With a well-thought-out grocery store investment strategy, you'll know exactly where to invest your money and how to get the highest returns.

Are Grocery Stores a Good Investment?

Grocery stores can be an excellent investment to diversify your portfolio and take advantage of the ever-changing food industry. Grocery stores offer stability and steady returns since they're typically open year-round, even during economic downturns.

Most grocery stores offer a wide variety of products and services, from fruits to cheeses to bakery items to frozen dinners, so it can be easier to get customers in the door than in other sectors. Before jumping in and investing, understand the different types of grocery stores. You can invest in big-box stores, small mom-and-pop stores, specialty stores that offer niche products or online grocery stores.

Each type of store offers different benefits and risks. Depending on the store's location, you may have volatile regional markets, which could lead to changes in demand. Competition from larger chain supermarkets or big-box retailers can sometimes make it hard to generate profit margins.

Nevertheless, when done correctly, investing in grocery stores can be a great way to make money while supporting local businesses. To assess whether a grocery store is a good investment opportunity, consider factors like location, product mix and customer demographics, and analyze its financial performance metrics, including gross profit margins and operating expenses.

Reasons for Investing in Grocery Stores

Grocery stores are a great investment opportunity for stability, diversification and steady returns. Here are some reasons why investing in grocery stores can be lucrative.

Low Start-Up Costs

Starting a grocery store business involves lower start-up costs than other retail sectors. Owners can get into the business quickly and begin making some profit right away.

High Profitability

Grocery stores generally have higher margins than other retail sectors, meaning your investments can offer great returns with less risk.

Customer Loyalty

Customers often return to the same grocery store weekly or monthly, generating consistent revenues.

Recession Resiliency

Grocery stores are historically resilient during economic downturns because shoppers still need to eat, no matter the economic environment.

Varied Products and Services

Grocery stores offer customers various products and services ranging from fresh produce to prepared foods and deli items, so they (and you) can make money on multiple fronts.

Ways to Invest in Grocery Stores

Depending on your risk tolerance, financial goals and resources, you can invest in grocery stores in various ways. Here are some of the most popular strategies.

Direct Investment

Direct investment involves buying a stake in an existing grocery store or opening a new one yourself. This is the most common way to invest and requires more capital upfront, but it offers potentially significant returns over the long term. When considering a direct investment, look at the location, customer demographics, product mix and potential competition.

Analyze its financial performance metrics, such as gross profit margins and operating expenses. For example, we can find this information by looking at Kroger financial statements on MarketBeat and clicking "SEC Filings" to view its annual reports.

Private Equity

With private equity investments, you invest in a stake in an existing grocery store business with other accredited investors or venture capitalists. By pooling your resources with other investors, this strategy lets you spread the risk with direct investments. Understand the terms and conditions of the deal before investing and look at the expected return on investment (ROI).

Franchising

Another way to invest in grocery stores is through franchising, which allows one person to own and operate a single store within a larger chain network. This gives you access to well-established brands while offering support from corporate headquarters. While minimal start-up costs are usually involved, the owner must pay royalties on ongoing sales and meet minimum purchase requirements when buying products from corporate headquarters. Additionally, you may need additional capital for renovations or equipment upgrades.

Real Estate

If opening your store isn't feasible, real estate investments can provide another means of entering the industry without taking on too much risk. Acquiring property that houses existing stores can offer steady returns depending on rent agreements and location.

One way to invest in real estate related to grocery stores is through real estate investment trusts (REITs). REITs own and operate properties that generate income, such as retail spaces, including those occupied by grocery stores. By investing in a REIT, you can earn returns on your investment through rental income and appreciation of the property value. For example, Kimco Realty Corp. NYSE: KIM is a retail REIT focused on grocery-anchored shopping centers.

Another option is to invest in the development of new grocery store properties by partnering with developers or investing in companies that specialize in this area. This can offer higher potential returns but also comes with a higher level of risk.

