Flossbach Von Storch AG boosted its position in Booking Holdings Inc. (NASDAQ:BKNG - Free Report) by 19.6% in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 8,349 shares of the business services provider's stock after purchasing an additional 1,371 shares during the period. Flossbach Von Storch AG's holdings in Booking were worth $29,616,000 at the end of the most recent quarter.

Flossbach Von Storch AG boosted its position in Booking Holdings Inc. (NASDAQ:BKNG - Free Report) by 19.6% in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 8,349 shares of the business services provider's stock after purchasing an additional 1,371 shares during the period. Flossbach Von Storch AG's holdings in Booking were worth $29,616,000 at the end of the most recent quarter.

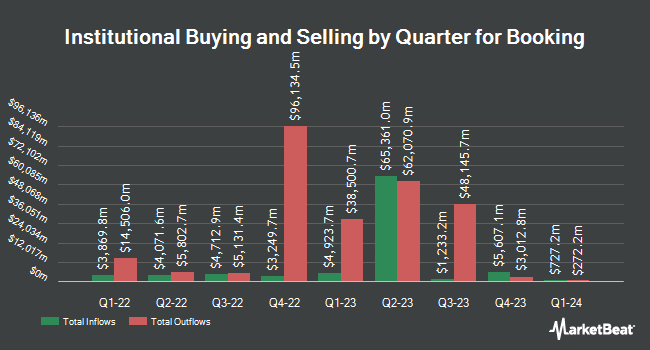

A number of other institutional investors and hedge funds have also bought and sold shares of BKNG. Activest Wealth Management bought a new stake in shares of Booking in the 4th quarter valued at about $25,000. Valued Wealth Advisors LLC bought a new stake in shares of Booking in the 4th quarter valued at about $28,000. Turtle Creek Wealth Advisors LLC bought a new stake in shares of Booking in the 4th quarter valued at about $28,000. Bourgeon Capital Management LLC bought a new stake in shares of Booking in the 4th quarter valued at about $28,000. Finally, Arlington Trust Co LLC bought a new stake in shares of Booking in the 4th quarter valued at about $32,000. Institutional investors and hedge funds own 92.42% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have commented on BKNG shares. Wells Fargo & Company reduced their price target on Booking from $3,548.00 to $3,435.00 and set an "equal weight" rating on the stock in a research report on Friday, February 23rd. StockNews.com upgraded Booking from a "hold" rating to a "buy" rating in a research report on Thursday, April 11th. Edward Jones restated a "hold" rating on shares of Booking in a research report on Friday, February 16th. Ascendiant Capital Markets upped their target price on Booking from $3,700.00 to $3,900.00 and gave the company a "buy" rating in a research report on Friday, December 29th. Finally, Barclays cut their target price on Booking from $3,900.00 to $3,800.00 and set an "overweight" rating on the stock in a research report on Friday, February 23rd. Seven analysts have rated the stock with a hold rating, twenty-two have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $3,723.41.

Read Our Latest Report on BKNG

Booking Trading Down 0.7 %

Shares of BKNG traded down $23.86 on Wednesday, reaching $3,443.91. 170,859 shares of the company's stock traded hands, compared to its average volume of 275,648. The stock has a market cap of $117.68 billion, a PE ratio of 29.19, a PEG ratio of 1.06 and a beta of 1.40. The stock's 50 day simple moving average is $3,586.29 and its two-hundred day simple moving average is $3,364.25. Booking Holdings Inc. has a 52-week low of $2,456.93 and a 52-week high of $3,918.00.

Booking (NASDAQ:BKNG - Get Free Report) last announced its quarterly earnings data on Thursday, February 22nd. The business services provider reported $32.00 earnings per share for the quarter, beating the consensus estimate of $29.72 by $2.28. Booking had a negative return on equity of 751.49% and a net margin of 20.08%. The business had revenue of $4.78 billion during the quarter, compared to analyst estimates of $4.71 billion. During the same period in the prior year, the company earned $24.74 earnings per share. Booking's revenue was up 18.2% compared to the same quarter last year. Analysts forecast that Booking Holdings Inc. will post 175.86 earnings per share for the current year.

Booking Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, March 28th. Shareholders of record on Friday, March 8th were issued a dividend of $8.75 per share. This represents a $35.00 annualized dividend and a yield of 1.02%. The ex-dividend date of this dividend was Thursday, March 7th. Booking's dividend payout ratio (DPR) is 29.67%.

Insider Buying and Selling at Booking

In other Booking news, CEO Glenn D. Fogel sold 4,302 shares of the stock in a transaction on Friday, March 15th. The stock was sold at an average price of $3,422.75, for a total transaction of $14,724,670.50. Following the completion of the transaction, the chief executive officer now directly owns 33,548 shares of the company's stock, valued at $114,826,417. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In other news, CEO Glenn D. Fogel sold 750 shares of the firm's stock in a transaction on Monday, April 15th. The stock was sold at an average price of $3,534.10, for a total value of $2,650,575.00. Following the completion of the transaction, the chief executive officer now directly owns 26,971 shares of the company's stock, valued at $95,318,211.10. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Glenn D. Fogel sold 4,302 shares of Booking stock in a transaction on Friday, March 15th. The shares were sold at an average price of $3,422.75, for a total value of $14,724,670.50. Following the sale, the chief executive officer now directly owns 33,548 shares of the company's stock, valued at approximately $114,826,417. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 5,461 shares of company stock valued at $18,815,825. Company insiders own 0.15% of the company's stock.

About Booking

(

Free Report)

Booking Holdings Inc, formerly The Priceline Group Inc, is a provider of travel and restaurant online reservation and related services. The Company, through its online travel companies (OTCs), connects consumers wishing to make travel reservations with providers of travel services across the world. It offers consumers an array of accommodation reservations (including hotels, bed and breakfasts, hostels, apartments, vacation rentals and other properties) through its Booking.com, priceline.com and agoda.com brands.

Further Reading

Want to see what other hedge funds are holding BKNG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Booking Holdings Inc. (NASDAQ:BKNG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Booking, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Booking wasn't on the list.

While Booking currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report