Calamos Advisors LLC boosted its holdings in Albertsons Companies, Inc. (NYSE:ACI - Free Report) by 88.4% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,504,264 shares of the company's stock after purchasing an additional 705,861 shares during the quarter. Calamos Advisors LLC owned about 0.26% of Albertsons Companies worth $34,598,000 at the end of the most recent quarter.

Calamos Advisors LLC boosted its holdings in Albertsons Companies, Inc. (NYSE:ACI - Free Report) by 88.4% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,504,264 shares of the company's stock after purchasing an additional 705,861 shares during the quarter. Calamos Advisors LLC owned about 0.26% of Albertsons Companies worth $34,598,000 at the end of the most recent quarter.

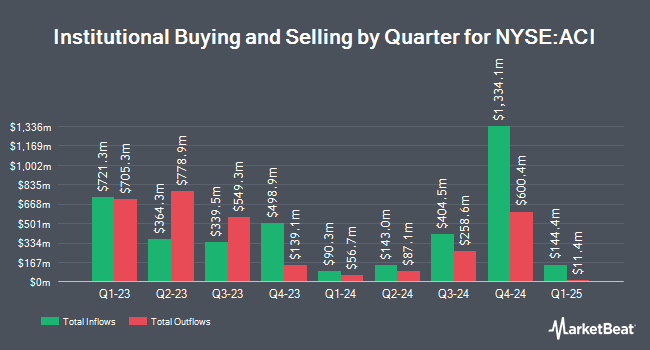

Other large investors also recently bought and sold shares of the company. NBC Securities Inc. purchased a new position in Albertsons Companies during the 3rd quarter worth $28,000. Blue Trust Inc. raised its position in Albertsons Companies by 255.1% during the 4th quarter. Blue Trust Inc. now owns 1,463 shares of the company's stock worth $34,000 after buying an additional 1,051 shares during the last quarter. UniSuper Management Pty Ltd acquired a new position in shares of Albertsons Companies during the 2nd quarter worth $46,000. Resurgent Financial Advisors LLC acquired a new position in shares of Albertsons Companies during the 4th quarter worth $45,000. Finally, Great West Life Assurance Co. Can acquired a new position in shares of Albertsons Companies during the 1st quarter worth $77,000. Hedge funds and other institutional investors own 71.35% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have recently weighed in on the stock. Evercore ISI lowered their price target on shares of Albertsons Companies from $23.00 to $22.00 and set an "in-line" rating on the stock in a research note on Tuesday. Telsey Advisory Group reissued a "market perform" rating and issued a $27.25 price objective on shares of Albertsons Companies in a research note on Wednesday. Tigress Financial reissued a "buy" rating and issued a $27.00 price objective on shares of Albertsons Companies in a research note on Friday, January 12th. Royal Bank of Canada reissued an "outperform" rating and issued a $24.00 price objective on shares of Albertsons Companies in a research note on Tuesday, February 13th. Finally, Roth Mkm increased their price objective on shares of Albertsons Companies from $23.00 to $24.00 and gave the company a "neutral" rating in a research note on Wednesday, January 10th. Three investment analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $24.85.

View Our Latest Stock Analysis on ACI

Albertsons Companies Trading Up 0.1 %

Shares of Albertsons Companies stock traded up $0.01 during mid-day trading on Thursday, hitting $20.46. 2,074,762 shares of the stock were exchanged, compared to its average volume of 3,465,126. Albertsons Companies, Inc. has a twelve month low of $19.88 and a twelve month high of $23.88. The stock has a market capitalization of $11.78 billion, a price-to-earnings ratio of 8.74, a price-to-earnings-growth ratio of 0.95 and a beta of 0.50. The company has a 50-day simple moving average of $20.93 and a 200 day simple moving average of $21.69. The company has a current ratio of 0.85, a quick ratio of 0.19 and a debt-to-equity ratio of 3.09.

Albertsons Companies Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, May 10th. Shareholders of record on Friday, April 26th will be paid a dividend of $0.12 per share. The ex-dividend date is Thursday, April 25th. This represents a $0.48 annualized dividend and a dividend yield of 2.35%. Albertsons Companies's dividend payout ratio is currently 20.51%.

Albertsons Companies Company Profile

(

Free Report)

Albertsons Companies, Inc, through its subsidiaries, engages in the operation of food and drug stores in the United States. The company's food and drug retail stores offer grocery products, general merchandise, health and beauty care products, pharmacy, fuel, and other items and services. It also manufactures and processes food products for sale in stores.

Read More

Before you consider Albertsons Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albertsons Companies wasn't on the list.

While Albertsons Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report