and other institutional investors own 91.74% of the company's stock.

Insiders Place Their Bets

In other Alarm.com news, insider Daniel Ramos sold 8,250 shares of the stock in a transaction on Tuesday, February 27th. The stock was sold at an average price of $74.44, for a total value of $614,130.00. Following the completion of the transaction, the insider now owns 39,700 shares in the company, valued at $2,955,268. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. In other news, CFO Steve Valenzuela sold 1,716 shares of the firm's stock in a transaction on Tuesday, April 2nd. The stock was sold at an average price of $70.00, for a total transaction of $120,120.00. Following the completion of the transaction, the chief financial officer now directly owns 35,784 shares in the company, valued at $2,504,880. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Daniel Ramos sold 8,250 shares of the firm's stock in a transaction on Tuesday, February 27th. The shares were sold at an average price of $74.44, for a total value of $614,130.00. Following the transaction, the insider now owns 39,700 shares of the company's stock, valued at $2,955,268. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 111,532 shares of company stock worth $8,116,333. 5.60% of the stock is owned by corporate insiders.

Alarm.com Trading Down 0.7 %

ALRM stock traded down $0.43 on Wednesday, reaching $64.25. The company's stock had a trading volume of 197,244 shares, compared to its average volume of 250,836. The business has a fifty day simple moving average of $71.30 and a two-hundred day simple moving average of $63.20. Alarm.com Holdings, Inc. has a 12-month low of $44.92 and a 12-month high of $77.29. The firm has a market cap of $3.21 billion, a PE ratio of 41.99, a PEG ratio of 3.73 and a beta of 0.94. The company has a debt-to-equity ratio of 0.72, a quick ratio of 4.91 and a current ratio of 5.46.

Alarm.com (NASDAQ:ALRM - Get Free Report) last announced its quarterly earnings results on Thursday, February 22nd. The software maker reported $0.47 EPS for the quarter, missing analysts' consensus estimates of $0.48 by ($0.01). The business had revenue of $226.20 million during the quarter, compared to analysts' expectations of $224.93 million. Alarm.com had a return on equity of 11.61% and a net margin of 9.19%. The business's revenue was up 8.7% compared to the same quarter last year. During the same period in the previous year, the business earned $0.33 EPS. As a group, research analysts forecast that Alarm.com Holdings, Inc. will post 1.39 EPS for the current year.

Wall Street Analyst Weigh In

Several brokerages have issued reports on ALRM. JPMorgan Chase & Co. upped their target price on Alarm.com from $62.00 to $70.00 and gave the stock a "neutral" rating in a research note on Friday, February 23rd. Barclays increased their price objective on Alarm.com from $66.00 to $78.00 and gave the company an "equal weight" rating in a research note on Friday, February 23rd. StockNews.com raised Alarm.com from a "buy" rating to a "strong-buy" rating in a research note on Friday, March 15th. TheStreet raised Alarm.com from a "c+" rating to a "b-" rating in a research note on Friday, February 23rd. Finally, Roth Mkm increased their price objective on Alarm.com from $67.00 to $70.00 and gave the company a "buy" rating in a research note on Wednesday, January 3rd. Two investment analysts have rated the stock with a hold rating, three have given a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus price target of $68.83.

Read Our Latest Report on Alarm.com

Alarm.com Profile

(

Free Report)

Alarm.com Holdings, Inc provides various Internet of Things (IoT) and solutions for residential, multi-family, small business, and enterprise commercial markets in North America and internationally. The company operates through two segments, Alarm.com and Other. It offers solutions to control and monitor security systems, as well as to IoT devices, including door locks, garage doors, thermostats, and video cameras; and video monitoring and analytics solutions, such as video analytics, escalated events, video doorbells, intelligent integration, live streaming, secure cloud storage, and video alerts.

Featured Stories

Want to see what other hedge funds are holding ALRM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Alarm.com Holdings, Inc. (NASDAQ:ALRM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alarm.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alarm.com wasn't on the list.

While Alarm.com currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report