Tripadvisor (NASDAQ:TRIP - Get Free Report) had its price objective dropped by investment analysts at JPMorgan Chase & Co. from $25.00 to $17.00 in a research note issued to investors on Thursday, Benzinga reports. The firm currently has an "underweight" rating on the travel company's stock. JPMorgan Chase & Co.'s target price would indicate a potential downside of 7.15% from the company's current price.

Tripadvisor (NASDAQ:TRIP - Get Free Report) had its price objective dropped by investment analysts at JPMorgan Chase & Co. from $25.00 to $17.00 in a research note issued to investors on Thursday, Benzinga reports. The firm currently has an "underweight" rating on the travel company's stock. JPMorgan Chase & Co.'s target price would indicate a potential downside of 7.15% from the company's current price.

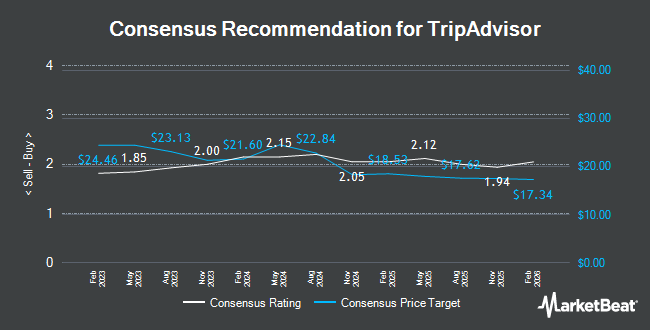

A number of other research firms have also weighed in on TRIP. Wedbush reissued a "neutral" rating and set a $30.00 target price on shares of Tripadvisor in a report on Thursday, April 18th. StockNews.com raised Tripadvisor from a "hold" rating to a "buy" rating in a research report on Friday, February 23rd. Mizuho reduced their price target on Tripadvisor from $23.00 to $21.00 and set a "neutral" rating on the stock in a research report on Thursday. B. Riley restated a "buy" rating and set a $34.00 price objective (up from $27.00) on shares of Tripadvisor in a research report on Friday, February 16th. Finally, The Goldman Sachs Group cut their price target on shares of Tripadvisor from $34.00 to $27.00 and set a "buy" rating on the stock in a research report on Thursday. Three analysts have rated the stock with a sell rating, ten have assigned a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $22.65.

Check Out Our Latest Stock Analysis on TRIP

Tripadvisor Price Performance

Shares of NASDAQ TRIP traded up $0.15 during midday trading on Thursday, reaching $18.31. 6,553,546 shares of the company were exchanged, compared to its average volume of 2,689,143. The stock's 50-day moving average price is $26.64 and its 200-day moving average price is $22.48. The stock has a market cap of $2.52 billion, a P/E ratio of 305.17, a PEG ratio of 1.62 and a beta of 1.56. The company has a quick ratio of 2.27, a current ratio of 2.27 and a debt-to-equity ratio of 1.02. Tripadvisor has a one year low of $14.15 and a one year high of $28.76.

Tripadvisor (NASDAQ:TRIP - Get Free Report) last issued its earnings results on Wednesday, February 14th. The travel company reported $0.21 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.07 by $0.14. The business had revenue of $390.00 million during the quarter, compared to analysts' expectations of $372.93 million. Tripadvisor had a return on equity of 11.69% and a net margin of 0.56%. On average, sell-side analysts anticipate that Tripadvisor will post 0.88 earnings per share for the current fiscal year.

Institutional Trading of Tripadvisor

A number of hedge funds have recently bought and sold shares of the business. DekaBank Deutsche Girozentrale bought a new position in shares of Tripadvisor during the 3rd quarter valued at approximately $34,000. International Assets Investment Management LLC grew its holdings in Tripadvisor by 2,053.0% during the fourth quarter. International Assets Investment Management LLC now owns 2,153 shares of the travel company's stock valued at $46,000 after purchasing an additional 2,053 shares during the period. Quadrant Capital Group LLC increased its position in Tripadvisor by 52.6% in the fourth quarter. Quadrant Capital Group LLC now owns 2,497 shares of the travel company's stock worth $54,000 after buying an additional 861 shares during the last quarter. Future Financial Wealth Managment LLC purchased a new stake in Tripadvisor during the first quarter valued at about $83,000. Finally, Tower Research Capital LLC TRC boosted its position in Tripadvisor by 46.7% during the fourth quarter. Tower Research Capital LLC TRC now owns 5,158 shares of the travel company's stock worth $111,000 after purchasing an additional 1,641 shares during the period. 98.99% of the stock is currently owned by institutional investors.

About Tripadvisor

(

Get Free Report)

TripAdvisor, Inc operates as an online travel company, primarily engages in the provision of travel guidance products and services worldwide. The company operates in three segments: Brand Tripadvisor, Viator, and TheFork. The Brand Tripadvisor segment offers travel guidance platforms for travelers to discover, generate, and share authentic user-generated content in the form of ratings and reviews for destinations, points-of-interest, experiences, accommodations, restaurants, and cruises.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tripadvisor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tripadvisor wasn't on the list.

While Tripadvisor currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report