Badger Meter (NYSE:BMI - Get Free Report) was upgraded by equities research analysts at StockNews.com from a "hold" rating to a "buy" rating in a report released on Friday.

Badger Meter (NYSE:BMI - Get Free Report) was upgraded by equities research analysts at StockNews.com from a "hold" rating to a "buy" rating in a report released on Friday.

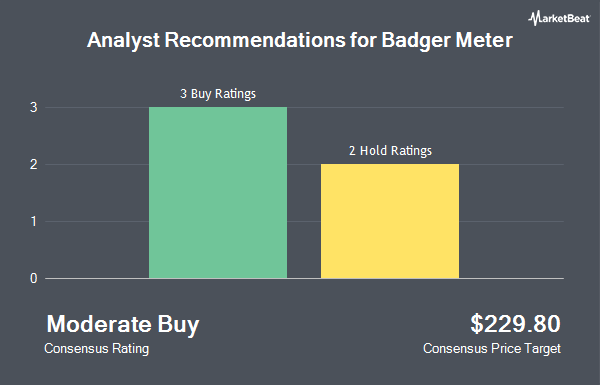

Other equities analysts also recently issued research reports about the stock. Maxim Group increased their price objective on shares of Badger Meter from $190.00 to $207.00 and gave the company a "buy" rating in a research note on Friday. Stifel Nicolaus raised their price target on shares of Badger Meter from $147.00 to $175.00 and gave the company a "hold" rating in a research note on Friday. Northcoast Research raised shares of Badger Meter from a "sell" rating to a "neutral" rating in a research note on Thursday. Finally, Robert W. Baird raised their price target on shares of Badger Meter from $151.00 to $180.00 and gave the company a "neutral" rating in a research note on Friday. Four equities research analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to MarketBeat, the stock has an average rating of "Hold" and a consensus target price of $162.50.

View Our Latest Analysis on BMI

Badger Meter Trading Down 1.0 %

NYSE:BMI traded down $1.80 on Friday, hitting $176.68. The company had a trading volume of 545,411 shares, compared to its average volume of 184,703. The stock has a market capitalization of $5.19 billion, a price-to-earnings ratio of 56.27, a PEG ratio of 3.52 and a beta of 0.86. The firm has a 50 day moving average of $157.41 and a two-hundred day moving average of $150.56. Badger Meter has a 52 week low of $126.66 and a 52 week high of $181.00.

Badger Meter (NYSE:BMI - Get Free Report) last issued its quarterly earnings data on Thursday, April 18th. The scientific and technical instruments company reported $0.99 EPS for the quarter, beating the consensus estimate of $0.82 by $0.17. The business had revenue of $196.80 million during the quarter, compared to the consensus estimate of $182.25 million. Badger Meter had a net margin of 13.16% and a return on equity of 19.07%. The firm's revenue was up 23.7% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.66 EPS. As a group, equities analysts forecast that Badger Meter will post 3.54 EPS for the current year.

Insider Transactions at Badger Meter

In other news, VP William R. A. Bergum sold 1,416 shares of the stock in a transaction on Monday, February 26th. The shares were sold at an average price of $156.23, for a total transaction of $221,221.68. Following the completion of the sale, the vice president now directly owns 13,422 shares in the company, valued at $2,096,919.06. The transaction was disclosed in a filing with the SEC, which is available at this link. In other news, VP William R. A. Bergum sold 1,416 shares of the stock in a transaction on Monday, February 26th. The shares were sold at an average price of $156.23, for a total transaction of $221,221.68. Following the completion of the sale, the vice president now directly owns 13,422 shares in the company, valued at $2,096,919.06. The transaction was disclosed in a filing with the SEC, which is available at this link. Also, VP William R. A. Bergum sold 194 shares of the stock in a transaction on Monday, March 4th. The stock was sold at an average price of $159.55, for a total transaction of $30,952.70. Following the sale, the vice president now owns 13,672 shares of the company's stock, valued at $2,181,367.60. The disclosure for this sale can be found here. Insiders sold a total of 2,813 shares of company stock worth $448,167 over the last three months. 0.80% of the stock is owned by company insiders.

Institutional Investors Weigh In On Badger Meter

A number of large investors have recently bought and sold shares of BMI. Frazier Financial Advisors LLC acquired a new stake in Badger Meter in the fourth quarter worth $31,000. McGlone Suttner Wealth Management Inc. acquired a new stake in Badger Meter in the fourth quarter worth $33,000. Asset Management One Co. Ltd. acquired a new stake in Badger Meter in the third quarter worth $35,000. GAMMA Investing LLC acquired a new stake in Badger Meter in the fourth quarter worth $40,000. Finally, Planned Solutions Inc. acquired a new stake in Badger Meter in the fourth quarter worth $45,000. 89.01% of the stock is currently owned by institutional investors and hedge funds.

About Badger Meter

(

Get Free Report)

Badger Meter, Inc manufactures and markets flow measurement, quality, control, and communication solutions worldwide. It offers mechanical or static water meters, and related radio and software technologies and services to municipal water utilities market. The company also provides flow instrumentation products, including meters, valves, and other sensing instruments to measure and control fluids going through a pipe or pipeline, including water, air, steam, and other liquids and gases to original equipment manufacturers as the primary flow measurement device within a product or system, as well as through manufacturers' representatives.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Badger Meter, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Badger Meter wasn't on the list.

While Badger Meter currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report