TimesSquare Capital Management LLC cut its stake in shares of Stevanato Group S.p.A. (NYSE:STVN - Free Report) by 9.8% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,833,276 shares of the company's stock after selling 199,085 shares during the period. TimesSquare Capital Management LLC's holdings in Stevanato Group were worth $50,030,000 at the end of the most recent reporting period.

TimesSquare Capital Management LLC cut its stake in shares of Stevanato Group S.p.A. (NYSE:STVN - Free Report) by 9.8% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,833,276 shares of the company's stock after selling 199,085 shares during the period. TimesSquare Capital Management LLC's holdings in Stevanato Group were worth $50,030,000 at the end of the most recent reporting period.

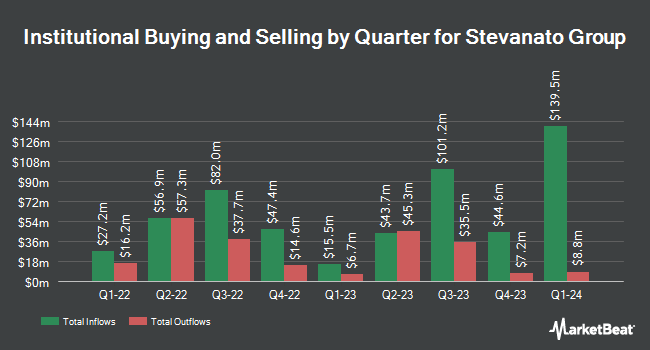

Other institutional investors and hedge funds have also recently modified their holdings of the company. Natixis Advisors L.P. boosted its position in shares of Stevanato Group by 1.9% during the 4th quarter. Natixis Advisors L.P. now owns 23,858 shares of the company's stock valued at $651,000 after acquiring an additional 449 shares during the last quarter. First Horizon Advisors Inc. increased its holdings in shares of Stevanato Group by 14.1% in the 4th quarter. First Horizon Advisors Inc. now owns 5,311 shares of the company's stock worth $145,000 after buying an additional 657 shares during the last quarter. Fifth Third Bancorp raised its position in shares of Stevanato Group by 70.1% during the 3rd quarter. Fifth Third Bancorp now owns 2,473 shares of the company's stock valued at $73,000 after buying an additional 1,019 shares in the last quarter. SRS Capital Advisors Inc. lifted its holdings in shares of Stevanato Group by 327.1% during the 4th quarter. SRS Capital Advisors Inc. now owns 1,593 shares of the company's stock worth $43,000 after acquiring an additional 1,220 shares during the last quarter. Finally, Calamos Wealth Management LLC grew its position in Stevanato Group by 3.3% in the fourth quarter. Calamos Wealth Management LLC now owns 50,585 shares of the company's stock worth $1,380,000 after acquiring an additional 1,607 shares in the last quarter.

Stevanato Group Stock Down 21.6 %

Shares of NYSE STVN traded down €5.81 ($6.25) on Thursday, reaching €21.10 ($22.69). 4,692,200 shares of the company's stock traded hands, compared to its average volume of 390,698. The company has a quick ratio of 1.06, a current ratio of 1.50 and a debt-to-equity ratio of 0.23. The company has a market cap of $6.24 billion, a price-to-earnings ratio of 36.05, a price-to-earnings-growth ratio of 2.92 and a beta of 0.76. The business's 50 day simple moving average is €29.36 and its two-hundred day simple moving average is €29.04. Stevanato Group S.p.A. has a 12 month low of €20.01 ($21.52) and a 12 month high of €36.30 ($39.03).

Stevanato Group (NYSE:STVN - Get Free Report) last released its quarterly earnings results on Thursday, March 7th. The company reported €0.18 ($0.19) earnings per share for the quarter, missing the consensus estimate of €0.19 ($0.20) by (€0.01) (($0.01)). The business had revenue of €320.60 million during the quarter, compared to the consensus estimate of €326.85 million. Stevanato Group had a return on equity of 14.31% and a net margin of 13.43%. The firm's revenue was up 9.8% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.19 earnings per share. As a group, equities research analysts forecast that Stevanato Group S.p.A. will post 0.67 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

STVN has been the topic of several recent research reports. Stephens reaffirmed an "overweight" rating and set a $38.00 target price on shares of Stevanato Group in a report on Monday, March 25th. BNP Paribas assumed coverage on Stevanato Group in a research note on Monday, April 22nd. They issued an "outperform" rating for the company. Finally, Morgan Stanley restated an "equal weight" rating and set a $30.00 price target on shares of Stevanato Group in a research report on Monday, April 22nd. Two research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat, Stevanato Group has a consensus rating of "Moderate Buy" and a consensus price target of €34.29 ($36.87).

Check Out Our Latest Report on STVN

About Stevanato Group

(

Free Report)

Stevanato Group S.p.A. engages in the design, production, and distribution of products and processes to provide integrated solutions for bio-pharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific. The company operates in two segments, Biopharmaceutical and Diagnostic Solutions; and Engineering.

See Also

Want to see what other hedge funds are holding STVN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Stevanato Group S.p.A. (NYSE:STVN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Stevanato Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stevanato Group wasn't on the list.

While Stevanato Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report