Grocery Store Stocks

Grocery store stocks can provide an excellent opportunity to gain exposure to the industry. These investments offer the potential for substantial long-term returns, depending on the company's performance. Choose from large-cap publicly traded grocery stores' stocks, such as The Kroger Co.NYSE: KR and Walmart Inc. NYSE: WMT, or smaller-cap supermarket stocks like SuperValu Inc. NYSE: SVU and SpartanNash Co. (SPTN).

Grocery Store Mutual Funds and ETFs

Investing in mutual funds and exchange-traded funds (ETFs) that specialize in the best grocery stocks can be a great option if you want to invest in the industry but don't have the knowledge or resources to invest in individual stocks. These funds offer exposure to a diversified portfolio of grocery store companies and can be less risky than individual stocks. Look for mutual funds and ETFs with a history of strong performance, low expense ratios and experienced fund managers.

One such ETF is the SPDR S&P Retail ETF NYSEARCA: XRT, which includes a mix of large and small-cap retail companies, including grocery stores.

Example of a Grocery Store Stock

Kroger is a large-cap grocery store stock with a long history of strong performance. Founded in 1883, Kroger operated over 1,200 stores in over 20 states as of 2023. It's the largest traditional grocery retailer in the United States and reported more than $148 billion in sales for 2022. Over the past few years, Kroger stock performance has been on an upward trend as the company continues to expand its reach and capitalize on new opportunities in digital grocery shopping.

Investing in Kroger is a longer-term play; its short-term performance can be volatile due to market fluctuations and other unpredictable events. However, based on its long track record of growth and positive returns, investments you make now will likely continue to yield positive returns over time.

How to Invest in Grocery Stores

With some research and careful planning, you can safely and successfully invest in grocery stores and make a profit. Here's how:

Step 1: Choose your investments.

The first step to investing in grocery stores is to choose the stocks, ETFs or other investments you want to include in your portfolio. You can choose individual stocks of companies involved in the grocery industry, such as Kroger, or ETFs that focus specifically on companies in the industry. For example, clicking on MarketBeat's Retail/Wholesale Stocks list will give you the top 50 largest stocks in that category, including grocery stores.

Step 2: Research potential investments.

Once you've identified potential investments, research and evaluate them carefully. Look into their financial performance, management team and other factors to ensure they fit your portfolio well. Pay attention to current and emerging trends in the grocery industry. For example, on MarketBeat, you can click on "compare" under Kroger's page, for example, to compare its stock performance to those of its competitors Dollar Tree Inc. NASDAQ: DLTR and Target Corporation NYSE: TGT.

Step 3: Invest with a strategy.

Before investing in any security, you should have a plan for how much money you're willing to invest and when you plan on selling it. It's also important to set realistic expectations of returns. Remember that an investment can always go up or down, so don't expect guaranteed profits. Finally, diversify your portfolio by investing in a mix of different securities so that if one investment doesn't do well, it won't significantly affect your overall returns.

Step 4: Monitor your investment.

