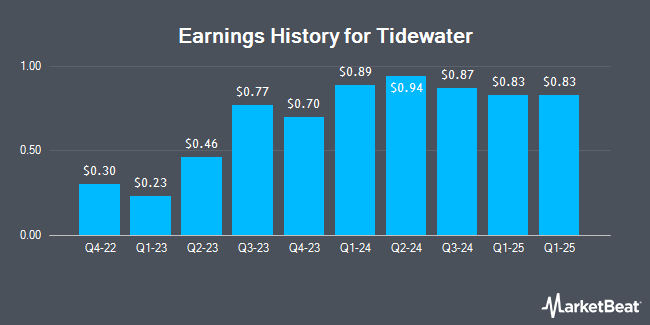

Tidewater (NYSE:TDW - Get Free Report) issued its quarterly earnings data on Thursday. The oil and gas company reported $0.89 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.49 by $0.40, Briefing.com reports. Tidewater had a return on equity of 13.37% and a net margin of 9.62%. The company had revenue of $321.20 million during the quarter, compared to the consensus estimate of $312.05 million. During the same period last year, the company earned $0.23 earnings per share. The firm's revenue was up 66.3% compared to the same quarter last year.

Tidewater (NYSE:TDW - Get Free Report) issued its quarterly earnings data on Thursday. The oil and gas company reported $0.89 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.49 by $0.40, Briefing.com reports. Tidewater had a return on equity of 13.37% and a net margin of 9.62%. The company had revenue of $321.20 million during the quarter, compared to the consensus estimate of $312.05 million. During the same period last year, the company earned $0.23 earnings per share. The firm's revenue was up 66.3% compared to the same quarter last year.

Tidewater Stock Up 13.4 %

Tidewater stock traded up $12.62 during mid-day trading on Friday, reaching $106.51. The stock had a trading volume of 2,548,596 shares, compared to its average volume of 771,498. The company has a debt-to-equity ratio of 0.61, a quick ratio of 1.70 and a current ratio of 1.80. Tidewater has a fifty-two week low of $39.53 and a fifty-two week high of $107.45. The stock's 50-day simple moving average is $88.77 and its 200-day simple moving average is $73.92. The firm has a market capitalization of $5.57 billion, a PE ratio of 58.02 and a beta of 1.21.

Tidewater announced that its Board of Directors has approved a share buyback plan on Thursday, February 29th that permits the company to repurchase $48.60 million in shares. This repurchase authorization permits the oil and gas company to buy up to 1.1% of its shares through open market purchases. Shares repurchase plans are typically a sign that the company's board believes its stock is undervalued.

Insider Buying and Selling at Tidewater

In other Tidewater news, EVP Daniel A. Hudson sold 8,000 shares of the firm's stock in a transaction that occurred on Tuesday, March 5th. The stock was sold at an average price of $82.00, for a total value of $656,000.00. Following the completion of the sale, the executive vice president now owns 104,312 shares of the company's stock, valued at $8,553,584. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, COO David E. Darling sold 17,821 shares of Tidewater stock in a transaction that occurred on Tuesday, March 5th. The stock was sold at an average price of $82.08, for a total transaction of $1,462,747.68. Following the transaction, the chief operating officer now owns 85,959 shares of the company's stock, valued at $7,055,514.72. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, EVP Daniel A. Hudson sold 8,000 shares of Tidewater stock in a transaction that occurred on Tuesday, March 5th. The shares were sold at an average price of $82.00, for a total value of $656,000.00. Following the transaction, the executive vice president now directly owns 104,312 shares in the company, valued at approximately $8,553,584. The disclosure for this sale can be found here. Over the last quarter, insiders sold 45,462 shares of company stock valued at $3,716,739. Company insiders own 9.59% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on the company. Evercore ISI raised their price objective on Tidewater from $87.00 to $89.00 and gave the stock an "outperform" rating in a research report on Monday, March 4th. StockNews.com upgraded Tidewater from a "sell" rating to a "hold" rating in a report on Monday, March 4th. BTIG Research lifted their target price on Tidewater from $90.00 to $110.00 and gave the stock a "buy" rating in a report on Tuesday, March 19th. Johnson Rice assumed coverage on Tidewater in a report on Friday, February 9th. They issued a "buy" rating and a $88.00 target price for the company. Finally, Pickering Energy Partners assumed coverage on Tidewater in a report on Tuesday, January 30th. They issued an "outperform" rating for the company. One investment analyst has rated the stock with a hold rating, four have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, Tidewater currently has an average rating of "Buy" and an average target price of $93.00.

View Our Latest Stock Analysis on Tidewater

Tidewater Company Profile

(

Get Free Report)

Tidewater Inc, together with its subsidiaries, provides offshore support vessels and marine support services to the offshore energy industry through the operation of a fleet of marine service vessels worldwide. It provides services in support of offshore oil and gas exploration, field development, and production, as well as windfarm development and maintenance, including towing of and anchor handling for mobile offshore drilling units; transporting supplies and personnel necessary to sustain drilling, workover, and production activities; offshore construction, and seismic and subsea support; geotechnical survey support for windfarm construction; and various specialized services, such as pipe and cable laying.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tidewater, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tidewater wasn't on the list.

While Tidewater currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report