Check Capital Management Inc. CA cut its position in Suncor Energy Inc. (NYSE:SU - Free Report) TSE: SU by 2.0% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,748,306 shares of the oil and gas producer's stock after selling 35,905 shares during the quarter. Suncor Energy comprises 2.1% of Check Capital Management Inc. CA's investment portfolio, making the stock its 7th biggest position. Check Capital Management Inc. CA owned about 0.14% of Suncor Energy worth $56,016,000 at the end of the most recent reporting period.

Check Capital Management Inc. CA cut its position in Suncor Energy Inc. (NYSE:SU - Free Report) TSE: SU by 2.0% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,748,306 shares of the oil and gas producer's stock after selling 35,905 shares during the quarter. Suncor Energy comprises 2.1% of Check Capital Management Inc. CA's investment portfolio, making the stock its 7th biggest position. Check Capital Management Inc. CA owned about 0.14% of Suncor Energy worth $56,016,000 at the end of the most recent reporting period.

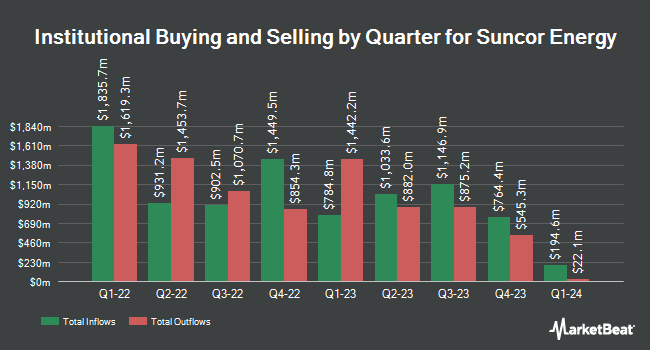

Other institutional investors and hedge funds have also bought and sold shares of the company. Vanguard Group Inc. grew its holdings in shares of Suncor Energy by 1.5% during the 3rd quarter. Vanguard Group Inc. now owns 50,379,614 shares of the oil and gas producer's stock valued at $1,732,051,000 after purchasing an additional 731,163 shares during the last quarter. Ninepoint Partners LP bought a new position in shares of Suncor Energy during the 3rd quarter valued at $77,355,000. JPMorgan Chase & Co. grew its holdings in shares of Suncor Energy by 13.3% during the 3rd quarter. JPMorgan Chase & Co. now owns 5,348,348 shares of the oil and gas producer's stock valued at $183,876,000 after purchasing an additional 628,262 shares during the last quarter. Assenagon Asset Management S.A. grew its holdings in Suncor Energy by 1,689.9% in the 4th quarter. Assenagon Asset Management S.A. now owns 565,339 shares of the oil and gas producer's stock worth $18,118,000 after acquiring an additional 533,754 shares during the last quarter. Finally, FMR LLC boosted its stake in shares of Suncor Energy by 0.3% during the 3rd quarter. FMR LLC now owns 17,248,932 shares of the oil and gas producer's stock valued at $593,188,000 after purchasing an additional 49,765 shares in the last quarter. 67.37% of the stock is currently owned by hedge funds and other institutional investors.

Suncor Energy Stock Performance

NYSE SU traded up $0.48 during trading hours on Friday, hitting $38.54. 4,912,495 shares of the company's stock traded hands, compared to its average volume of 4,343,938. The firm has a market capitalization of $49.60 billion, a P/E ratio of 8.22, a P/E/G ratio of 3.34 and a beta of 1.13. Suncor Energy Inc. has a 52 week low of $27.59 and a 52 week high of $39.32. The business's fifty day moving average price is $35.62 and its two-hundred day moving average price is $33.64. The company has a current ratio of 1.44, a quick ratio of 0.88 and a debt-to-equity ratio of 0.26.

Suncor Energy (NYSE:SU - Get Free Report) TSE: SU last posted its quarterly earnings results on Wednesday, February 21st. The oil and gas producer reported $0.93 earnings per share for the quarter, topping analysts' consensus estimates of $0.80 by $0.13. Suncor Energy had a net margin of 16.33% and a return on equity of 16.08%. The business had revenue of $10.39 billion during the quarter, compared to analyst estimates of $8.46 billion. During the same period in the prior year, the business posted $1.33 earnings per share. Equities research analysts predict that Suncor Energy Inc. will post 3.78 EPS for the current year.

Suncor Energy Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, March 25th. Stockholders of record on Monday, March 4th were issued a $0.406 dividend. This represents a $1.62 annualized dividend and a dividend yield of 4.21%. The ex-dividend date of this dividend was Friday, March 1st. This is an increase from Suncor Energy's previous quarterly dividend of $0.39. Suncor Energy's payout ratio is 34.26%.

Analyst Ratings Changes

A number of analysts have recently commented on SU shares. Morgan Stanley lifted their price target on shares of Suncor Energy from $50.00 to $52.00 and gave the stock an "overweight" rating in a research note on Thursday, March 28th. StockNews.com upgraded shares of Suncor Energy from a "hold" rating to a "buy" rating in a research note on Friday, April 12th. Three equities research analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $52.00.

Read Our Latest Analysis on Suncor Energy

Suncor Energy Profile

(

Free Report)

Suncor Energy Inc operates as an integrated energy company in Canada, the United States, and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Suncor Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suncor Energy wasn't on the list.

While Suncor Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report