Xerox (NYSE:XRX - Get Free Report) is set to issue its quarterly earnings data before the market opens on Tuesday, April 23rd. Analysts expect the company to announce earnings of $0.37 per share for the quarter.

Xerox (NYSE:XRX - Get Free Report) is set to issue its quarterly earnings data before the market opens on Tuesday, April 23rd. Analysts expect the company to announce earnings of $0.37 per share for the quarter.

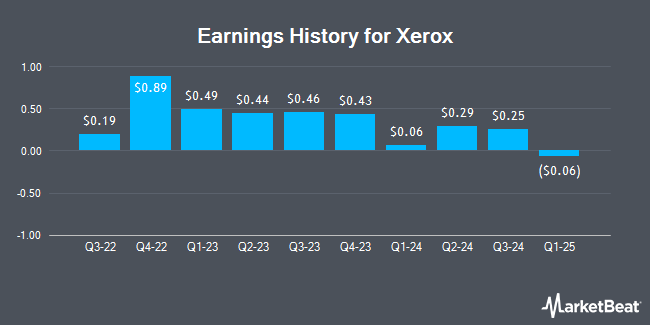

Xerox (NYSE:XRX - Get Free Report) last issued its quarterly earnings data on Thursday, January 25th. The information technology services provider reported $0.43 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.52 by ($0.09). The business had revenue of $1.77 billion for the quarter, compared to analysts' expectations of $1.79 billion. Xerox had a net margin of 0.01% and a return on equity of 9.41%. The business's quarterly revenue was down 8.8% compared to the same quarter last year. During the same period in the previous year, the business earned $0.89 earnings per share. On average, analysts expect Xerox to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Xerox Stock Down 0.1 %

XRX stock traded down $0.02 during trading on Wednesday, hitting $16.19. 1,817,188 shares of the company's stock traded hands, compared to its average volume of 2,298,689. The firm has a market capitalization of $2.01 billion, a P/E ratio of -80.95 and a beta of 1.56. The business has a fifty day simple moving average of $17.73 and a two-hundred day simple moving average of $16.29. The company has a quick ratio of 0.91, a current ratio of 1.14 and a debt-to-equity ratio of 1.06. Xerox has a 1 year low of $12.06 and a 1 year high of $19.78.

Xerox Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, April 30th. Shareholders of record on Friday, March 29th will be issued a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 6.18%. The ex-dividend date of this dividend is Wednesday, March 27th. Xerox's dividend payout ratio is currently -500.00%.

Wall Street Analysts Forecast Growth

Several equities analysts have issued reports on the stock. StockNews.com raised shares of Xerox from a "hold" rating to a "buy" rating in a report on Tuesday. JPMorgan Chase & Co. boosted their price objective on shares of Xerox from $16.00 to $18.00 and gave the company an "underweight" rating in a report on Friday, January 26th.

View Our Latest Analysis on XRX

Institutional Investors Weigh In On Xerox

A number of large investors have recently made changes to their positions in the stock. BlackRock Inc. lifted its position in Xerox by 15.1% during the first quarter. BlackRock Inc. now owns 15,540,136 shares of the information technology services provider's stock valued at $239,318,000 after purchasing an additional 2,033,262 shares during the period. AQR Capital Management LLC lifted its position in Xerox by 81.3% during the first quarter. AQR Capital Management LLC now owns 1,889,370 shares of the information technology services provider's stock valued at $28,378,000 after purchasing an additional 847,204 shares during the period. State Street Corp lifted its position in Xerox by 14.8% during the second quarter. State Street Corp now owns 4,706,349 shares of the information technology services provider's stock valued at $71,049,000 after purchasing an additional 607,148 shares during the period. Norges Bank acquired a new position in Xerox during the fourth quarter valued at $7,594,000. Finally, Renaissance Technologies LLC lifted its position in Xerox by 382.3% during the first quarter. Renaissance Technologies LLC now owns 656,024 shares of the information technology services provider's stock valued at $10,103,000 after purchasing an additional 520,000 shares during the period. 85.36% of the stock is owned by hedge funds and other institutional investors.

About Xerox

(

Get Free Report)

Xerox Holdings Corporation, together with its subsidiaries, operates as a workplace technology company that integrates hardware, services, and software for enterprises in the Americas, Europe, the Middle East, Africa, India, and internationally. The company operates through two segments, Print and Other; and FITTLE.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Xerox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xerox wasn't on the list.

While Xerox currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report