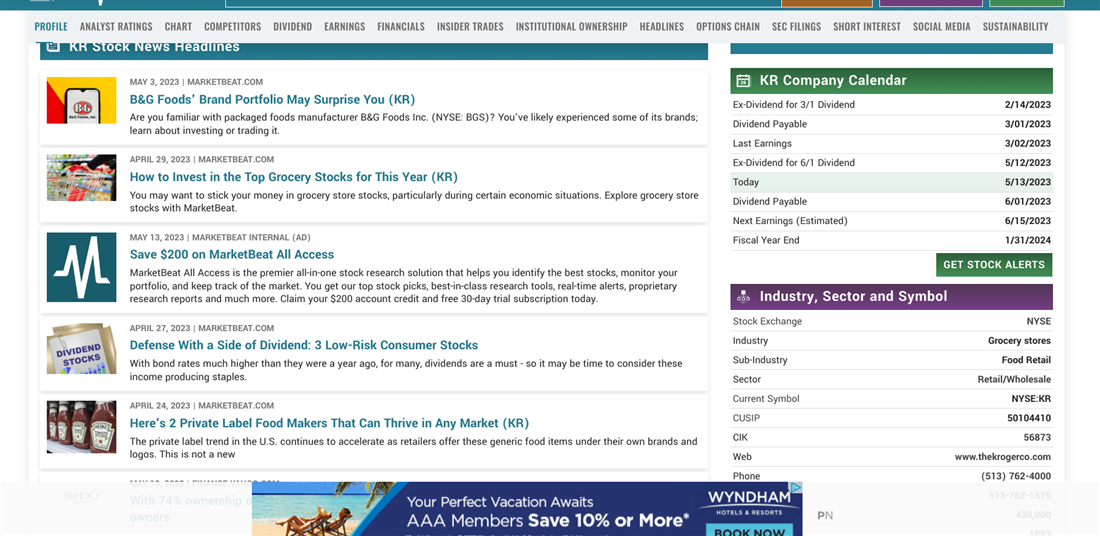

Once you've invested in grocery store stocks or ETFs, monitor their performance regularly to know when it might be time to sell or adjust your strategy. Do research on any news related to the companies and industries involved. For example, on Kroger's stock page, you can look under the "KR Stock News Headlines" to monitor news related to Kroger stock, its competitors and its industry.

Monitoring will help inform you about changes that may impact your investment decision-making process.

Benefits of Investing in Grocery Stores

Investing in grocery stores can be a great way to diversify your portfolio and take advantage of the constantly changing food industry. There are many benefits, including:

- Lower risk: Grocery store stocks generally perform well during both economic upturns and downturns, making them a safer investment than other stocks.

- Higher returns: Since the food industry is constantly changing, you may have the opportunity to experience higher returns than you would with other investments.

- Diversification: Investing in grocery stores diversifies your portfolio and reduces overall risk.

- Low costs: Investing in grocery store stocks doesn't typically require large upfront costs or ongoing maintenance fees.

Risks of Investing in Grocery Stores

Investing in grocery stores can be profitable, but you must understand the risks involved. Some of the potential risks you face when investing in grocery stores include:

- Volatility: Grocery store stocks can be volatile and subject to sudden changes in price due to economic or industry-specific factors.

- Market competition: The grocery industry is highly competitive. There's always a risk of new businesses entering the market and putting pressure on the already existing companies.

- Supply chain issues: Disruptions to the supply chain can affect grocery store stocks as shortages or cost increases can impact their profitability. Most recently, We've seen that with the COVID-19 pandemic, supply chain disruptions caused shortages and price increases in food and household products.

- Government regulation: Changes in government policies or regulations could hurt the performance of grocery store stocks. For example, if new regulations increase labor costs, it could reduce profits and negatively impact the stock's performance.

- Consumer behavior: Changes in consumer behavior can significantly impact grocery store stocks. For example, traditional brick-and-mortar stores may suffer if there's a trend toward online grocery shopping.

Grocery Stores: A Delicious Option for Investors

Investing in grocery stores can be a fantastic way to diversify your portfolio, reduce risk and potentially achieve higher returns than you would with other investments. However, these stocks can be volatile and subject to sudden changes, so always keep an eye on the market and stay informed about potential risks. By taking time to understand all these factors and staying up to date on industry news, you can make better decisions and potentially benefit from consumers' need to eat.

FAQs

If you still have questions about how to invest in a grocery store, read on for answers to some of the most commonly-asked questions.

How do you invest in grocery stores?

There are several strategies to consider when investing in grocery stores, such as buying stocks and mutual funds or investing in private equity deals or real estate. Before deciding, understand the potential risks and rewards associated with each and research the company, its competitors, industry trends and other factors.

What is the best grocery store stock to buy?

The best grocery store stock will depend on your investing goals, risk tolerance and financial resources. Some popular grocery store stocks include Walmart, Kroger, Albertsons Companies Inc. NYSE: ABS, Amazon.com Inc. NASDAQ: AMZN and Target. Do you research and consider factors such as the company's financial performance and market share, competitive position, trends within the industry, track record of dividend payments, if any, and whether they offer in-demand products.

Are supermarkets a good investment?

Investing in supermarkets can help diversify your portfolio and achieve high returns. While risks are associated with investing in any company, supermarkets can offer a more stable investment option due to their diversity of products, steady customer base and low financial leverage.

Do your research, understand industry trends and investigate the company's financial profile before investing in any supermarket stock.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...