TimesSquare Capital Management LLC lessened its stake in shares of Microchip Technology Incorporated (NASDAQ:MCHP - Free Report) by 3.6% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 850,329 shares of the semiconductor company's stock after selling 31,400 shares during the quarter. Microchip Technology comprises about 1.1% of TimesSquare Capital Management LLC's holdings, making the stock its 27th biggest holding. TimesSquare Capital Management LLC owned 0.16% of Microchip Technology worth $76,683,000 as of its most recent filing with the Securities and Exchange Commission.

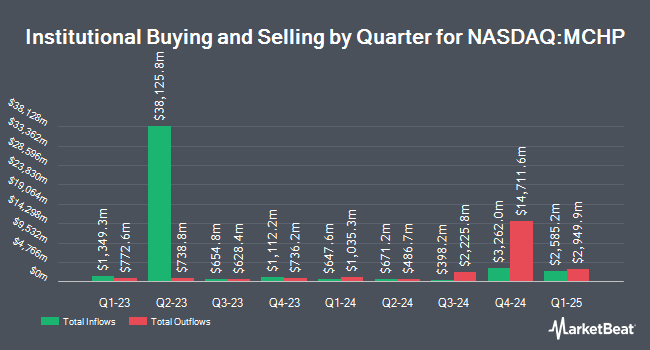

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Cambridge Investment Research Advisors Inc. lifted its stake in Microchip Technology by 4.7% in the third quarter. Cambridge Investment Research Advisors Inc. now owns 39,162 shares of the semiconductor company's stock valued at $3,057,000 after buying an additional 1,769 shares during the last quarter. Stratos Wealth Partners LTD. raised its holdings in shares of Microchip Technology by 7.1% in the third quarter. Stratos Wealth Partners LTD. now owns 5,799 shares of the semiconductor company's stock valued at $453,000 after buying an additional 383 shares during the last quarter. Brown Advisory Inc. boosted its stake in shares of Microchip Technology by 2.1% during the third quarter. Brown Advisory Inc. now owns 104,768 shares of the semiconductor company's stock worth $8,177,000 after buying an additional 2,201 shares during the period. Concord Wealth Partners increased its position in Microchip Technology by 1,871.2% in the 3rd quarter. Concord Wealth Partners now owns 1,025 shares of the semiconductor company's stock valued at $80,000 after acquiring an additional 973 shares during the period. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its position in Microchip Technology by 95.7% during the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 208,321 shares of the semiconductor company's stock worth $16,259,000 after acquiring an additional 101,887 shares during the period. 91.51% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities research analysts recently weighed in on the company. Truist Financial increased their price target on Microchip Technology from $93.00 to $96.00 and gave the stock a "buy" rating in a report on Tuesday. KeyCorp raised their price objective on shares of Microchip Technology from $90.00 to $110.00 and gave the company an "overweight" rating in a research report on Tuesday. Susquehanna raised their price target on Microchip Technology from $100.00 to $105.00 and gave the company a "positive" rating in a report on Tuesday. B. Riley upped their price objective on Microchip Technology from $105.00 to $110.00 and gave the stock a "buy" rating in a report on Tuesday. Finally, Mizuho boosted their target price on shares of Microchip Technology from $82.00 to $85.00 and gave the stock a "neutral" rating in a research report on Tuesday. Six equities research analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $98.47.

View Our Latest Stock Analysis on MCHP

Microchip Technology Trading Down 0.6 %

Shares of MCHP traded down $0.51 during mid-day trading on Thursday, hitting $91.48. The company had a trading volume of 3,904,925 shares, compared to its average volume of 5,617,005. Microchip Technology Incorporated has a 1-year low of $68.75 and a 1-year high of $96.14. The company has a quick ratio of 0.58, a current ratio of 0.98 and a debt-to-equity ratio of 0.57. The business's 50-day simple moving average is $88.79 and its 200-day simple moving average is $85.46. The stock has a market cap of $49.44 billion, a PE ratio of 21.37, a P/E/G ratio of 2.79 and a beta of 1.60.

Microchip Technology (NASDAQ:MCHP - Get Free Report) last issued its earnings results on Monday, May 6th. The semiconductor company reported $0.57 earnings per share for the quarter, hitting the consensus estimate of $0.57. The business had revenue of $1.33 billion for the quarter, compared to analyst estimates of $1.33 billion. Microchip Technology had a return on equity of 45.59% and a net margin of 27.59%. The business's quarterly revenue was down 40.6% on a year-over-year basis. During the same period last year, the company posted $1.56 EPS. Sell-side analysts forecast that Microchip Technology Incorporated will post 4.64 earnings per share for the current year.

Microchip Technology Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, June 5th. Stockholders of record on Wednesday, May 22nd will be paid a $0.452 dividend. This represents a $1.81 dividend on an annualized basis and a dividend yield of 1.98%. The ex-dividend date is Tuesday, May 21st. This is an increase from Microchip Technology's previous quarterly dividend of $0.45. Microchip Technology's dividend payout ratio (DPR) is currently 42.06%.

Insiders Place Their Bets

In related news, CFO James Eric Bjornholt sold 1,970 shares of the firm's stock in a transaction on Friday, February 23rd. The shares were sold at an average price of $83.90, for a total transaction of $165,283.00. Following the completion of the sale, the chief financial officer now directly owns 32,893 shares of the company's stock, valued at approximately $2,759,722.70. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. 2.07% of the stock is currently owned by insiders.

About Microchip Technology

(

Free Report)

Microchip Technology Incorporated develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

See Also

Want to see what other hedge funds are holding MCHP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Microchip Technology Incorporated (NASDAQ:MCHP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Microchip Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microchip Technology wasn't on the list.

While Microchip Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.