Altshuler Shaham Ltd trimmed its stake in shares of Enlight Renewable Energy Ltd (NASDAQ:ENLT - Free Report) by 14.1% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 5,410,569 shares of the company's stock after selling 890,821 shares during the period. Enlight Renewable Energy comprises about 5.8% of Altshuler Shaham Ltd's holdings, making the stock its 7th biggest holding. Altshuler Shaham Ltd owned 4.68% of Enlight Renewable Energy worth $105,991,000 as of its most recent filing with the Securities & Exchange Commission.

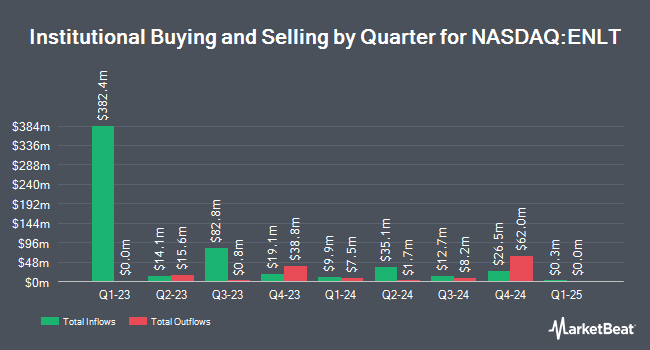

A number of other hedge funds and other institutional investors have also modified their holdings of ENLT. Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in shares of Enlight Renewable Energy by 12.1% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 48,192 shares of the company's stock valued at $761,000 after purchasing an additional 5,215 shares in the last quarter. Yelin Lapidot Holdings Management Ltd. purchased a new stake in shares of Enlight Renewable Energy in the third quarter valued at $3,120,000. Y.D. More Investments Ltd purchased a new stake in shares of Enlight Renewable Energy in the third quarter valued at $3,226,000. Swiss National Bank lifted its holdings in shares of Enlight Renewable Energy by 3.6% in the third quarter. Swiss National Bank now owns 260,411 shares of the company's stock valued at $4,098,000 after purchasing an additional 9,069 shares in the last quarter. Finally, Assenagon Asset Management S.A. raised its holdings in shares of Enlight Renewable Energy by 40.1% during the third quarter. Assenagon Asset Management S.A. now owns 410,362 shares of the company's stock worth $6,476,000 after acquiring an additional 117,525 shares in the last quarter. Institutional investors and hedge funds own 38.89% of the company's stock.

Enlight Renewable Energy Trading Up 0.2 %

NASDAQ:ENLT traded up $0.03 on Thursday, hitting $18.12. 11,720 shares of the stock were exchanged, compared to its average volume of 44,187. The company's 50-day moving average price is $16.85 and its 200 day moving average price is $16.90. Enlight Renewable Energy Ltd has a 52 week low of $12.11 and a 52 week high of $20.44. The stock has a market capitalization of $2.09 billion, a price-to-earnings ratio of 32.11 and a beta of 1.68. The company has a debt-to-equity ratio of 1.63, a quick ratio of 1.14 and a current ratio of 1.14.

Enlight Renewable Energy (NASDAQ:ENLT - Get Free Report) last announced its quarterly earnings results on Wednesday, May 8th. The company reported $0.14 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.09 by $0.05. Enlight Renewable Energy had a net margin of 27.74% and a return on equity of 5.05%. The company had revenue of $90.40 million during the quarter, compared to analyst estimates of $79.31 million. During the same quarter in the previous year, the business earned $0.20 EPS. The firm's revenue was up 27.3% on a year-over-year basis. On average, equities research analysts forecast that Enlight Renewable Energy Ltd will post 0.44 earnings per share for the current year.

Analyst Ratings Changes

ENLT has been the topic of several recent research reports. JPMorgan Chase & Co. restated a "neutral" rating and set a $16.00 target price (down from $19.00) on shares of Enlight Renewable Energy in a report on Monday, April 8th. Barclays lowered their price target on Enlight Renewable Energy from $21.00 to $20.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 10th. Finally, Roth Mkm reaffirmed a "buy" rating and issued a $20.00 price target (up from $19.00) on shares of Enlight Renewable Energy in a research report on Thursday.

Read Our Latest Report on Enlight Renewable Energy

Enlight Renewable Energy Profile

(

Free Report)

Enlight Renewable Energy Ltd operates a renewable energy platform in Israel, Central-Eastern Europe, Western Europe, and the United States. The company develops, finances, constructs, owns, and operates utility-scale renewable energy projects. It develops wind energy and solar energy projects, as well as energy storage projects.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Enlight Renewable Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enlight Renewable Energy wasn't on the list.

While Enlight Renewable Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.